Allegiant Travel (ALGT) Turns Q4 Profit Of US$31.9m And Tests Bearish Loss Narratives

Allegiant Travel posts mixed FY 2025 finish as profitability swings quarter to quarter

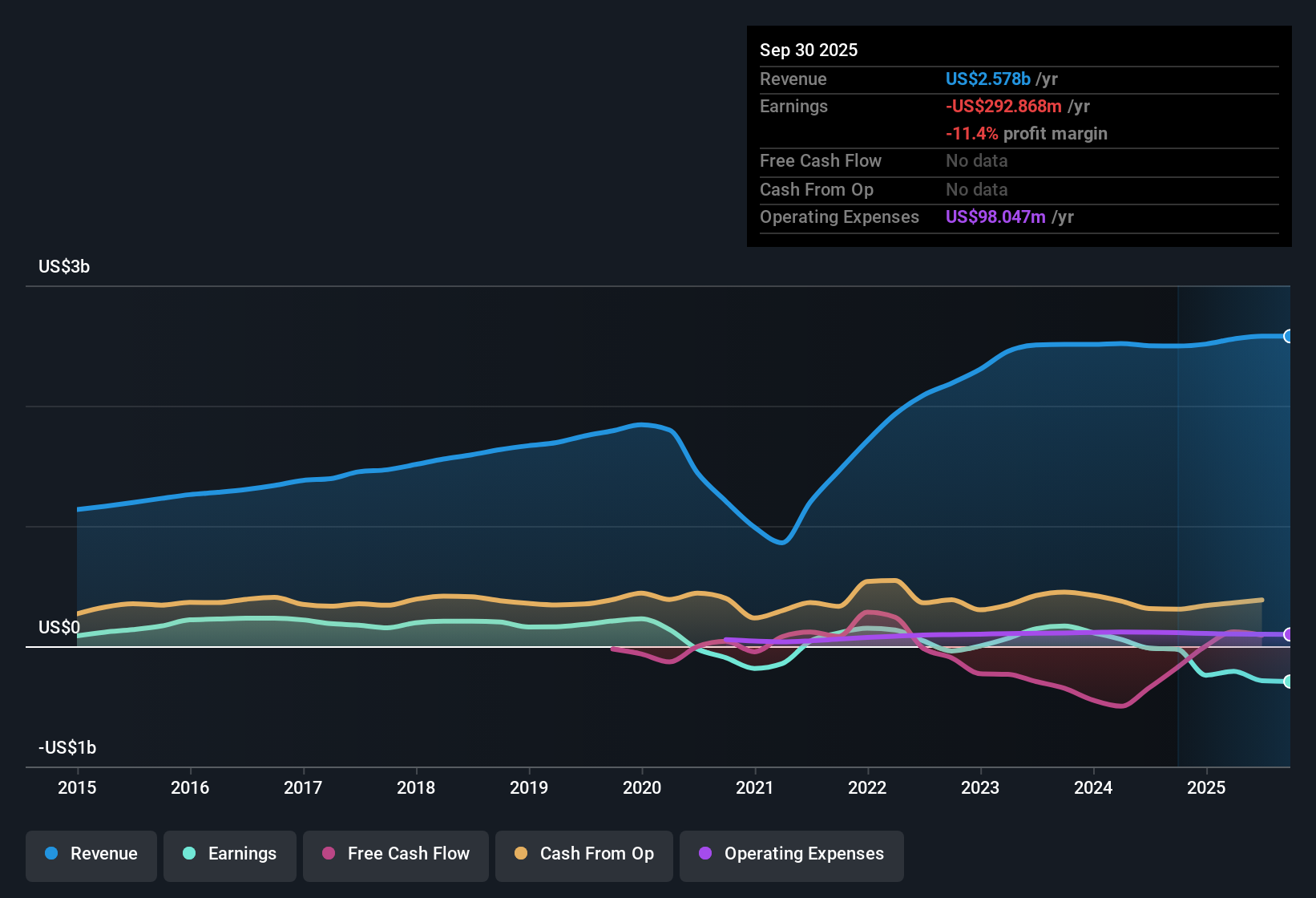

Allegiant Travel (ALGT) closed out FY 2025 with fourth quarter revenue of US$656.2 million and basic EPS of US$1.76, alongside net income of US$31.9 million. The trailing twelve months still show a loss, with EPS at US$2.48 and net income of US$44.7 million. The company has seen quarterly revenue shift between US$561.9 million and US$699.1 million across 2025, with EPS moving from a loss of US$3.62 in Q2 to a profit of roughly US$1.74 to US$1.76 in Q1 and Q4. This sets up a story that hinges on whether recent margin improvement can hold.

See our full analysis for Allegiant Travel.With the latest numbers on the table, the next step is to see how this earnings path lines up with the widely shared narratives about Allegiant Travel, and where the figures start to challenge those views.

Curious how numbers become stories that shape markets? Explore Community Narratives

US$2606.6m in LTM revenue, still TTM net loss of US$44.7m

- On a trailing 12 month view to Q4 2025, Allegiant booked US$2,606.6m in revenue and a net loss of US$44.7m, which contrasts with the profitable Q4 itself where net income reached US$31.9m on US$656.2m of revenue.

- Bears focus on the company’s unprofitable trailing 12 months and five year loss trend of about 32.9% per year, and these figures line up with that concern, while the swing from a Q3 2025 loss of US$43.6m to a Q4 profit of US$31.9m introduces tension around how repeatable the quarterly improvements really are.

- The latest 12 month net loss of US$44.7m sits alongside earlier TTM losses of US$292.9m at Q3 2025 and US$286.1m at Q2 2025, so the overall period is still loss making even though the most recent quarter is in the black.

- Critics highlight that quarterly EPS has moved between a loss of US$3.62 in Q2 2025 and profits of about US$1.74 to US$1.76 in Q1 and Q4 2025, which keeps the bearish view focused on earnings volatility rather than a clean turn to profitability.

Interest coverage risk alongside higher P/S than peers

- The stock trades at a P/S of 0.7x versus a 0.6x North American airline industry average and a 0.5x peer average, while the risk summary flags that interest payments are not well covered by earnings over the last 12 months.

- Bears argue that paying more than peers on P/S is hard to justify when earnings do not comfortably cover interest, and the current TTM loss of US$44.7m plus the interest coverage warning both reinforce that caution, even as the business generated US$2,606.6m in revenue over the same period.

- What stands out is that the stock’s higher P/S multiple sits against a backdrop of forecast revenue growth of 5.5% per year, which is below the 10.3% market benchmark quoted in the data.

- The combination of weaker interest coverage and below market revenue growth in the forecasts gives critics a clear numeric basis for questioning how much downside protection investors have at a 0.7x P/S multiple.

Forecast earnings ramp versus DCF fair value gap

- The analysis data pairs a DCF fair value of US$1,260.81 with the current share price of US$99.42, while also flagging forecast earnings growth of 67.06% per year and an expectation of profitability within three years.

- Bullish investors point to that very large gap between the DCF fair value and today’s price alongside the 67.06% forecast earnings growth rate, and the fact that Allegiant has already delivered profitable quarters like Q1 and Q4 2025, yet the trailing 12 month loss of US$44.7m and the 5.5% projected revenue growth rate leave a clear check on the bullish story because the company still needs to move from intermittent profits to consistent coverage of both operating costs and interest.

- Supporters highlight that quarterly net income has already reached around US$31.3m to US$31.9m in Q1 and Q4 2025, which they see as early confirmation of the earnings ramp implied by the 67.06% growth forecast.

- At the same time, the fact that Allegiant remains loss making on a TTM basis shows that the optimistic earnings path built into the DCF fair value is not yet visible in the consolidated 12 month numbers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Allegiant Travel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Allegiant Travel’s mix of a US$44.7m trailing twelve month loss, weak interest coverage, and earnings volatility highlights balance sheet and risk concerns for cautious investors.

If that combination feels too fragile for your taste, take a few minutes to check out solid balance sheet and fundamentals stocks screener (46 results), where you can focus on companies built on stronger financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal