AbbVie Vitiligo Filing Puts RINVOQ And Valuation In Fresh Focus

- AbbVie has submitted regulatory applications to the FDA and EMA for upadacitinib (RINVOQ) as a potential first systemic treatment for non segmental vitiligo.

- The filings aim to address a major unmet need in an autoimmune skin condition that currently lacks systemic options.

- The move adds a new potential indication to AbbVie’s immunology pipeline and could be relevant for its broader portfolio if approvals follow.

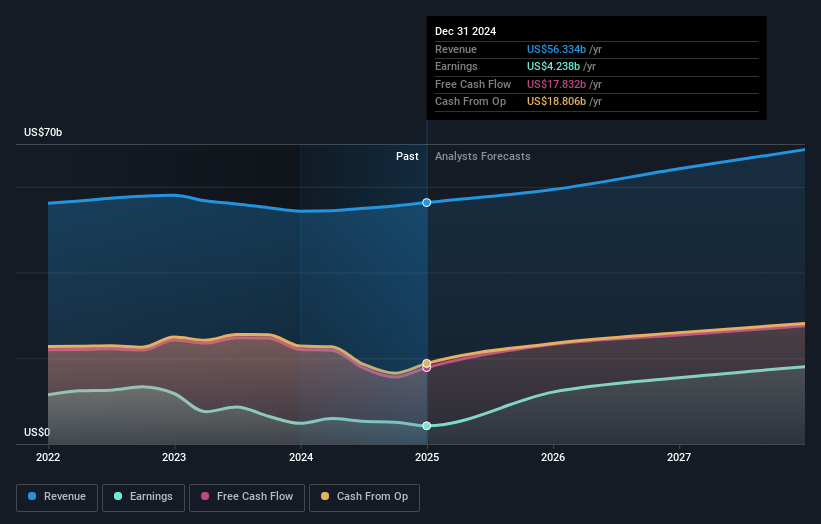

For investors watching AbbVie (NYSE:ABBV), the new vitiligo submissions come with the stock trading around $217.11 and a 1 year return of 17.0%. Over 3 years, the share price return of 67.3% and 5 year return of 152.7% reflect the role of immunology assets in the company’s strategy to date.

If RINVOQ gains approval in non segmental vitiligo, it would expand AbbVie’s reach into a patient group with limited systemic treatment choices today. The key question for investors is how this potential new indication might fit alongside AbbVie’s existing immunology franchise and what it could mean for future revenue mix and pipeline optionality.

Stay updated on the most important news stories for AbbVie by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on AbbVie.

How AbbVie stacks up against its biggest competitors

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$217.11 vs a consensus target of US$244.89, AbbVie trades about 11% below analyst expectations.

- ✅ Simply Wall St Valuation: Simply Wall St currently views AbbVie as trading roughly 39.9% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return of about 1.4% decline signals soft short term momentum despite the vitiligo news.

Check out Simply Wall St's in depth valuation analysis for AbbVie.

Key Considerations

- 📊 The RINVOQ vitiligo filings add another possible use for an existing immunology asset, which could influence how you think about AbbVie’s long term treatment portfolio.

- 📊 Watch regulatory timelines for the FDA and EMA, plus any commentary on potential uptake among non segmental vitiligo patients if approvals are granted.

- ⚠️ With a P/E of 90.8 versus a Biotechs industry average P/E of 20.0, valuation based on current earnings is demanding even if the DCF view suggests undervaluation.

Dig Deeper

For the full picture including more risks and rewards, check out the complete AbbVie analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal