EnerSys (ENS) Valuation Check After Strong Multi Period Share Price Gains

EnerSys stock at a glance after recent gains

EnerSys (ENS) has quietly moved higher recently, with the share price at $185.03 and total return figures over the past year and past 3 months giving investors fresh performance context.

See our latest analysis for EnerSys.

The recent move to a share price of $185.03 follows a strong run, with a 30-day share price return of 19.44% and a 90-day share price return of 43.15%. The 1-year total shareholder return of 97.14% and 3-year total shareholder return of 120.67% indicate that momentum has been building over both shorter and longer periods.

If EnerSys's climb has caught your attention, this could be a moment to broaden your watchlist with aerospace and defense stocks as another source of potential ideas.

With EnerSys trading near its price target and only a modest intrinsic discount indicated, the key question is whether recent gains still leave room for upside or whether the market is already pricing in future growth.

Most Popular Narrative: 6% Overvalued

EnerSys closed at $185.03 against a most-followed fair value estimate of $174.60, so the narrative currently sees the share price ahead of its model.

Major cost-reduction initiatives, including a strategic realignment and transition to Centers of Excellence (CoEs), are expected to generate $80 million in annualized savings starting in fiscal 2026, structurally expanding net and operating margins. The electrification of industrial equipment (e.g., forklifts, lift trucks) and automation trends are driving increased demand for maintenance-free batteries and advanced charger solutions, positioning Motive Power for a rebound in volumes and margin expansion as macro and tariff headwinds abate.

Curious how margin uplift, moderate growth assumptions and a future earnings multiple combine into that fair value? The narrative blends disciplined cost savings, measured revenue expansion and a premium on future profitability. The key link between those pieces sits in a handful of earnings and valuation assumptions you have not seen yet.

Result: Fair Value of $174.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged trade policy uncertainty and any stumble in integrating acquisitions could quickly challenge the current fair value story you have just seen.

Find out about the key risks to this EnerSys narrative.

Another way to look at EnerSys's valuation

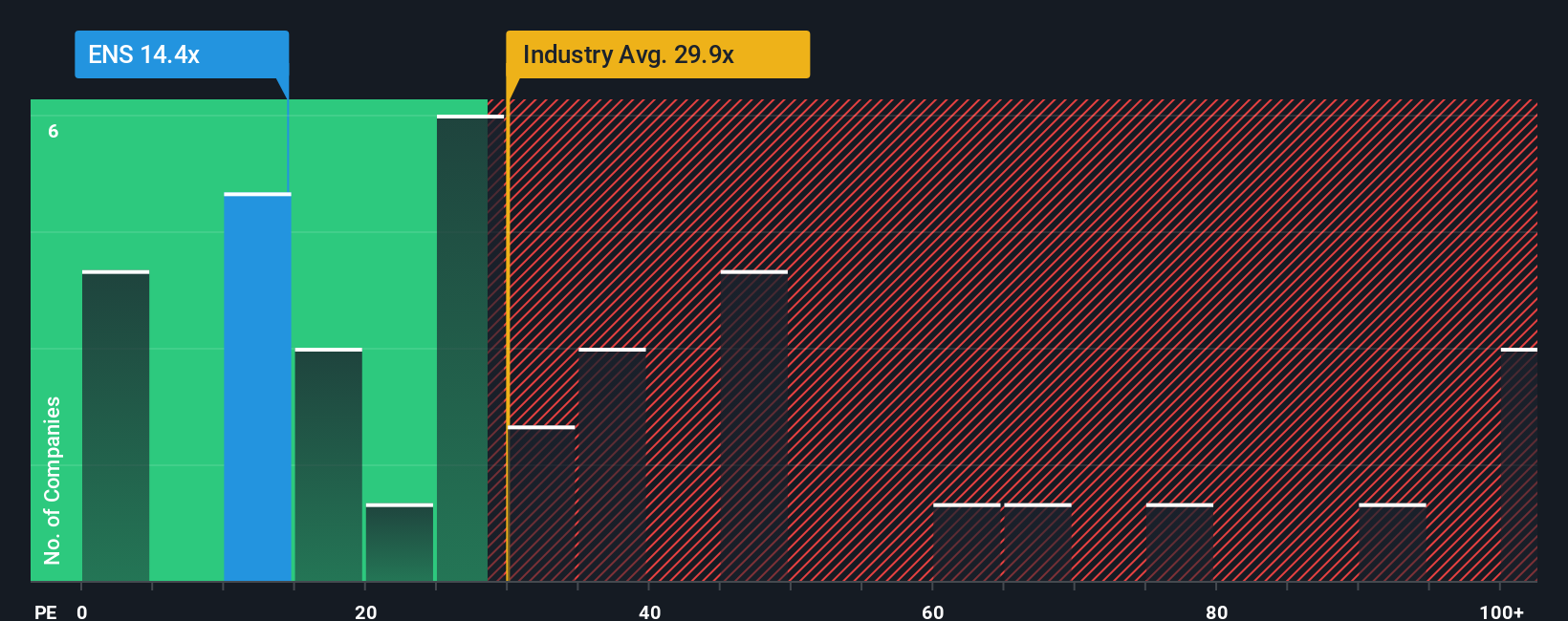

The narrative model you just saw suggests EnerSys is 6% overvalued based on a fair value of $174.60. Yet on simple earnings-based metrics, the picture is different, with the current P/E of 20.3x sitting well below the US Electrical industry at 35.7x, peers at 46.4x and a fair ratio of 27x.

If the market ever shifted closer to that 27x fair ratio, the gap between today’s P/E and those higher benchmarks could matter a lot. So which signal do you trust more right now: the narrative fair value or the earnings multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EnerSys Narrative

If you see the numbers differently, or simply prefer to trust your own work, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If EnerSys is already on your radar, do not stop there, you could miss other opportunities that fit your style just as well or even better.

- Spot potential turnarounds early by scanning these 3533 penny stocks with strong financials that already show stronger financial footing than many expect at this size.

- Target the intersection of healthcare and automation by reviewing these 105 healthcare AI stocks where data and medicine come together in listed companies.

- Consider possible mispricing opportunities with these 867 undervalued stocks based on cash flows which focuses on businesses trading below estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal