Autodesk (ADSK) Valuation Check After Recent Share Price Weakness And Recurring Revenue Performance

What recent returns say about Autodesk (ADSK)

Autodesk (ADSK) has drawn fresh attention after a stretch of weak share performance, with the stock showing negative returns over the past week, month, past 3 months, year to date, and past year.

In this context, investors are weighing the company’s reported US$6.9b in revenue and US$1.1b in net income, along with its current value score of 3, to assess how the recent pullback lines up with its fundamentals.

See our latest analysis for Autodesk.

Over the past year, Autodesk’s share price has slipped, with a 1-year total shareholder return of a 21.82% decline and a 3-year total shareholder return of a 9.98% gain, suggesting longer term holders have still seen positive results despite recent weakness around the US$243.41 level.

If Autodesk’s recent pullback has you reassessing your watchlist, this can be a good moment to look across other high growth tech and AI opportunities using high growth tech and AI stocks.

With Autodesk shares down despite reported US$6.9b in revenue and US$1.1b in net income, the key question is whether a value score of 3 and current pricing reflect a genuine opportunity or if markets already incorporate expectations of future growth.

Most Popular Narrative: 33.4% Undervalued

Autodesk’s most followed narrative places fair value at about $365.58 versus the recent $243.41 share price, so the current pullback sits well below that reference point.

Accelerating adoption of cloud-based platforms, such as Autodesk Construction Cloud and Fusion 360, and ongoing rollout of subscription and SaaS models are increasing recurring revenue, improving revenue visibility, and enhancing net margin stability due to higher operating leverage and sales efficiency improvements.

Curious how that recurring revenue story gets to a higher fair value? It leans on faster earnings growth, firmer margins, and a richer profit multiple. The exact mix might surprise you.

Result: Fair Value of $365.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on Autodesk staying ahead in AI tools while keeping pricing power intact, as cheaper rivals and open source options continue to gain traction.

Find out about the key risks to this Autodesk narrative.

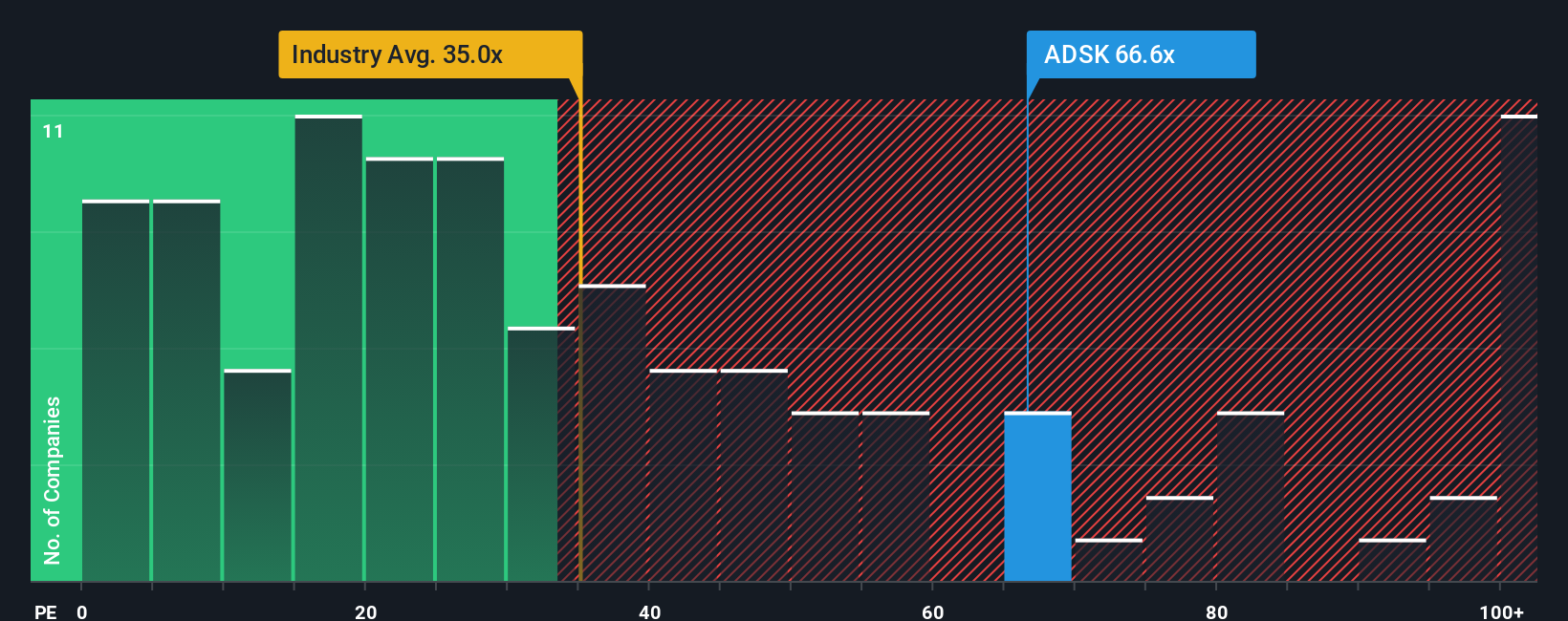

Another View: What Earnings Multiples Are Saying

If you step away from fair value models and look at plain P/E, Autodesk trades on 46.4x earnings, compared with a 35.2x fair ratio, 37.5x for peers and 26.2x for the wider US Software group. That is a clear premium. Is that extra price tag comfort or a red flag for you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Autodesk Narrative

If you see the numbers differently or just prefer to test your own assumptions, you can build a complete Autodesk narrative yourself in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Autodesk.

Ready for more investment ideas?

If Autodesk has sharpened your thinking, do not stop here. Broaden your watchlist with fresh ideas other investors might be overlooking right now.

- Spot potential mispricings by checking out these 868 undervalued stocks based on cash flows that could offer more value than the market currently assigns.

- Back bold growth themes by scanning these 27 AI penny stocks tapping into real world applications of artificial intelligence across multiple industries.

- Add income potential to your shortlist by focusing on these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal