A Look At Ellington Financial (EFC) Valuation After Its Follow On Stock Offering And Book Value Update

Ellington Financial (EFC) has drawn fresh attention after completing a US$118.46 million follow on common stock offering and releasing an updated estimated book value per share alongside ongoing monthly dividend payments.

See our latest analysis for Ellington Financial.

At a share price of US$12.66, Ellington Financial has seen a 1 day share price return of a 1.48% decline and a 7 day share price return of an 8.66% decline. However, its 1 year total shareholder return of 13.75% and 5 year total shareholder return of 47.06% point to longer term investors having a very different experience from those focused on the recent follow on offering and preferred stock developments.

If recent capital raises have you thinking about portfolio balance, it could be a good moment to look beyond a single name and check out fast growing stocks with high insider ownership.

With Ellington Financial trading at US$12.66 against an estimated book value of US$13.16 and an analyst price target of US$14.63, investors may ask whether there is still a buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 12.9% Undervalued

With Ellington Financial at $12.66 against a narrative fair value of $14.53, the gap between price and expectations is clear and worth understanding in detail.

The ongoing shift of mortgage origination and credit provision away from regulated banks toward non-bank lenders, alongside potential GSE (Fannie/Freddie) footprint reduction, is enlarging Ellington's addressable market in non-QM and private-label loans. New product segments may offer opportunities to deploy capital at attractive yields, potentially boosting net interest income and ROE.

Curious what sits behind that fair value gap? The narrative leans heavily on compound revenue growth, fatter margins, and a future earnings multiple that is lower than many peers. Want to see which specific top line and profit assumptions are doing the heavy lifting in that $14.53 figure, and how long they are expected to hold?

Result: Fair Value of $14.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if home price weakness pushes delinquencies higher or if funding markets tighten and compress Ellington Financial's net interest margins.

Find out about the key risks to this Ellington Financial narrative.

Another View on Value

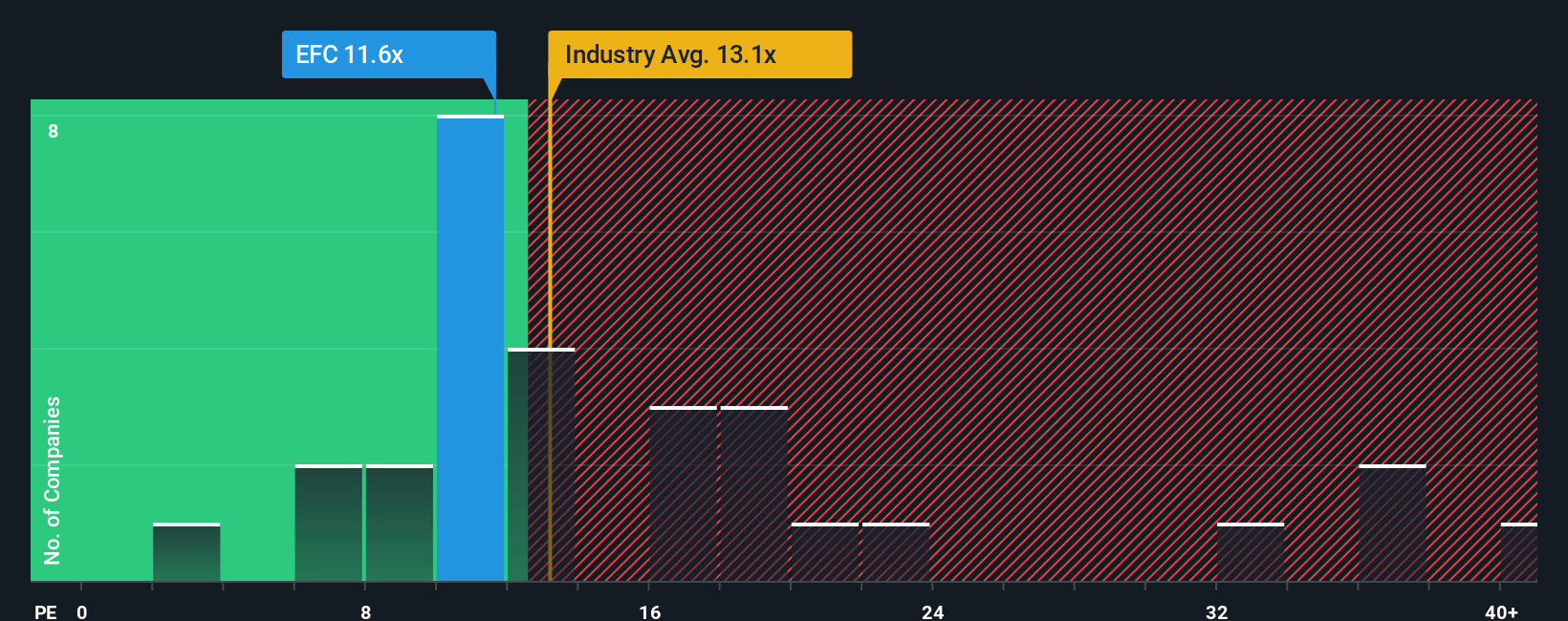

While the narrative fair value points to Ellington Financial trading below its estimated worth, the current P/E of 12.5x is a touch higher than the US Mortgage REITs industry at 12.1x, yet below both the peer average of 18.9x and a fair ratio of 14.1x. This suggests some valuation tension between relative pricing and earnings expectations. How much weight do you put on that gap when you think about risk and opportunity here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ellington Financial Narrative

If you see the story differently or prefer to weigh the numbers yourself, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Ellington Financial research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at one name. Use the screener to surface fresh ideas that fit your style.

- Spot potential bargains by checking out these 871 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Capture growth themes early by scanning these 24 AI penny stocks at the center of artificial intelligence trends.

- Target higher income opportunities by reviewing these 13 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal