A Look At Arcos Dorados Holdings (NYSE:ARCO) Valuation As New 2026 Restaurant Expansion Plan Emerges

Arcos Dorados Holdings (NYSE:ARCO) is drawing fresh attention after outlining plans to open 105 to 115 new restaurants across Latin America and the Caribbean in 2026, funded mainly through operating cash flow and existing reserves.

See our latest analysis for Arcos Dorados Holdings.

The expansion plan and recent cash tender offer for up to US$150 million of sustainability linked notes have coincided with firming momentum, with a 30 day share price return of 12.21% and a 1 year total shareholder return of 11.17%. The 5 year total shareholder return of 70.47% points to a much stronger longer term outcome than the more modest 3 year figure of 2.91%.

If news like Arcos Dorados’ restaurant rollout has your attention, this could be a good moment to widen your search with fast growing stocks with high insider ownership.

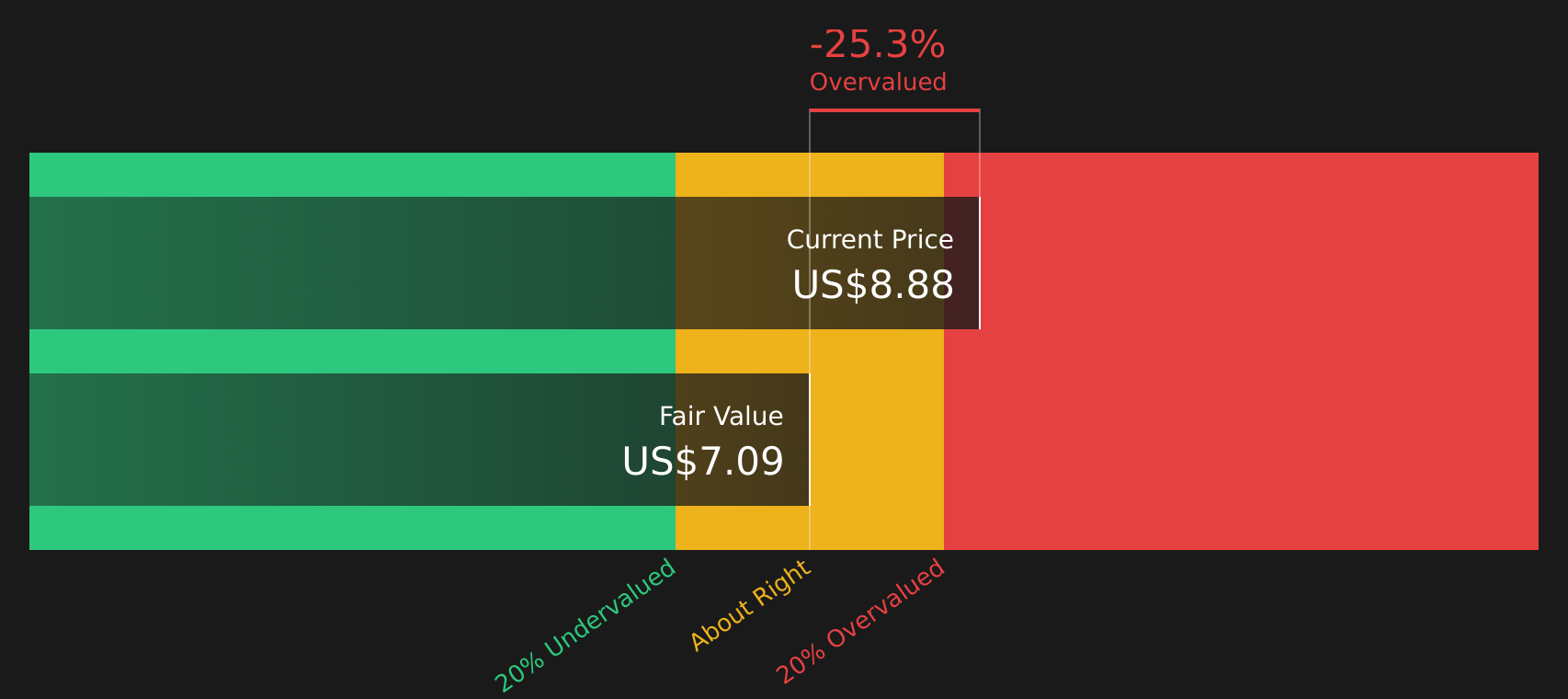

With Arcos Dorados trading at US$8.18 and sitting at a discount to the average analyst price target, the real question is whether the current valuation still leaves upside or if the market is already pricing in future growth.

Most Popular Narrative: 13.9% Undervalued

With Arcos Dorados last closing at $8.18 against a narrative fair value of $9.50, the key question is how those expectations are built.

Continued digital adoption, including loyalty program rollouts, app engagement, and digital ordering, are driving higher visit frequency, stronger customer retention, and higher identified sales, which is likely to support future revenue growth and improve gross margins as digital channels scale.

Curious how this digital push translates into that fair value gap? Revenue runways, margin shifts, and a higher future earnings multiple all sit behind the narrative, but the exact mix might surprise you.

Result: Fair Value of $9.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that gap can close quickly if Brazil’s weak consumer demand drags on same store sales or if higher beef and input costs continue to squeeze margins.

Find out about the key risks to this Arcos Dorados Holdings narrative.

Another View: Cash Flows Point The Other Way

There is a twist when you look at Arcos Dorados through the SWS DCF model. In this view, the current share price of $8.18 sits above an estimated future cash flow value of $6.58. This implies the stock screens as overvalued rather than 13.9% undervalued.

This gap between earnings-based and cash flow-based views raises a practical question for you as an investor. Which set of assumptions about growth, margins, and risk do you trust more at today’s price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcos Dorados Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 891 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcos Dorados Holdings Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can create your own narrative in just a few minutes with Do it your way.

A great starting point for your Arcos Dorados Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single company when you can quickly scan dozens of opportunities that fit what you care about most in your portfolio.

- Target income first and check out these 12 dividend stocks with yields > 3% that may help you build a portfolio with a focus on cash returns.

- Review these 24 AI penny stocks that are directly tied to artificial intelligence themes.

- Assess these 18 cryptocurrency and blockchain stocks linked to cryptocurrency and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal