A Look At Agree Realty (ADC) Valuation After Dividend Hike And US$1.5b 2026 Investment Plan

Agree Realty (ADC) has drawn fresh attention after announcing a 3.6% increase in its monthly cash dividend and outlining a 2026 investment plan of up to US$1.5b for retail property acquisitions and developments.

See our latest analysis for Agree Realty.

At a share price of US$72.23, Agree Realty’s recent dividend increase and 2026 investment plan arrive after relatively muted share price movement over the past quarter. Its 1 year total shareholder return of 3.37% and 5 year total shareholder return of 35.71% point to steadier value being created through reinvested income than through capital gains alone.

If this kind of income focused story has your attention, it could be a good moment to broaden your watchlist and check out pharma stocks with solid dividends as potential income ideas beyond real estate.

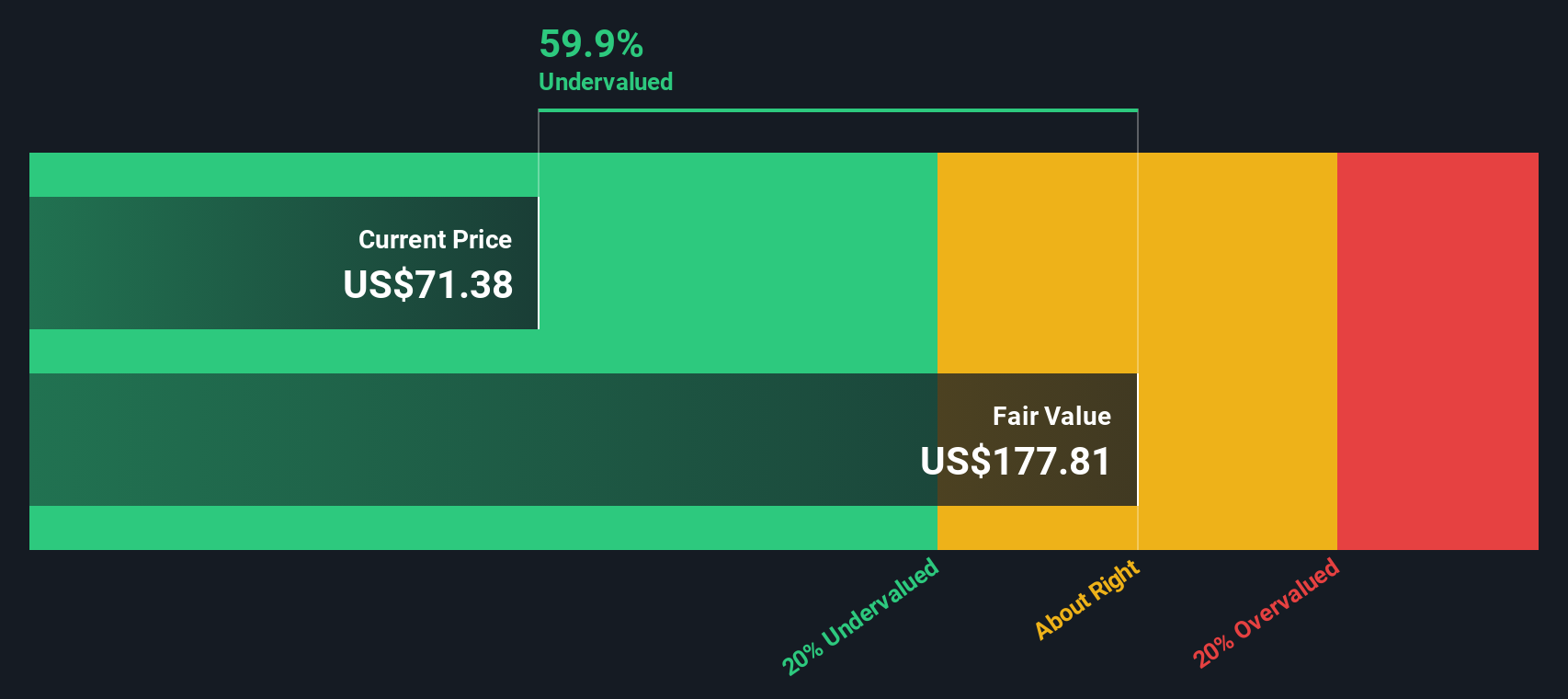

With revenue of US$688.6m, net income of US$185.7m and a current price of US$72.23 that sits below an average analyst target of US$81.58, is Agree Realty quietly undervalued, or is the market already accounting for any future growth?

Most Popular Narrative: 11.8% Undervalued

Agree Realty's most followed narrative points to a fair value of $81.88 per share, compared with the last close of $72.23, putting projected fundamentals in the spotlight.

The durability of essential retail categories (grocery, pharmacy, home improvement, auto parts) is translating into high-quality, e-commerce-resistant tenant composition, supporting rent stability and protecting net margins against shifts in consumer behavior or economic cycles.

Strategic focus on high-credit, national tenants (68% investment-grade across the portfolio) and demonstrated track record of re-leasing challenged assets at significantly higher rents, provides resilience in credit cycles and supports sustainable, long-term net margin expansion.

Curious how steady rent checks and tenant quality translate into that valuation gap? The narrative leans heavily on faster top line expansion, firmer margins, and a richer earnings multiple a few years out. If you want to see exactly how those pieces fit together, the full narrative breaks down the assumptions step by step.

Result: Fair Value of $81.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that gap can close quickly if heavy acquisition spending leads to shareholder dilution, or if reliance on large retailers results in unexpected vacancies and weaker rent collection.

Find out about the key risks to this Agree Realty narrative.

Another View: High P/E Puts The Brakes On The Undervaluation Story

Our DCF estimate suggests Agree Realty trades at a large discount to an implied fair value of $169.14, which points to a very different picture to the 11.8% gap in the popular narrative. If cash flows look this attractive, why is the market still keeping the share price closer to $72?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Agree Realty Narrative

If you are not on board with these assumptions or prefer to lean on your own homework, you can pull up the numbers, stress test the scenarios, and shape a narrative that fits your view in just a few minutes with Do it your way.

A great starting point for your Agree Realty research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Agree Realty has sharpened your focus, do not stop there. You can quickly scan a wider set of ideas that might better fit your income and growth goals.

- Spot potential bargains early by checking out these 886 undervalued stocks based on cash flows that may offer pricing that does not fully reflect their cash flow profile.

- Tap into new growth themes by reviewing these 24 AI penny stocks that are tied to advances in artificial intelligence and related technologies.

- Strengthen your income watchlist by scanning these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal