Assessing Sterling Infrastructure (STRL) Valuation After Earnings Optimism And New Contracts Fuel Investor Enthusiasm

Recent optimism around Sterling Infrastructure (STRL) was sparked by fresh contract wins, an acquisition that expanded its site development and electrical capabilities, and coverage initiations that spotlight its role across US infrastructure projects.

See our latest analysis for Sterling Infrastructure.

At a share price of US$357.91, Sterling Infrastructure has had a 12.1% year to date share price return and a 151.3% total shareholder return over the last year. Despite a recent 5.6% daily pullback after strong contract news and an acquisition, momentum over the past month still reflects growing interest in its role across US infrastructure projects and the debate around how that aligns with current valuation work suggesting the shares screen as expensive on intrinsic value estimates.

If Sterling Infrastructure is on your radar after this run, it could be a good moment to see how it compares with other infrastructure exposed names and check out fast growing stocks with high insider ownership.

So, with Sterling Infrastructure’s strong share price run, upbeat analyst coverage, and valuation work suggesting the stock appears expensive on intrinsic value estimates, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 19.3% Undervalued

Compared to the last close at $357.91, the most followed narrative points to a fair value of $443.25, which reflects a specific view on Sterling Infrastructure's growth, margins, and future valuation multiple.

Record-high and growing backlog, particularly in E-Infrastructure Solutions (up 44% year-over-year to $1.2 billion), coupled with a robust pipeline of future phase work approaching $2 billion, provides multi-year revenue visibility and stability, mitigating downside risk to revenues and supporting sustained earnings growth.

Want to see what kind of revenue path and margin profile that backlog is expected to support? The narrative links it to future earnings and a richer P/E than the wider construction space, based on specific assumptions about how those contracts convert over time.

Result: Fair Value of $443.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on continued mega-project and data center activity. Any squeeze on margins or slowdown in infrastructure funding could quickly challenge that 19.3% undervalued case.

Find out about the key risks to this Sterling Infrastructure narrative.

Another View: Cash Flows Point to a Richer Price

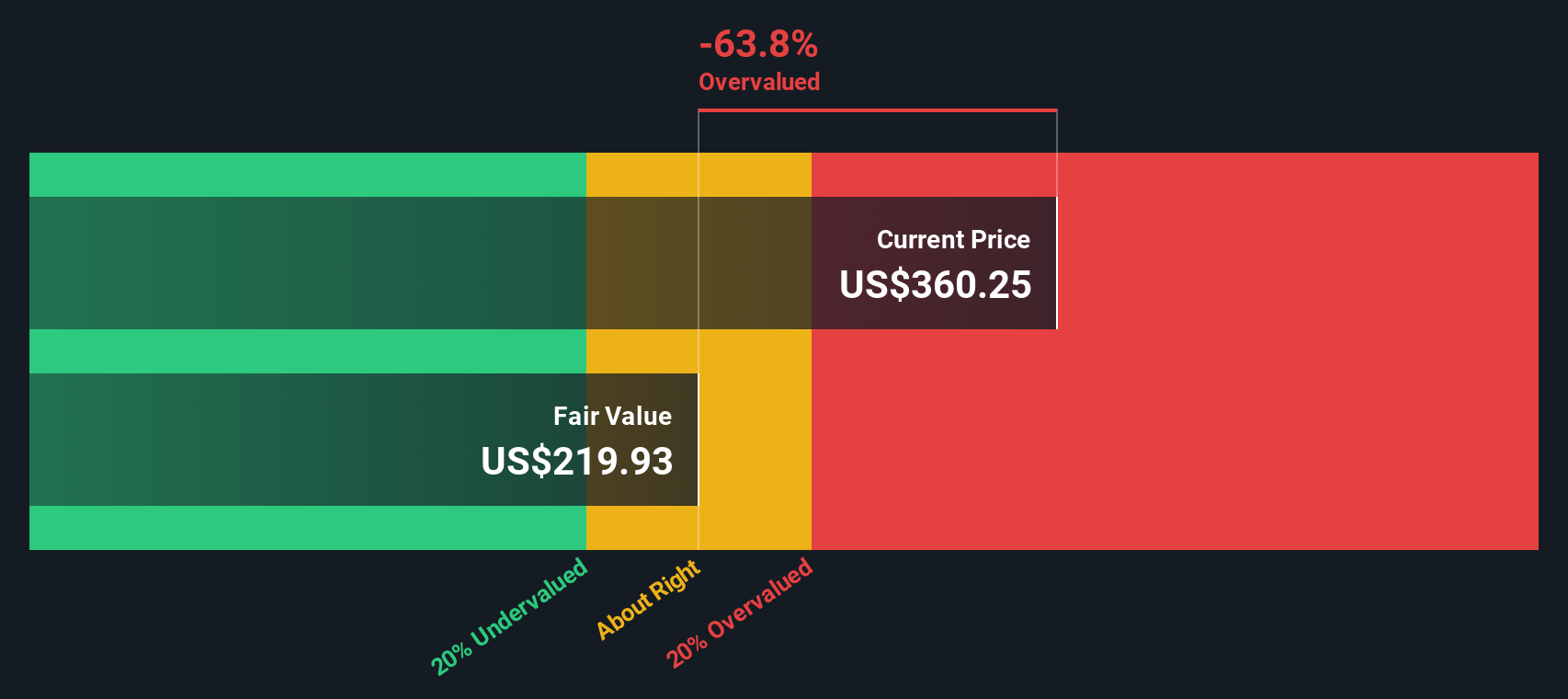

While the popular narrative suggests Sterling Infrastructure is 19.3% undervalued with a fair value of $443.25, our DCF model paints a different picture, with a fair value estimate of $250.80. On that view, today’s $357.91 price looks expensive rather than cheap. This raises a key question: which story do you trust more, earnings multiples or cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sterling Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sterling Infrastructure Narrative

If you prefer a different perspective on the data or want to develop your own view, you can build a custom Sterling Infrastructure story in minutes with Do it your way.

A great starting point for your Sterling Infrastructure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to scout more stock ideas?

If Sterling Infrastructure has caught your attention, do not stop there. Use the Simply Wall Street Screener to quickly surface other focused ideas that match your style.

- Target dependable cash generators by checking out these 12 dividend stocks with yields > 3% that might appeal if you want regular income from established businesses.

- Zero in on future tech themes by scanning these 24 AI penny stocks that are tied to artificial intelligence trends across different parts of the market.

- Hunt for potential mispricings by reviewing these 874 undervalued stocks based on cash flows that could sit below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal