Is Advanced Energy Industries (AEIS) Still Reasonably Valued After Its 122% One Year Surge

- If you are wondering whether Advanced Energy Industries is still fairly priced after its strong run, this article will walk through what the current numbers actually say about value.

- The stock last closed at US$255.36, with returns of 22.0% over the past 30 days and 122.5% over the past year, following gains of 15.0% year to date, 160.3% over 3 years and 130.1% over 5 years.

- Recent news coverage has focused on Advanced Energy Industries as part of broader discussions about semiconductor equipment and power solutions suppliers, as investors reassess how these companies fit into long term electronics and industrial trends. This backdrop provides the context for the strong multi year share price performance shown in the recent return figures.

- Despite this, Advanced Energy Industries currently holds a valuation score of 0 out of 6. Next, we will walk through the common valuation approaches investors might use and finish with a way of thinking about valuation that can tie all of these methods together.

Advanced Energy Industries scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

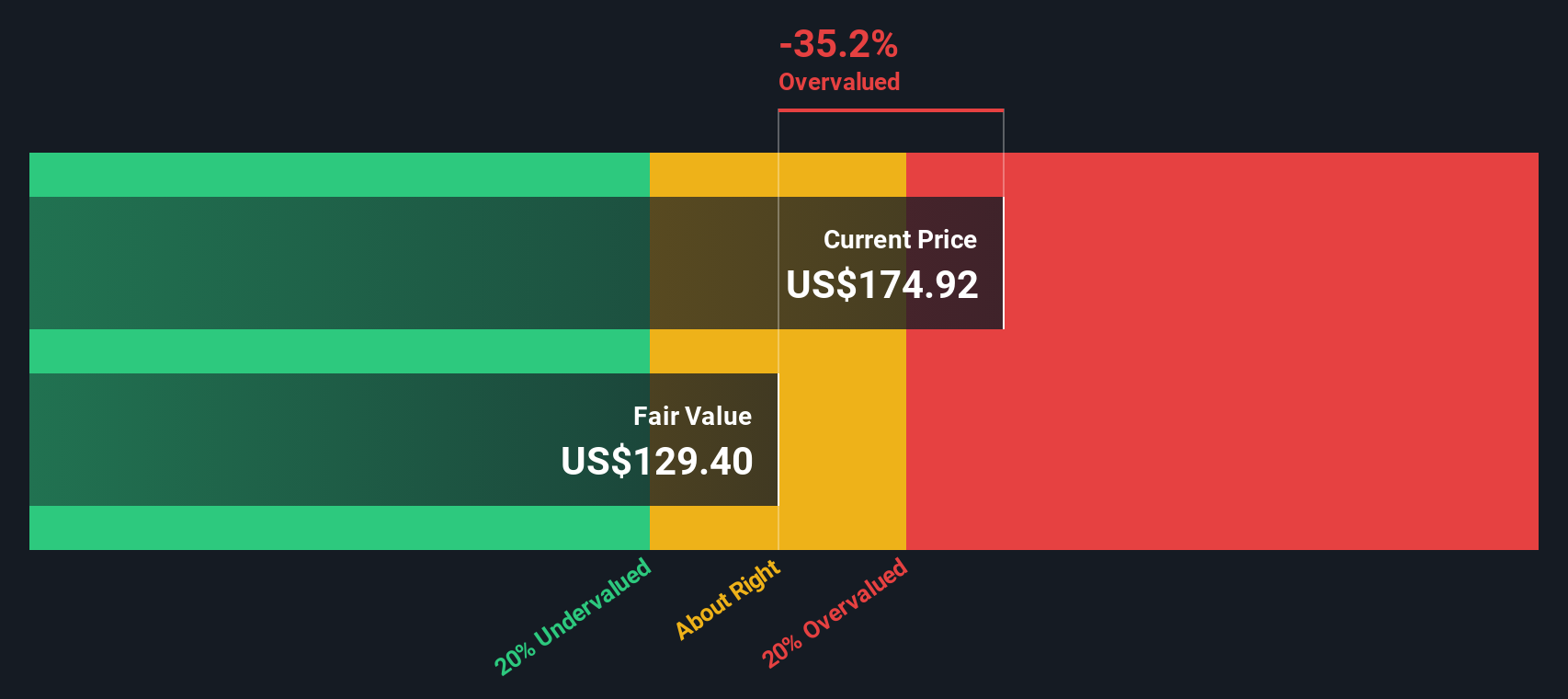

Approach 1: Advanced Energy Industries Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes projected future cash flows and discounts them back to today using a required return, giving a single estimate of what the business could be worth in total right now.

For Advanced Energy Industries, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month free cash flow is about $163.0 million, and analysts provide explicit free cash flow estimates through 2027, including $296.0 million in 2027. Beyond that, Simply Wall St extrapolates further, with a ten year path that runs from $74.3 million in 2026 to $659.3 million in 2035, all in $ and mostly discounted back to present values in the low to mid $300 million range.

When all these discounted cash flows are added together, the model arrives at an estimated intrinsic value of about $222.75 per share. Compared with the recent share price of $255.36, that implies the stock is around 14.6% overvalued based on this DCF snapshot.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Energy Industries may be overvalued by 14.6%. Discover 868 undervalued stocks or create your own screener to find better value opportunities.

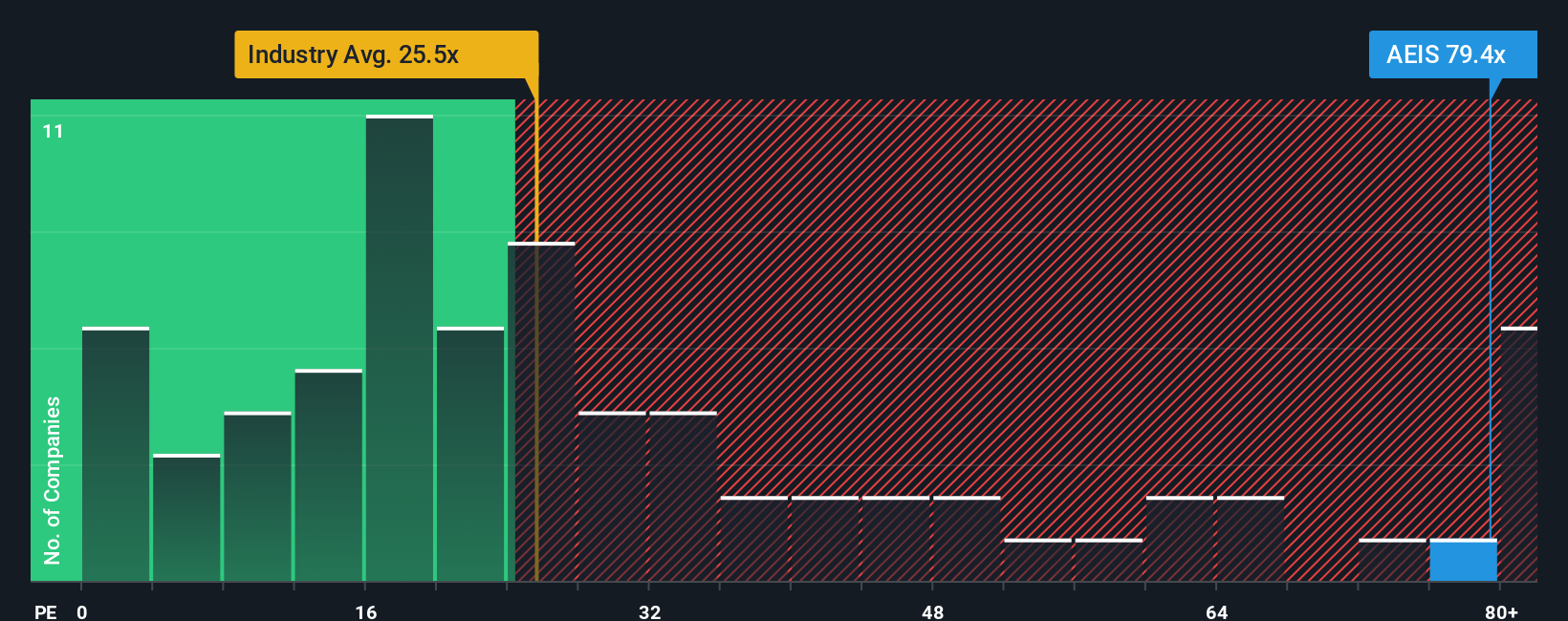

Approach 2: Advanced Energy Industries Price vs Earnings

For a profitable company, the P/E ratio is a useful quick check because it links what you pay for each share directly to the earnings that business is currently generating. It is a simple way to see how many dollars investors are willing to pay today for one dollar of annual earnings.

What counts as a “normal” P/E depends on expectations and risk. Higher expected earnings growth or lower perceived risk can support a higher multiple, while lower growth expectations or higher risk usually call for a lower one.

Advanced Energy Industries currently trades on a P/E of 66.11x. That sits well above the Electronic industry average of 26.61x, and also above the broader peer group average of 30.28x. Simply Wall St’s Fair Ratio for Advanced Energy Industries is 41.24x, which is its proprietary estimate of what the P/E might look like after factoring in items such as earnings growth profile, industry characteristics, profit margins, market cap and company specific risks.

This Fair Ratio can be more informative than a simple comparison with peers because it adjusts for those fundamentals rather than assuming that all companies in the same industry deserve similar multiples. Set against the current P/E of 66.11x, the Fair Ratio of 41.24x suggests the shares are trading above that customized benchmark.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Energy Industries Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about Advanced Energy Industries to the numbers you see on the screen.

A Narrative is your view of the company, written into a set of assumptions about future revenue, earnings and margins that then flows through to a fair value estimate, so you are not just looking at ratios in isolation.

On Simply Wall St, many investors build and share these Narratives on the Community page. Each one links a clear story to a forecast and then to a fair value that can be compared directly with the current share price to help you reflect on whether you see the company as attractive, fairly valued or unattractive.

Your Narrative is not static. It updates when new information such as earnings releases or major news is reflected in the underlying forecasts, so your fair value view stays aligned with what is happening in real time.

For Advanced Energy Industries, one investor might set very optimistic revenue growth and margin assumptions and arrive at a high fair value, while another uses more cautious inputs and arrives at a much lower figure. Both can clearly see how their story leads to their number.

Do you think there's more to the story for Advanced Energy Industries? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal