Assessing Viper Energy (VNOM) Valuation After Recent Short Term Share Price Momentum

Without a clear news headline driving attention to Viper Energy (VNOM) today, you might still be looking at the stock after its recent performance and valuation signals caught your eye.

See our latest analysis for Viper Energy.

At a share price of $41.99, Viper Energy’s recent 7 day share price return of 6.9% and 90 day share price return of 11.79% contrast with a 1 year total shareholder return of a 3.77% decline. This suggests short term momentum, while longer term holders have not yet seen that reflected in total returns.

If this move in Viper has you thinking about energy related opportunities more broadly, it could be a good moment to scan similar names across aerospace and defense stocks.

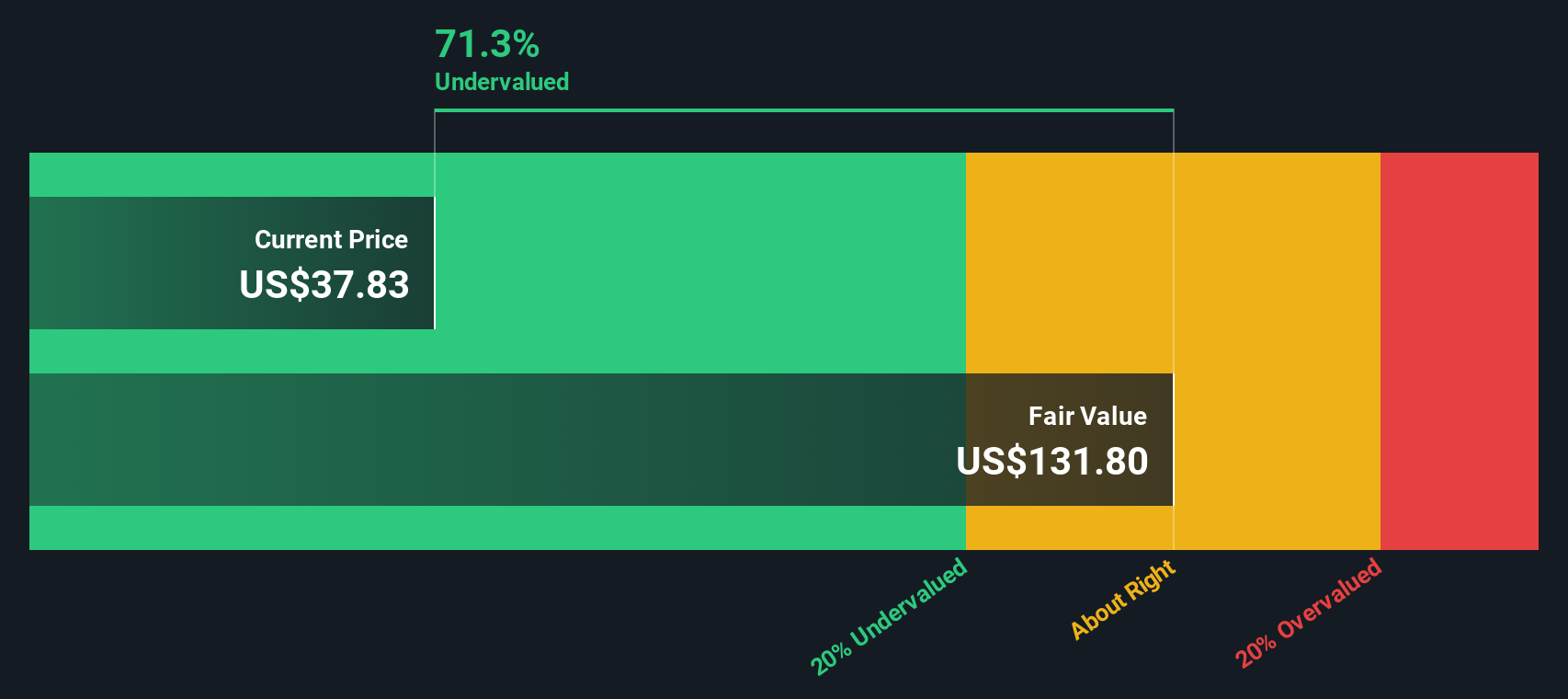

So with Viper Energy trading at $41.99, sitting at a discount to its analyst price target and an indicated intrinsic discount, are you looking at an undervalued energy royalty play, or is the market already baking in future growth?

Most Popular Narrative: 110% Overvalued

Viper Energy closed at $41.99, while the most followed narrative pegs fair value at $20. That gap creates a very different story from recent price strength.

This is one of three major benefits the company brings to the table: As I just briefly explained, the company has a high-margin business model, as it does not incur drilling costs. The Permian is home to almost half of all onshore horizontal rigs in the United States. Essentially, it is a key area for oil and gas production with elevated reserves and low breakeven prices. In a recent article, I showed the chart below. As we can see, the Permian has mostly undeveloped wells, which bodes well for future production. ImageBloomberg Related to the second advantage, the Permian also benefits from decent infrastructure, a favorable regulatory environment, and lower operational risks compared to emerging basins. Nonetheless, because of elevated production, more infrastructure is needed in the years ahead, which is one of the reasons why I am also very bullish on the midstream industry.

Curious how a business with high margins and prized Permian exposure can still land at a much lower fair value? The key ingredients are its assumed long term profitability profile, the way future cash flows are discounted, and a profit multiple that sits well below fast growth market darlings. Want to see exactly how those pieces come together in the full valuation story?

Result: Fair Value of $20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh risks such as changing assumptions about long-term profitability or shifts in how royalty names are valued relative to high-growth peers.

Find out about the key risks to this Viper Energy narrative.

Another View: Cash Flows Tell a Different Story

That 110% overvalued narrative sits awkwardly beside our DCF model, which estimates Viper Energy’s future cash flows at $101.20 per share. With the stock at $41.99, this view frames VNOM as trading at a very large discount. Which story do you think fits the risks better?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Viper Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 866 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Viper Energy Narrative

If you are not on board with this view or prefer to roll up your sleeves and work through the data yourself, you can shape your own take in just a few minutes, starting with Do it your way.

A great starting point for your Viper Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Viper Energy is only one piece of your watchlist, this is the moment to widen the net and line up your next set of candidates.

- Target reliable income by checking out these 14 dividend stocks with yields > 3% that could help you build a steadier cash return profile.

- Spot potential mispricings early by scanning these 866 undervalued stocks based on cash flows that might not yet reflect their underlying cash flows.

- Get ahead of emerging themes with these 18 cryptocurrency and blockchain stocks sitting at the crossroads of digital assets and listed equities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal