Cadence Design Systems (CDNS) Valuation Check After Lightmatter Photonic AI Partnership

Cadence Design Systems (CDNS) shares are drawing attention after Lightmatter announced a collaboration that pairs Cadence’s high speed SerDes IP with Lightmatter’s Passage optical engine for co packaged optics in AI and high performance computing.

See our latest analysis for Cadence Design Systems.

Despite the new Lightmatter collaboration and January’s HiFi iQ DSP launch for voice AI and immersive audio, recent share price momentum has softened, with a 30 day share price return of a 4.10% decline and a 1 year total shareholder return of 1.65%. This suggests long term holders have seen modest gains, while short term traders have faced pressure.

If this kind of AI infrastructure story interests you, it may be worth scanning other high growth tech names through high growth tech and AI stocks to see what else fits your style.

With shares easing back over the past quarter but revenue and net income still positive, the key question is whether Cadence is now a quality AI infrastructure pick at a reasonable price or if the market already reflects its future growth.

Most Popular Narrative: 21.2% Undervalued

Cadence Design Systems' most followed narrative pegs fair value at about $384, comfortably above the recent $302.67 close, framing the stock as materially discounted on that view.

The analysts have a consensus price target of $369.573 for Cadence Design Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $410.0, and the most bearish reporting a price target of just $200.0.

Curious what kind of revenue climb, margin profile, and future earnings power sit behind that higher fair value and premium multiple story? The full narrative explains the growth path, the profitability assumptions, and the earnings per share line that need to align for $384 to be a reasonable estimate.

Result: Fair Value of $384.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story can break if geopolitical tensions or a pullback in semiconductor spending hit Cadence’s China exposure, key partnerships, or AI centric design activity.

Find out about the key risks to this Cadence Design Systems narrative.

Another Angle On Valuation

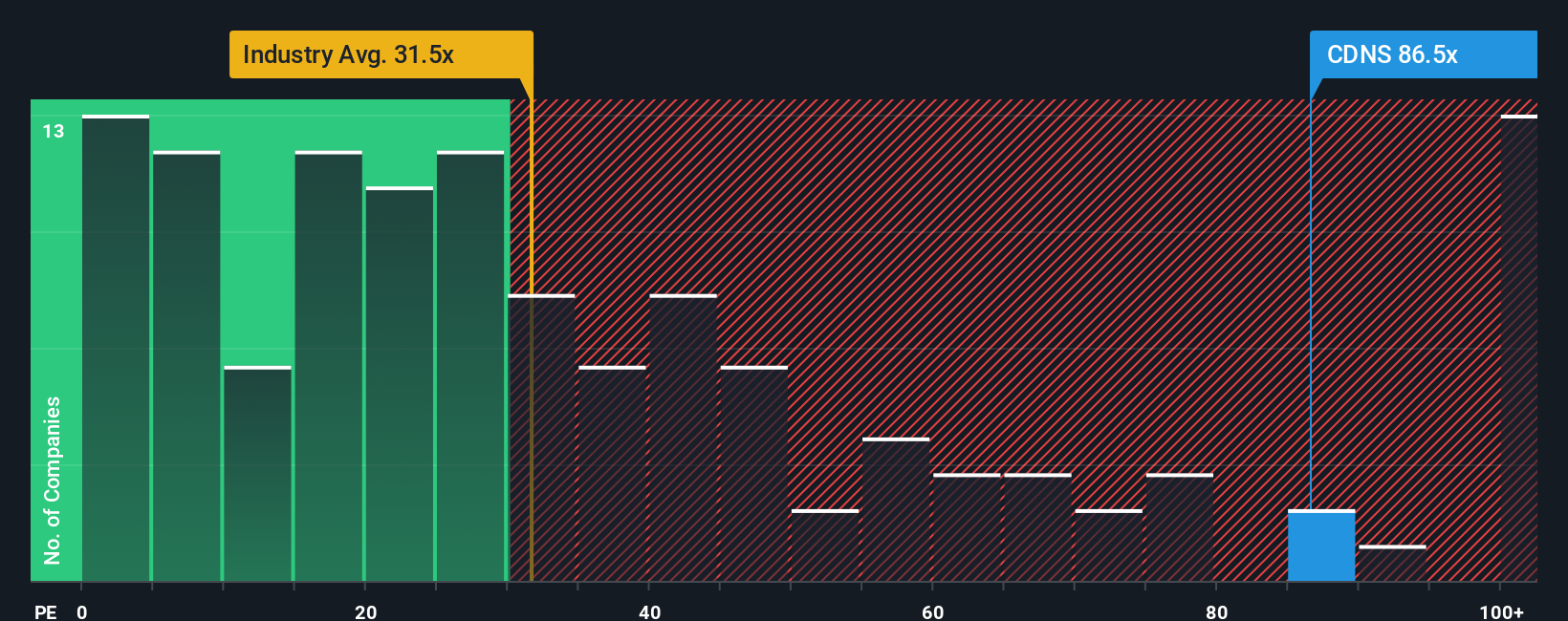

That 21.2% undervalued narrative sits awkwardly next to the current P/E of 77.7x. Our fair ratio estimate is 39x, while peers trade around 51.4x and the wider US Software group is at 28.8x. That leaves you weighing how much valuation risk you are really comfortable with.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Design Systems Narrative

If this consensus story does not quite fit how you see Cadence, or you prefer to test the numbers yourself, you can build a tailored view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cadence Design Systems.

Looking for more investment ideas?

If Cadence sparks your interest, do not stop here. Broaden your watchlist with other focused stock ideas that could better match your risk and return preferences.

- Target potential mispricings by scanning these 868 undervalued stocks based on cash flows that currently trade below what their cash flows might justify.

- Lean into the AI theme by checking out these 24 AI penny stocks linked to artificial intelligence projects and tools.

- Add diversification by reviewing these 14 dividend stocks with yields > 3% that provide income through yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal