West Bancorporation (WTBA) Margin Improvement Reinforces Bullish Narratives Despite Five Year Earnings Decline

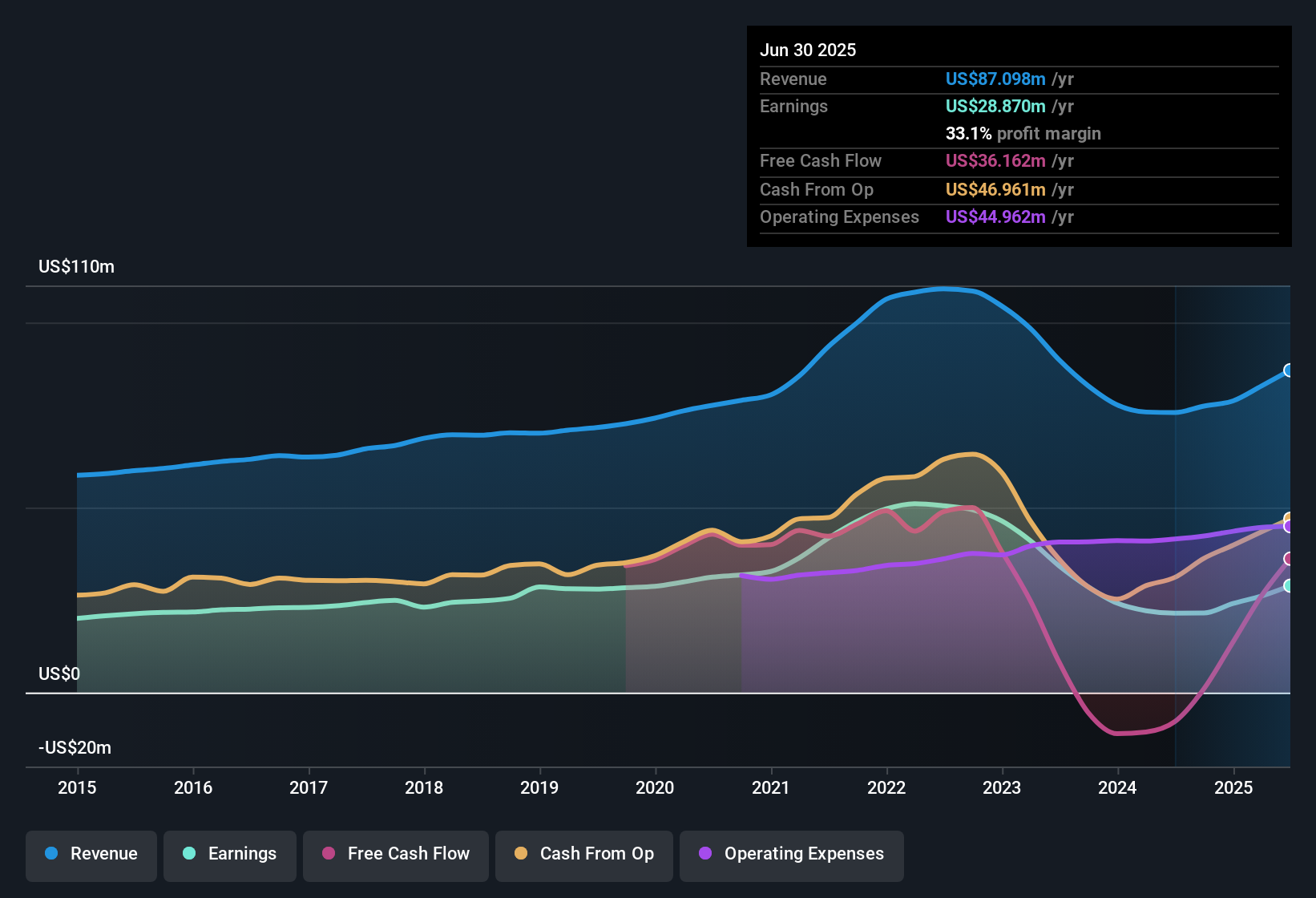

West Bancorporation (WTBA) closed out FY 2025 with fourth quarter revenue of US$23.3 million and basic EPS of US$0.44, capping a trailing twelve month stretch that produced US$95.2 million in revenue and US$1.92 in EPS. Over that period, revenue moved from US$78.8 million to US$95.2 million while EPS rose from US$1.43 to US$1.92, indicating that earnings have grown faster than revenue as the bank converted more of its income into profit. With net profit margins higher over the last year and forecasts calling for solid growth in both earnings and revenue, the latest results give investors more information to consider when assessing the sustainability of recent margin strength.

See our full analysis for West Bancorporation.With the headline numbers now on the table, the next step is to see how this earnings profile compares with the main narratives around West Bancorporation, highlighting where recent performance is consistent with those stories and where it may challenge them.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins and costs: 34.2% profit and lower cost ratios

- Over the last 12 months, West Bancorporation converted US$32.56 million of net income from US$95.25 million of revenue, which equates to a 34.2% net margin alongside a cost to income ratio that moved from 63.28% in 2024 Q3 to 54.06% by 2025 Q3.

- What stands out for the bullish view is how this margin picture lines up with the recent data:

- Earnings grew 35.4% over the last year while net margin moved from 30.5% to 34.2%, and quarterly cost to income ratios stayed in the mid 50% range in 2025, which supports the idea that profitability has been tighter on both the revenue and expense sides.

- At the same time, the five year earnings trend shows a 12.3% annual decline, so anyone with a bullish stance has to weigh the stronger recent margins against that longer running earnings record.

Valuation gap: P/E of 12.1x vs DCF value

- West Bancorporation trades on a trailing P/E of 12.1x compared with a peer average of 30.7x and a US Banks industry average of 11.7x, and the current share price of US$23.27 sits below a DCF fair value of about US$28.38.

- Supporters of a more bullish angle point to this mix of earnings growth and valuation:

- The 35.4% earnings increase over the last year, combined with forecasts for earnings growth of about 16.5% per year and revenue growth around 12.1% per year, is being compared to a P/E that is well below the 30.7x peer average.

- At the same time, the P/E is slightly above the 11.7x US Banks industry level and the DCF fair value of US$28.38 is an output of a model, so investors still need to decide how much weight to put on the gap between that figure and the US$23.27 share price.

Growth rebound vs five year decline

- On a trailing basis, earnings grew 35.4% over the last year and basic EPS reached US$1.92, while the five year trend still shows an annual earnings decline of 12.3% and trailing twelve month revenue of US$95.25 million up from US$78.80 million a year earlier.

- Critics with a more bearish tilt focus on how these timeframes differ:

- The recent 35.4% earnings growth and net income of US$32.56 million over the last 12 months highlight a much stronger year than the longer history suggests, which raises questions for bears about how representative this latest period is.

- However, the five year annual decline of 12.3% in earnings gives those same bears a data point that the longer cycle has been weaker, and they may watch future quarters closely to see whether the current US$1.92 EPS level can be maintained or not.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on West Bancorporation's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

West Bancorporation’s recent 35.4% earnings growth sits against a five year annual earnings decline of 12.3%, which raises questions about consistency across cycles.

If that uneven record makes you want steadier compounding, check out CTA_SCREENER_STABLE_GROWTH to focus on companies with more consistent revenue and earnings through different periods.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal