Gloo Holdings And 2 More High Growth Companies With Strong Insider Ownership

As the U.S. stock market faces turbulence with major indices like the Dow Jones and S&P 500 experiencing declines, investors are keenly observing companies that exhibit resilience and potential for growth. In such a volatile environment, stocks of growth companies with high insider ownership often stand out as they suggest strong internal confidence in the business's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 25.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 32.2% | 85.6% |

| Niu Technologies (NIU) | 37.2% | 101.1% |

| Karman Holdings (KRMN) | 17.3% | 62% |

| GBank Financial Holdings (GBFH) | 28.9% | 46.2% |

| Corcept Therapeutics (CORT) | 11.5% | 43.7% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 136.7% |

| Astera Labs (ALAB) | 10.5% | 28.8% |

Here we highlight a subset of our preferred stocks from the screener.

Gloo Holdings (GLOO)

Simply Wall St Growth Rating: ★★★★★☆

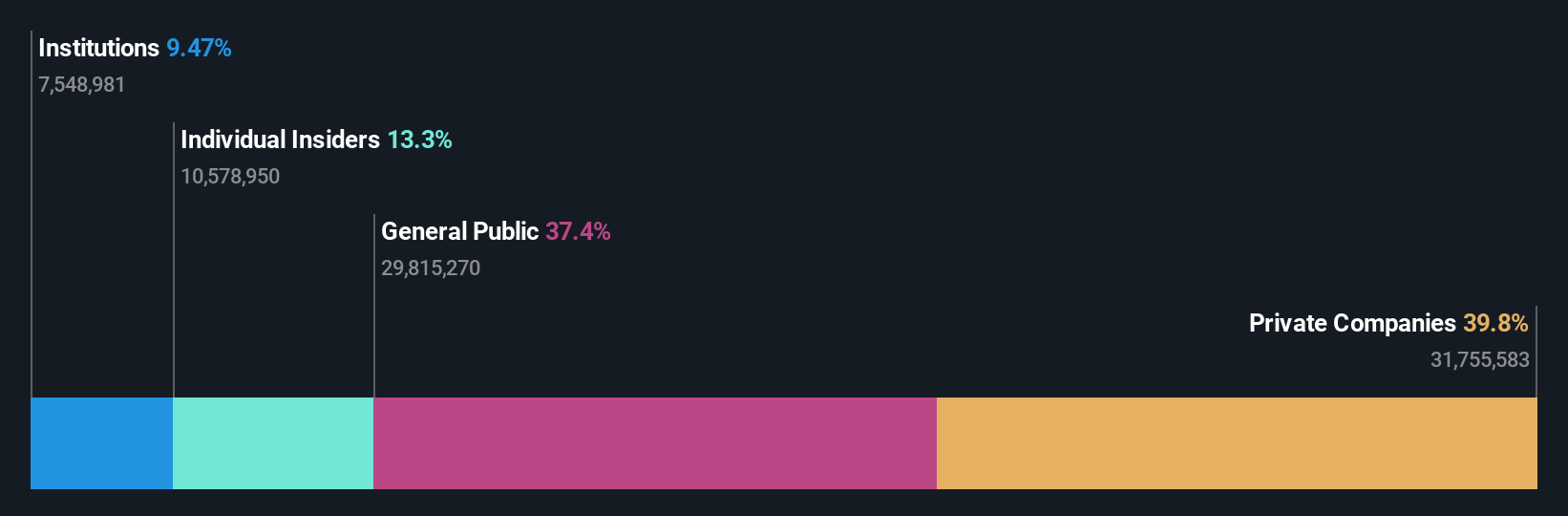

Overview: Gloo Holdings, Inc. designs and develops a vertical technology platform for the faith and flourishing ecosystem, with a market cap of approximately $477.40 million.

Operations: The company's revenue segment includes the Gloo Segment, which generated $67.52 million.

Insider Ownership: 13.3%

Revenue Growth Forecast: 39.2% p.a.

Gloo Holdings demonstrates potential as a growth company with high insider ownership, evidenced by substantial insider buying over the past three months. Despite recent losses, revenue grew 197% year-over-year, and earnings are forecast to grow 80.9% annually. The company anticipates more than doubling its revenue in fiscal year 2026 to over US$180 million. However, Gloo faces challenges with a volatile share price and less than one year of cash runway.

- Get an in-depth perspective on Gloo Holdings' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Gloo Holdings' share price might be on the expensive side.

Similarweb (SMWB)

Simply Wall St Growth Rating: ★★★★★☆

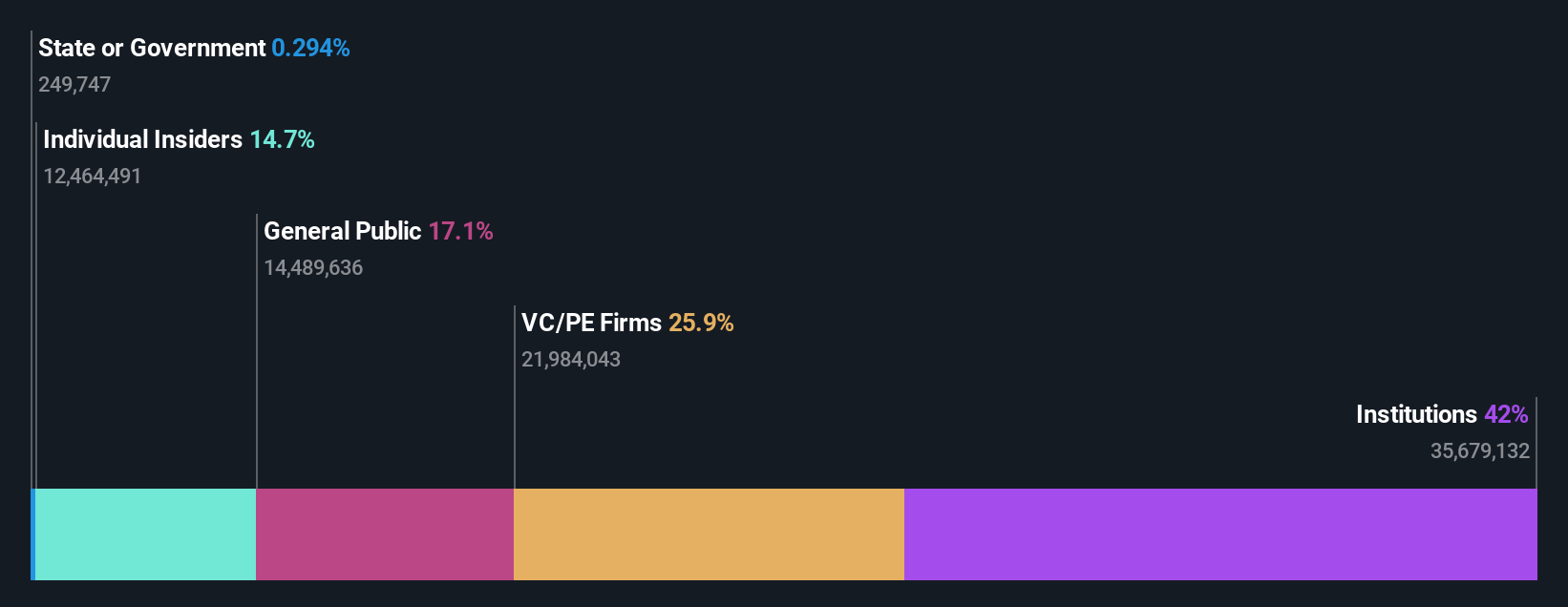

Overview: Similarweb Ltd. offers digital data and analytics services to support critical business decisions across various regions globally, with a market cap of approximately $485.76 million.

Operations: The company's revenue primarily stems from its On Line Financial Information Providers segment, generating $275.43 million.

Insider Ownership: 14.4%

Revenue Growth Forecast: 13% p.a.

Similarweb exhibits potential in the growth sector, supported by its strategic collaboration with Manus to enhance AI-driven digital marketing capabilities. Despite a net loss of US$25.44 million for the first nine months of 2025, revenue increased to US$209.84 million from the previous year. The company's revenue is forecasted to grow at 13% annually, outpacing the broader U.S. market, and it is expected to achieve profitability within three years with high return on equity projections.

- Dive into the specifics of Similarweb here with our thorough growth forecast report.

- According our valuation report, there's an indication that Similarweb's share price might be on the cheaper side.

ZKH Group (ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

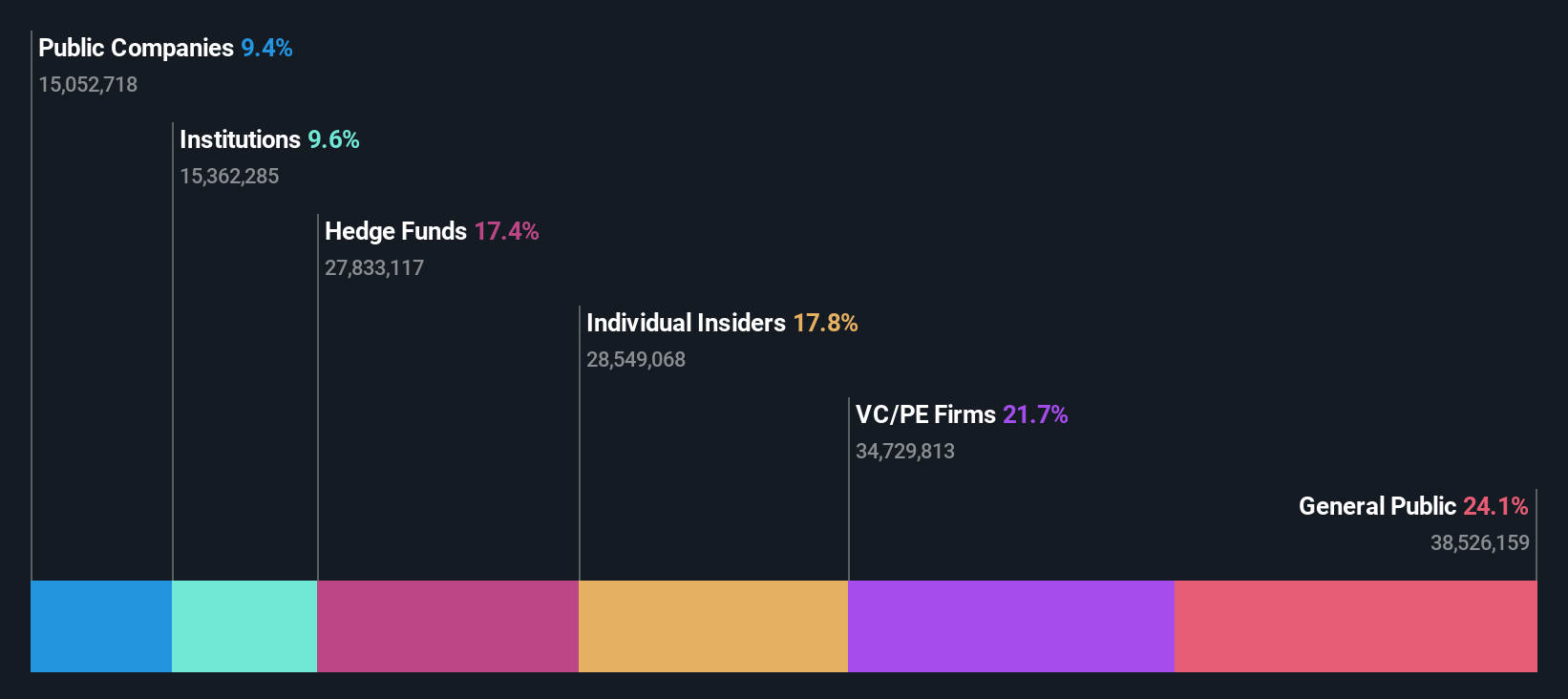

Overview: ZKH Group Limited operates a trading and service platform for MRO products, including spare parts, chemicals, manufacturing parts, general consumables, and office supplies in China with a market cap of approximately $551.36 million.

Operations: The company's revenue is primarily derived from its Business-To-Business Trading and Services of Industrial Products segment, which generated approximately CN¥8.80 billion.

Insider Ownership: 16.8%

Revenue Growth Forecast: 11.9% p.a.

ZKH Group's recent earnings report shows a narrowing net loss for the third quarter and nine months of 2025, with revenues reaching CNY 2.33 billion and CNY 6.43 billion, respectively. The company is expected to turn profitable within three years, with revenue growth forecasted at 11.9% annually, surpassing the broader U.S. market rate of 10.6%. Trading significantly below its estimated fair value suggests potential investment appeal despite low projected return on equity at 6%.

- Click here and access our complete growth analysis report to understand the dynamics of ZKH Group.

- Our valuation report here indicates ZKH Group may be undervalued.

Next Steps

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 201 more companies for you to explore.Click here to unveil our expertly curated list of 204 Fast Growing US Companies With High Insider Ownership.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal