Caesarstone And 2 More Penny Stocks Worth Watching

As the U.S. market faces fluctuations with major indices like the Dow Jones and S&P 500 experiencing declines, investors are increasingly seeking alternative opportunities to diversify their portfolios. Penny stocks, a term that may seem outdated, continue to hold potential for those willing to explore smaller or newer companies that can offer growth at lower price points. With strong balance sheets and solid fundamentals, these stocks can present hidden gems in today's market landscape, offering compelling opportunities for investors looking beyond the mainstream options.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.82 | $612.91M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.71 | $603.98M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8103 | $137.38M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $2.90 | $496.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuya (TUYA) | $2.15 | $1.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.66 | $170.09M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.44 | $931.68M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.93 | $6.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.61 | $84.96M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 330 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Caesarstone (CSTE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Caesarstone Ltd. designs, develops, manufactures, and sells engineered stone and porcelain products globally under various brands, with a market cap of $84.32 million.

Operations: The company's revenue comes entirely from its Building Products segment, totaling $400.66 million.

Market Cap: $84.32M

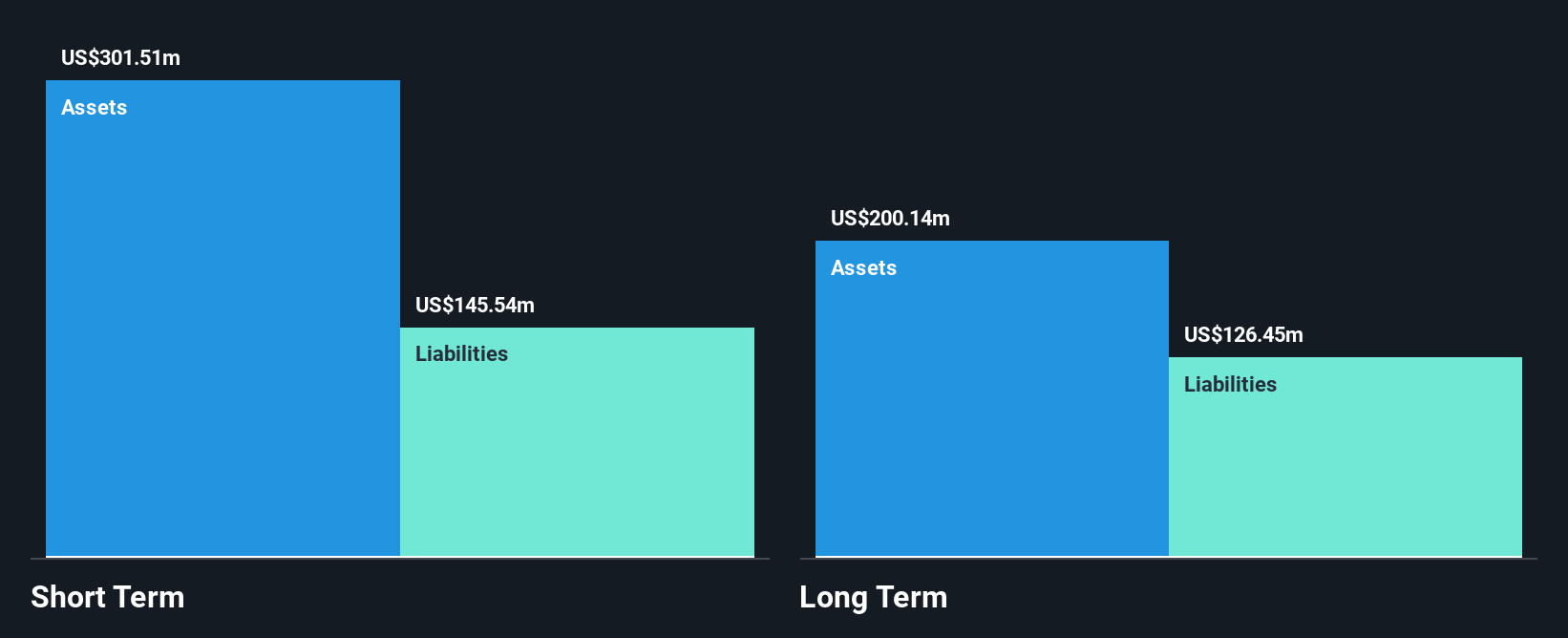

Caesarstone Ltd., with a market cap of US$84.32 million, is navigating challenges typical of penny stocks, including recent financial losses and restructuring efforts. The company reported a net loss of US$18.1 million for Q3 2025, reflecting ongoing profitability issues. Despite this, Caesarstone's short-term assets exceed both its long-term and short-term liabilities, indicating some balance sheet strength. Recent strategic moves include closing a manufacturing facility in Israel to improve competitiveness and profitability. Additionally, the board has seen changes with the appointment of Yaron Arzi, who brings extensive leadership experience across multiple industries to aid in potential turnaround efforts.

- Navigate through the intricacies of Caesarstone with our comprehensive balance sheet health report here.

- Assess Caesarstone's previous results with our detailed historical performance reports.

PMV Pharmaceuticals (PMVP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PMV Pharmaceuticals, Inc. is a precision oncology company focused on discovering and developing small molecule and tumor-agnostic therapies for p53 mutations in cancer, with a market cap of $64.39 million.

Operations: PMV Pharmaceuticals, Inc. currently does not report any revenue segments.

Market Cap: $64.39M

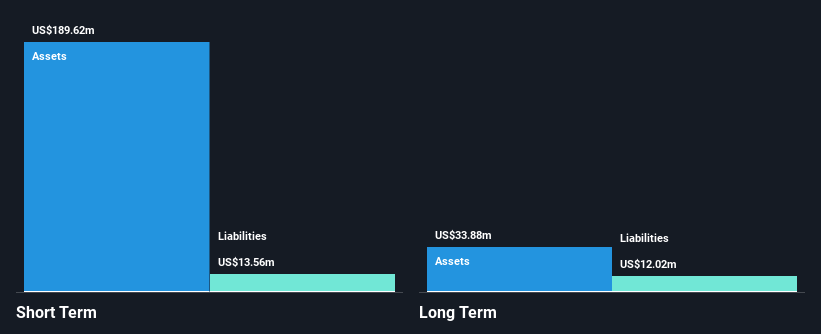

PMV Pharmaceuticals, Inc., with a market cap of US$64.39 million, is a pre-revenue company focused on precision oncology. The firm reported an increased net loss of US$21.06 million for Q3 2025, reflecting its ongoing unprofitability and lack of significant revenue streams. Despite these challenges, PMV's financial position shows resilience with short-term assets amounting to US$132.4 million exceeding both short-term and long-term liabilities, and the company remains debt-free for over five years. The management team and board are experienced with average tenures of 4.9 years, providing stability amidst the company's current financial hurdles.

- Take a closer look at PMV Pharmaceuticals' potential here in our financial health report.

- Understand PMV Pharmaceuticals' earnings outlook by examining our growth report.

Grove Collaborative Holdings (GROV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grove Collaborative Holdings, Inc. is a consumer products company that develops and sells household, personal care, beauty, and other consumer products in the United States with a market cap of approximately $62.50 million.

Operations: The company generates revenue primarily through online retailers, amounting to $180.81 million.

Market Cap: $62.5M

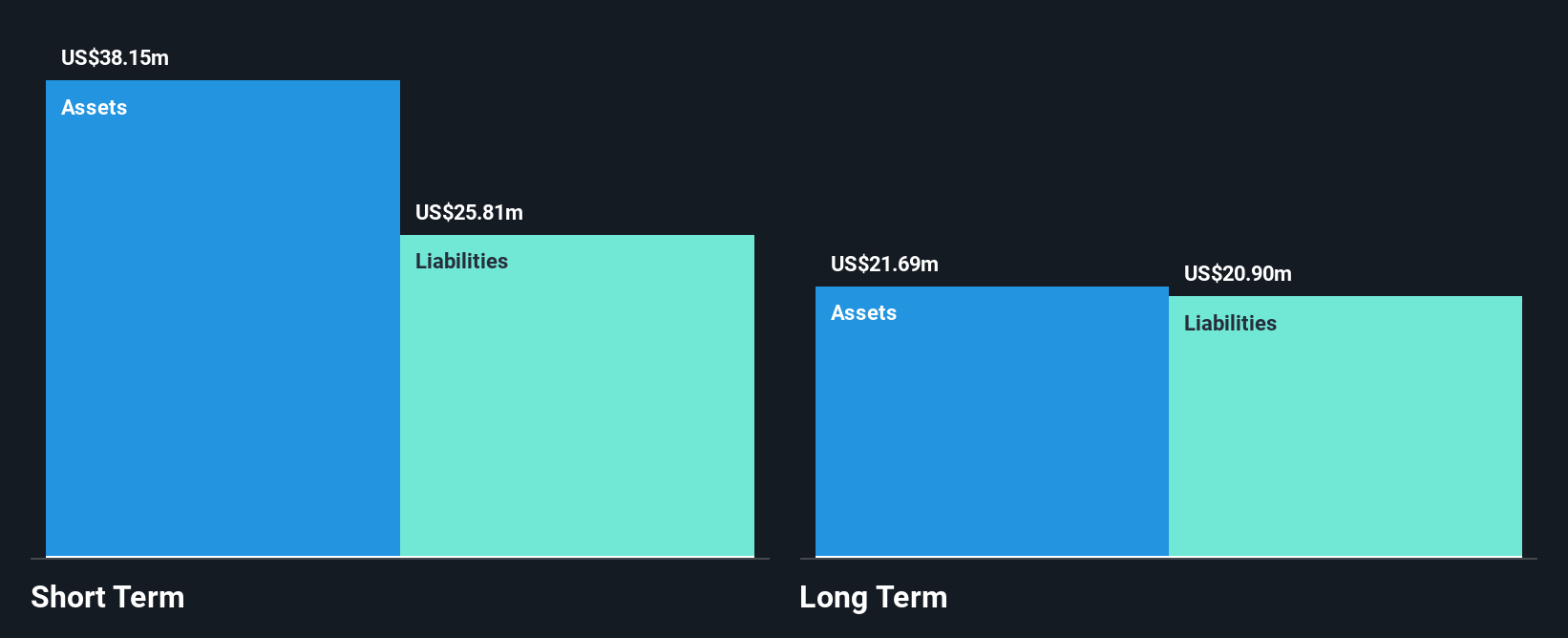

Grove Collaborative Holdings, Inc., with a market cap of US$62.50 million, is navigating challenges typical for penny stocks. The company reported a decline in revenue to US$43.73 million for Q3 2025 and increased net losses compared to the previous year. Despite its unprofitability, Grove has managed to reduce losses over the past five years at a significant rate and maintains more cash than total debt. However, its cash runway is limited to less than a year if free cash flow continues growing historically. Management's decision to lower advertising investment reflects strategic adjustments amid financial constraints.

- Unlock comprehensive insights into our analysis of Grove Collaborative Holdings stock in this financial health report.

- Gain insights into Grove Collaborative Holdings' outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Explore the 330 names from our US Penny Stocks screener here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal