Sterling Infrastructure Puts E-Infrastructure And Data Centers At Center Stage

- Sterling Infrastructure's E-Infrastructure segment is drawing attention as a key growth driver, with a particular focus on data center projects.

- The company is being viewed as relatively resilient to concerns around the AI investment cycle, supported by its data center construction activity.

- Investors are watching how this segment could influence near term sentiment toward NasdaqGS:STRL.

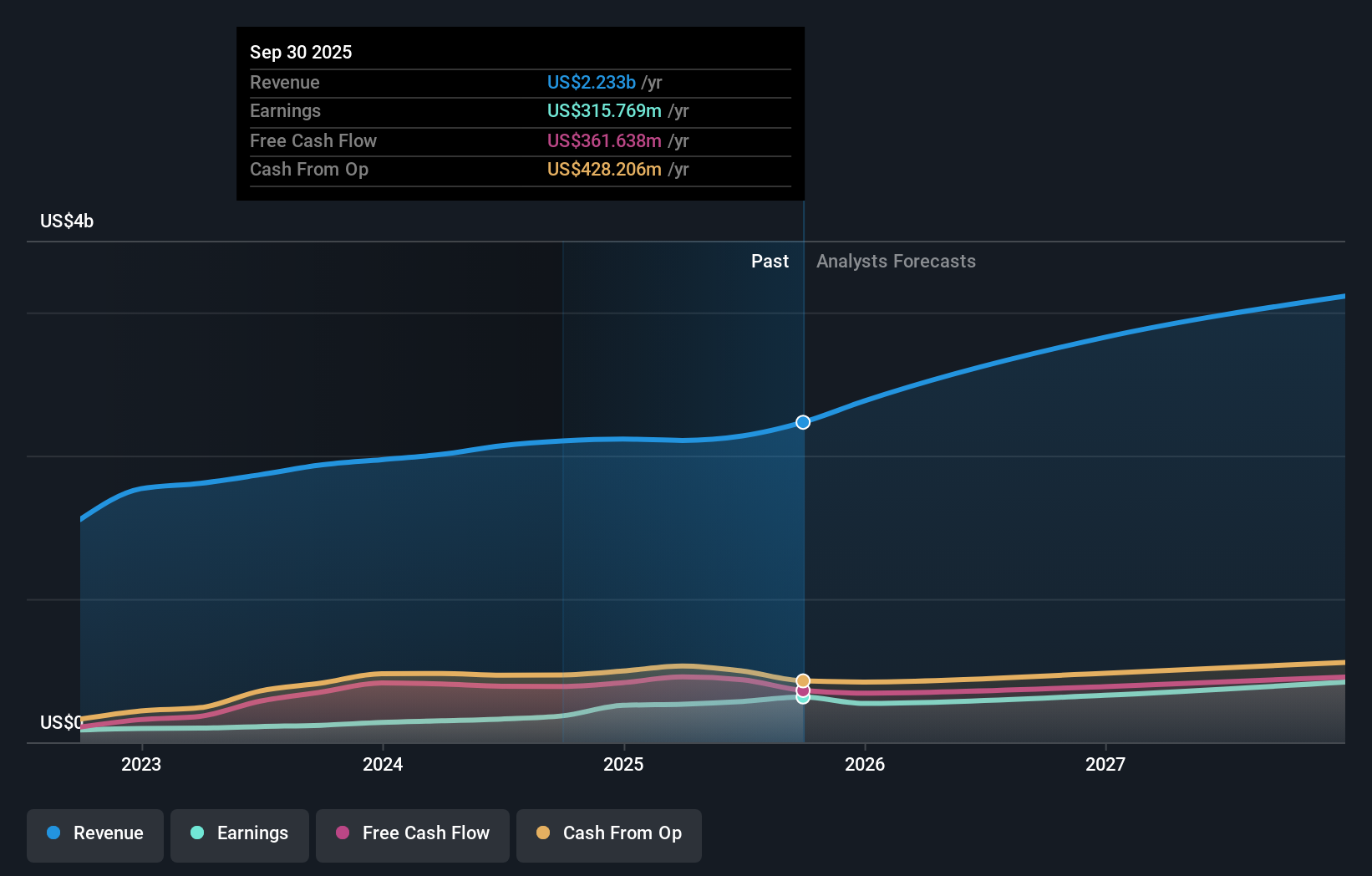

Sterling Infrastructure, trading on NasdaqGS:STRL, is increasingly being evaluated through the lens of its E-Infrastructure business rather than its traditional construction roots. With the share price at $373.52 and a very large 5 year return, the stock already reflects strong interest from the market. The growing focus on data center work adds another layer for investors tracking how the company is positioned within key technology related build outs.

The emphasis on data center projects may help frame how investors think about potential earnings drivers and contract visibility over the near term. For readers, the key question is how durable this order flow could be if AI related spending patterns become more uneven, and whether E-Infrastructure provides some insulation from broader sector swings.

Stay updated on the most important news stories for Sterling Infrastructure by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sterling Infrastructure.

How Sterling Infrastructure stacks up against its biggest competitors

The growing importance of Sterling Infrastructure's E-Infrastructure segment puts data center projects at the center of the story, and investors are effectively treating this as a separate, higher-value business line compared with traditional roads or building work. With large tech and cloud customers continuing to prioritize data capacity, this focus can support perceptions of better contract visibility and potentially less sensitivity to short-term swings in generic construction spending, especially when you compare Sterling with peers like Jacobs or AECOM that also target complex infrastructure work.

Sterling Infrastructure narrative is increasingly about E-Infrastructure

The latest attention on E-Infrastructure ties directly into the existing narrative that Sterling's record backlog and data-centric projects are key to its future, with mega data centers and advanced manufacturing often cited as important drivers. At the same time, prior analysis has flagged that heavy reliance on these mega-projects can cut both ways, so this news tends to reinforce the story that execution quality and customer relationships in E-Infrastructure are central to how the stock is viewed rather than its legacy construction exposure.

Risks and rewards investors are weighing now

- E-Infrastructure projects linked to data centers can support multi-year revenue visibility and differentiate Sterling from more commodity-like contractors such as Tutor Perini or Granite Construction.

- A focus on complex, higher-margin work in data-centric sectors fits with prior commentary around margin support from larger, more technical jobs.

- Concentration in mega data center and AI-related infrastructure work introduces exposure if customer capital spending plans are revised or delayed.

- Analysts have flagged at least 1 risk related to earnings quality, so investors may want to watch how project timing and one-off items affect reported results as E-Infrastructure grows.

What to watch from here

From here, it is worth tracking whether Sterling converts its E-Infrastructure pipeline into new awards at a pace that supports current expectations, and how consistently it executes large data center jobs without cost or schedule issues. If you want more context on how other investors are thinking about this shift, take a look at community narratives for Sterling Infrastructure on Simply Wall St and compare the E-Infrastructure story against your own view of AI-related spending and construction risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal