A Look At Brightstar Lottery’s Valuation As New Wisconsin And Ontario Contracts Highlight Its Lottery Tech Expansion

Brightstar Lottery (BRSL) is back in focus after announcing new agreements with the Wisconsin Lottery and Ontario Lottery, highlighting fresh contract activity and broader adoption of its lottery technology platforms.

See our latest analysis for Brightstar Lottery.

Those Wisconsin and Ontario wins come after a softer period for the stock, with a 30 day share price return of a 9.6% decline and a 90 day share price return of a 14.75% decline, while the 1 year total shareholder return of 4.97% sits against a 3 year total shareholder return of a 27.25% decline and a 5 year total shareholder return of 17.26%, hinting at mixed momentum around the current US$14.22 share price.

If this kind of lottery tech story has your attention, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With fresh contract wins, positive 1 year returns and a US$14.22 share price sitting at a sizeable discount to analyst targets, the real question is whether Brightstar is still mispriced or if the market already sees the growth story coming.

Most Popular Narrative: 29.5% Undervalued

At a last close of $14.22 versus a narrative fair value of $20.17, Brightstar Lottery is framed as underpriced on long term cash generation potential.

Regulatory liberalization and successful contract renewals (notably Italy Lotto secured through 2034 and new/extended deals in Missouri, Portugal, and France) are expanding the addressable market and extending Brightstar's average revenue-weighted contract life to 7 years, thus providing long-term revenue stability and enhanced cash flow visibility.

Want to see what sits behind that cash flow story? The narrative leans heavily on gradual revenue gains, margin repair and a future earnings multiple that has to do some lifting. Curious which specific assumptions really drive that $20.17 fair value and the gap to today’s price?

Result: Fair Value of $20.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative still hinges on regulatory decisions and the high cost of long term licenses, either of which could pressure margins and future cash generation.

Find out about the key risks to this Brightstar Lottery narrative.

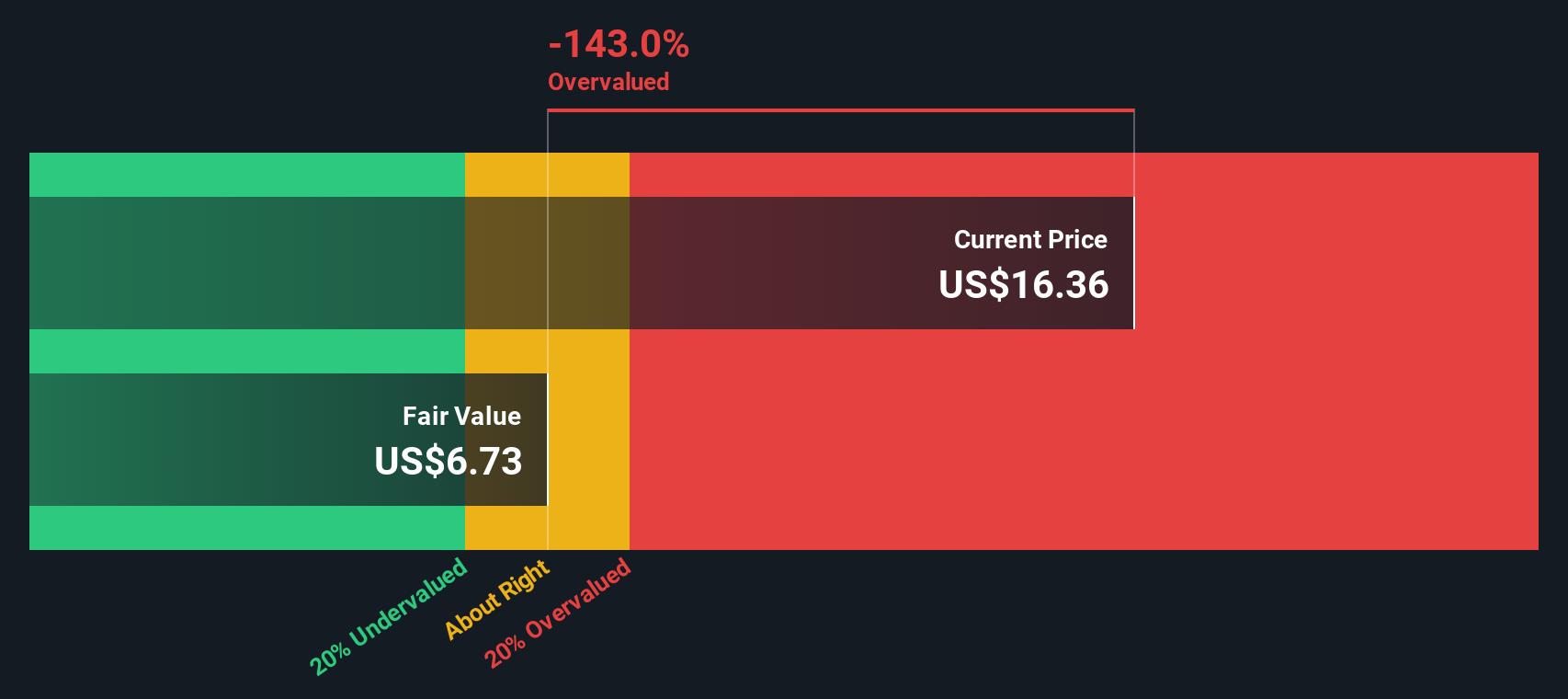

Another View: SWS DCF Says Overvalued

There is a twist when you compare the $20.17 narrative fair value with our DCF model. On the SWS DCF numbers, Brightstar Lottery’s estimated future cash flow value sits at $9.78, which is below the current $14.22 share price, pointing to an overvalued outcome rather than a discount.

That kind of gap between a cash flow model and a narrative target raises a simple question for you: which set of assumptions about future growth and margins feels closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brightstar Lottery for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brightstar Lottery Narrative

If you are not fully on board with these assumptions or simply want to stress test them yourself, you can build your own view in just a few minutes by starting with Do it your way.

A great starting point for your Brightstar Lottery research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Brightstar has sparked your interest, do not stop here, use the Simply Wall Street Screener to quickly surface fresh, data driven ideas that match your style.

- Spot potential value plays early by checking out these 881 undervalued stocks based on cash flows that screen for companies priced below their estimated cash flow value.

- Ride the momentum of transformative tech by scanning these 24 AI penny stocks where artificial intelligence sits at the core of each business model.

- Hunt for income ideas with these 13 dividend stocks with yields > 3% focused on companies offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal