Assessing Clean Harbors (CLH) Valuation After Recent Share Price Momentum

Why Clean Harbors Is on Investors’ Radar Today

Clean Harbors (CLH) is drawing attention after recent share price moves, with the stock showing different returns over the past week, month, and past 3 months that may prompt investors to reassess their view.

See our latest analysis for Clean Harbors.

At the current share price of US$260.29, Clean Harbors has posted a 30 day share price return of 8.08% and a year to date share price return of 6.92%. Longer term total shareholder returns of 102.92% over three years and 227.90% over five years point to momentum that has built over time rather than appearing suddenly.

If Clean Harbors has you looking more broadly at industrial and services names tied to long term trends, it could be a good moment to check out fast growing stocks with high insider ownership for other potential ideas.

With Clean Harbors trading at US$260.29, showing an intrinsic discount of 24.80% and only a small gap to the average analyst target, you have to ask whether this is a genuine mispricing or whether the market is already banking on future growth.

Most Popular Narrative: 20% Undervalued

Compared with the last close at $260.29, the most followed narrative puts Clean Harbors' fair value at about $260.69. This frames only a small gap between model and market and places more weight on how future earnings and cash flows evolve from here.

The growing urgency and evolving regulatory landscape around PFAS and hazardous waste management is expected to create a multibillion-dollar opportunity, and Clean Harbors' unique position as the only company with end-to-end PFAS destruction capabilities positions it to capture significant long-term revenue and margin growth as new government and corporate standards take effect.

Curious what has to happen for that fair value to hold up? Revenue, margins and future earnings all have to move in sync. The narrative spells out how.

Result: Fair Value of $260.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if zero waste efforts or new treatment technologies cut hazardous volumes or reduce demand for legacy disposal services, this PFAS focused thesis could weaken.

Find out about the key risks to this Clean Harbors narrative.

Another Way to Look at Clean Harbors’ Value

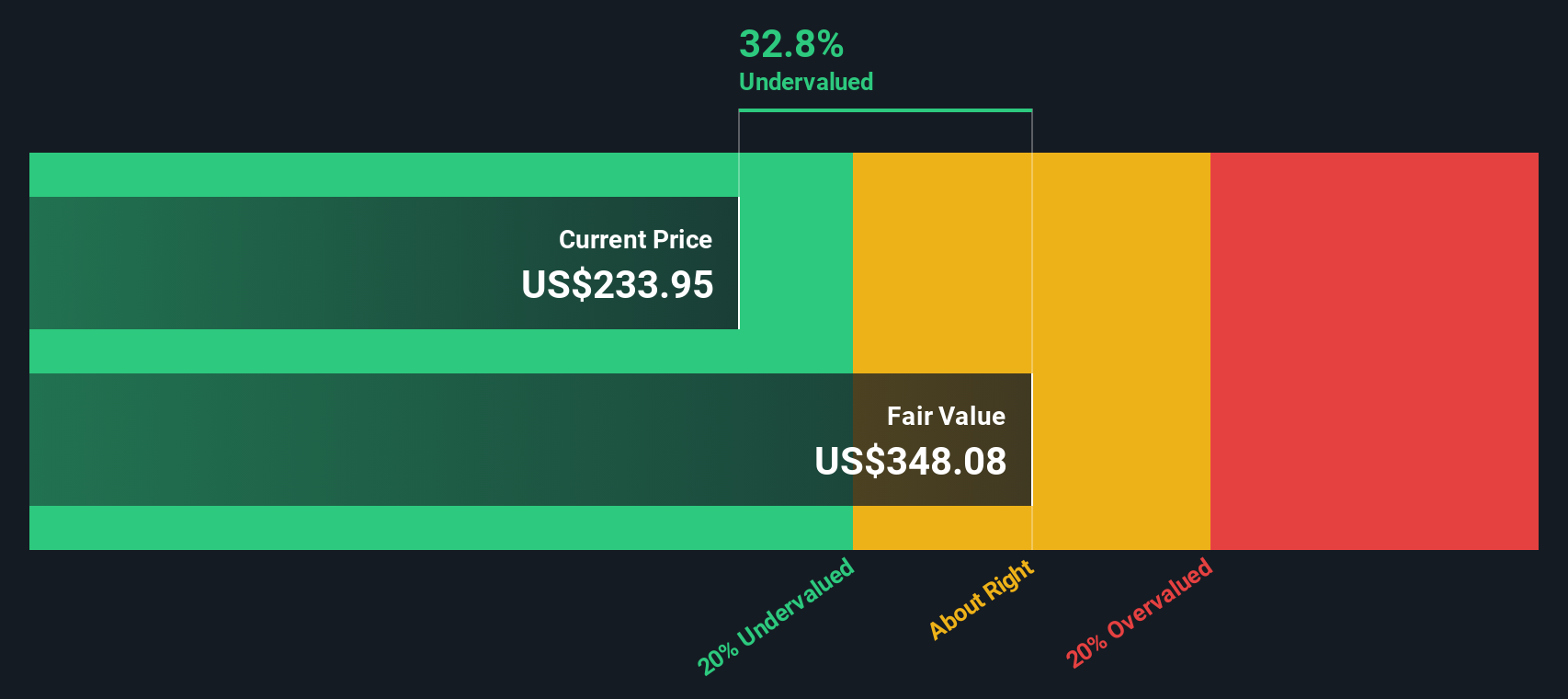

Our DCF model puts Clean Harbors’ fair value at about $346.13 per share, which is well above the current $260.29 price and implies the stock is undervalued even more than the $260.69 narrative fair value suggests. If both are right, what is the market hesitating on?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clean Harbors Narrative

If you see the data differently or simply prefer to test your own assumptions, you can pull the numbers together and shape a custom thesis in just a few minutes, Do it your way.

A great starting point for your Clean Harbors research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Clean Harbors has sharpened your interest, do not stop here. The Simply Wall St Screener can surface focused sets of stocks that match what you want.

- Target higher income potential by scanning these 13 dividend stocks with yields > 3% that offer yields above 3% while you compare quality and consistency.

- Spot future tech leaders early by reviewing these 24 AI penny stocks and seeing which businesses are building real products around artificial intelligence.

- Add contrarian ideas by checking these 887 undervalued stocks based on cash flows that trade below their estimated cash flow value and might warrant a closer look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal