Ameresco (AMRC) Valuation Check After New Nuclear Micro Reactor Collaboration With NANO Nuclear Energy

Ameresco’s new nuclear micro reactor collaboration

Ameresco (AMRC) is back in focus after NANO Nuclear Energy announced a Memorandum of Understanding to explore integrating its modular micro reactors with Ameresco’s engineering and construction services for potential federal and commercial projects.

See our latest analysis for Ameresco.

At a share price of $32.51, Ameresco has seen a 7.72% 1 month share price return after a weaker 90 day period. Its 47.77% 1 year total shareholder return suggests momentum has recently improved despite longer term total return figures remaining negative.

If this move in Ameresco has your attention, it could be a good moment to see how other energy and infrastructure names compare through aerospace and defense stocks.

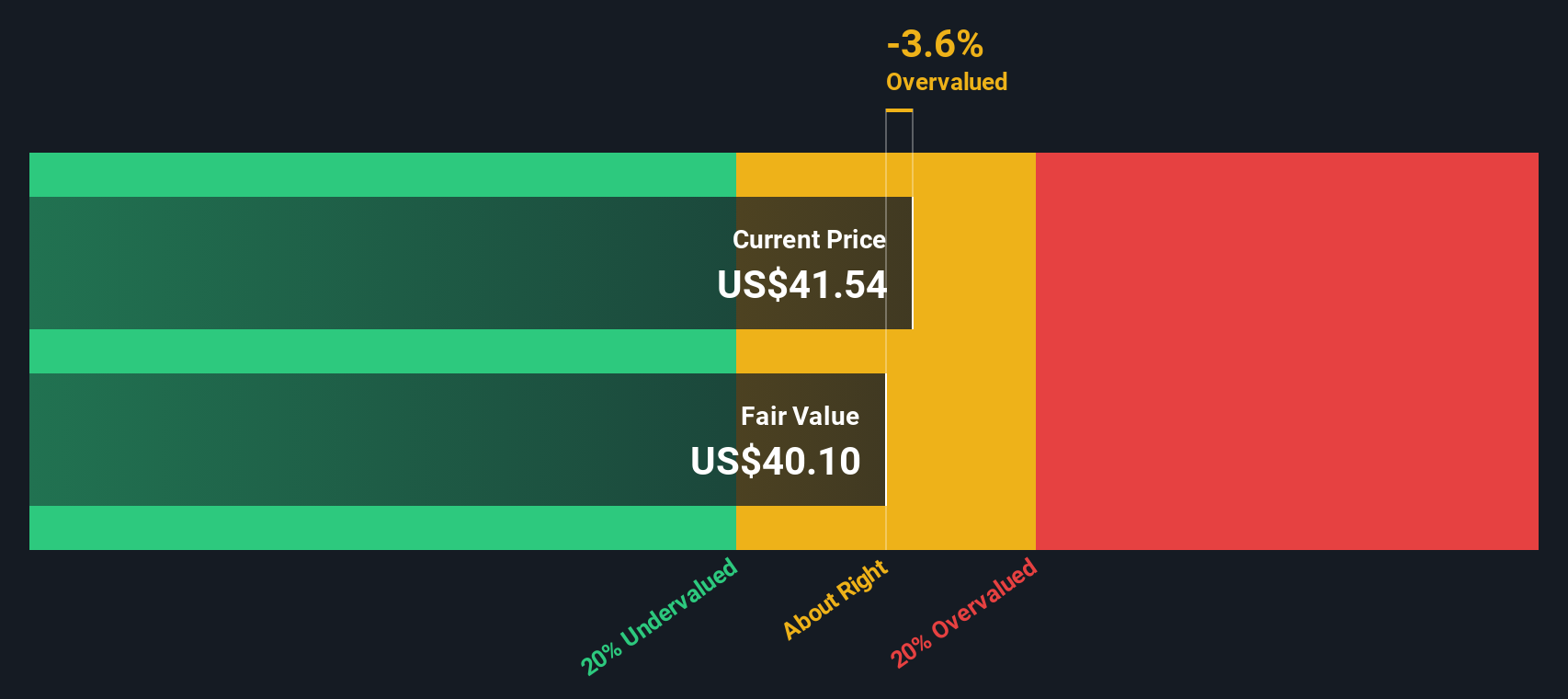

With annual revenue of about US$1.88b, net income of US$62.89m and a value score of 3, the market clearly has a view on Ameresco, but is it underestimating the nuclear micro reactor angle or already pricing in future growth?

Most Popular Narrative: 26% Undervalued

Ameresco’s most followed valuation narrative pegs fair value at about $43.78 per share, which sits well above the recent $32.51 close. That gap is built on specific growth, margin and earnings assumptions rather than sentiment.

Growing recurring O&M contract revenue and a rising base of operating energy assets (now at 750MW) are providing Ameresco with more predictable, higher-margin income, supporting greater financial stability and margin expansion over time.

To see what kind of revenue trajectory and margin profile support a fair value near $44, and how a richer future earnings multiple fits in, the most popular narrative lays out the exact growth path, profitability lift and valuation assumptions behind that view.

Result: Fair Value of $43.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the risk that supply chain setbacks or changes to clean energy policy could disrupt projects and challenge the current earnings outlook.

Find out about the key risks to this Ameresco narrative.

Another View: Cash Flows Point to a Very Different Story

While the popular narrative sees Ameresco as about 26% undervalued at a fair value of $43.78, the SWS DCF model tells a very different story. It presents an estimated future cash flow value of $12.20 per share, suggesting the stock screens as overvalued on that basis. Which lens feels more convincing to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ameresco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 867 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ameresco Narrative

If you read these views and feel they do not quite match your own thinking, you can weigh the same data yourself and Do it your way in just a few minutes.

A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ameresco has sharpened your focus, do not stop here. Use the Simply Wall St Screener to quickly uncover fresh stock ideas that fit your style.

- Target income potential by scanning these 14 dividend stocks with yields > 3% that already offer yields above 3% and see which ones align with your return expectations.

- Hunt for value by reviewing these 867 undervalued stocks based on cash flows where current prices sit below their estimated cash flow based worth.

- Get ahead of emerging themes by checking out these 18 cryptocurrency and blockchain stocks connected to digital assets and blockchain related business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal