IMAX (IMAX) Valuation Check After Exclusive Dune Part Three IMAX Run Announcement

IMAX’s exclusive Dune Part Three run puts premium screens in focus

IMAX (IMAX) is back in the spotlight after Warner Bros. confirmed Dune Part Three will occupy all IMAX screens for three weeks from December 18, 2026, concentrating premium box office demand on the format.

See our latest analysis for IMAX.

The Dune Part Three announcement lands after a strong run in IMAX’s shares, with a 7 day share price return of 9.14% and a 90 day share price return of 17.31%, while the 1 year total shareholder return of 61.69% and 3 year total shareholder return of 125.61% point to momentum that has been building over a longer period.

If premium cinema is on your radar after IMAX’s latest win, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With IMAX trading at US$37.61 and sitting at a 38.67% intrinsic discount plus a 16.27% gap to analyst targets, you have to ask: is this genuine mispricing, or is the market already baking in future growth?

Price-to-Earnings of 51.2x: Is it justified?

With IMAX at US$37.61 on a 51.2x P/E, the market is putting a rich price on current earnings compared with both its sector and an estimated fair ratio.

The P/E multiple tells you how much investors are paying today for every dollar of IMAX’s earnings. This is a common yardstick for entertainment and media companies. A higher P/E can sometimes reflect confidence in future profit growth, while a lower one can point to more muted expectations.

Here, the 51.2x P/E stands well above the US Entertainment industry average of 20.3x and also sits above the estimated fair P/E of 23.8x. This is the level the multiple could theoretically move toward over time if expectations cool. That leaves IMAX trading at more than double the sector average earnings multiple and also well ahead of the modelled fair ratio, which highlights how much future performance is already reflected in the price.

Explore the SWS fair ratio for IMAX

Result: Price-to-Earnings of 51.2x (OVERVALUED)

However, you are paying up for that story, and any slowdown in premium-format demand or weaker content slate could quickly challenge such a rich earnings multiple.

Find out about the key risks to this IMAX narrative.

Another view: DCF points in the opposite direction

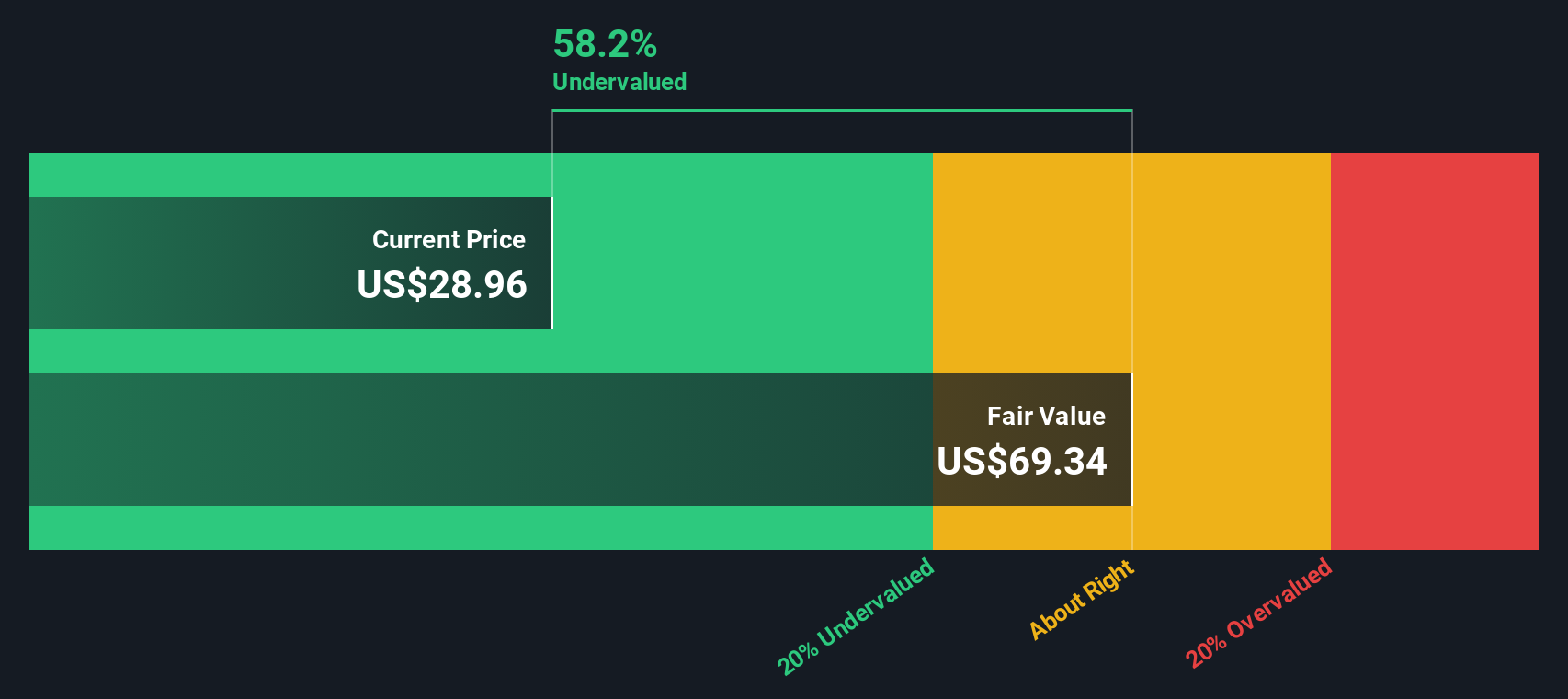

While the 51.2x P/E suggests IMAX is expensive, our DCF model says something different. On that view, IMAX at US$37.61 trades about 38.7% below an estimated fair value of US$61.32, which frames the current price as a potential discount rather than excess.

That tension between an earnings multiple that looks stretched and a DCF that flags undervaluation puts the onus back on you. Do you lean more on today’s earnings and peer comparisons, or on longer term cash flow assumptions that suggest more upside is already built into the business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IMAX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IMAX Narrative

If you are not on board with this view or prefer to rely on your own research, you can create a custom IMAX story yourself in just a few minutes by starting with Do it your way.

A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If IMAX has sharpened your focus on premium experiences, do not stop there. Use the Simply Wall St Screener to uncover more focused opportunities across the market.

- Target potential high income by checking out these 13 dividend stocks with yields > 3% that may suit a yield focused portfolio.

- Spot potential growth stories in cutting edge tech through these 24 AI penny stocks shaping artificial intelligence across sectors.

- Tap into themes at the intersection of medicine and machine learning with these 109 healthcare AI stocks that blend data and healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal