Is Kaspi.kz (NasdaqGS:KSPI) Offering Long Term Value After Recent Share Price Weakness

- Wondering if Kaspi.kz at US$77.40 is offering real value or just headline noise? This article walks through what the current price could mean for you as an investor.

- The share price closed at US$77.40, with a 1.3% decline over the last 7 days, a 0.2% decline over the last 30 days, a 0.2% decline year to date, a 19.0% decline over 1 year, and returns of 17.8% over 3 years and 53.6% over 5 years.

- Recent coverage of Kaspi.kz has focused on how the business fits into the broader fintech and digital services space. This helps frame how investors think about its growth profile and risk. This backdrop is important context when you assess whether the current share price reflects its underlying fundamentals or more sentiment driven swings.

- On our checklist of 6 valuation tests, Kaspi.kz scores 5 out of 6. Next, we will walk through what different valuation methods say about that score, before finishing with a way to tie all those valuation signals together more effectively.

Find out why Kaspi.kz's -19.0% return over the last year is lagging behind its peers.

Approach 1: Kaspi.kz Excess Returns Analysis

The Excess Returns model looks at how much value a company can create above the return that equity investors require. Instead of focusing on cash flows, it starts with current book value, estimates a sustainable level of earnings, and then measures how much of those earnings are above the implied cost of equity.

For Kaspi.kz, the model uses a Book Value of US$11,908.49 per share and a Stable EPS of US$11,991.88 per share, based on the median return on equity from the past 5 years. The Cost of Equity is US$1,625.78 per share, which leads to an Excess Return of US$10,366.10 per share. That excess is then projected on a Stable Book Value of US$16,438.46 per share, using future book value estimates from 2 analysts.

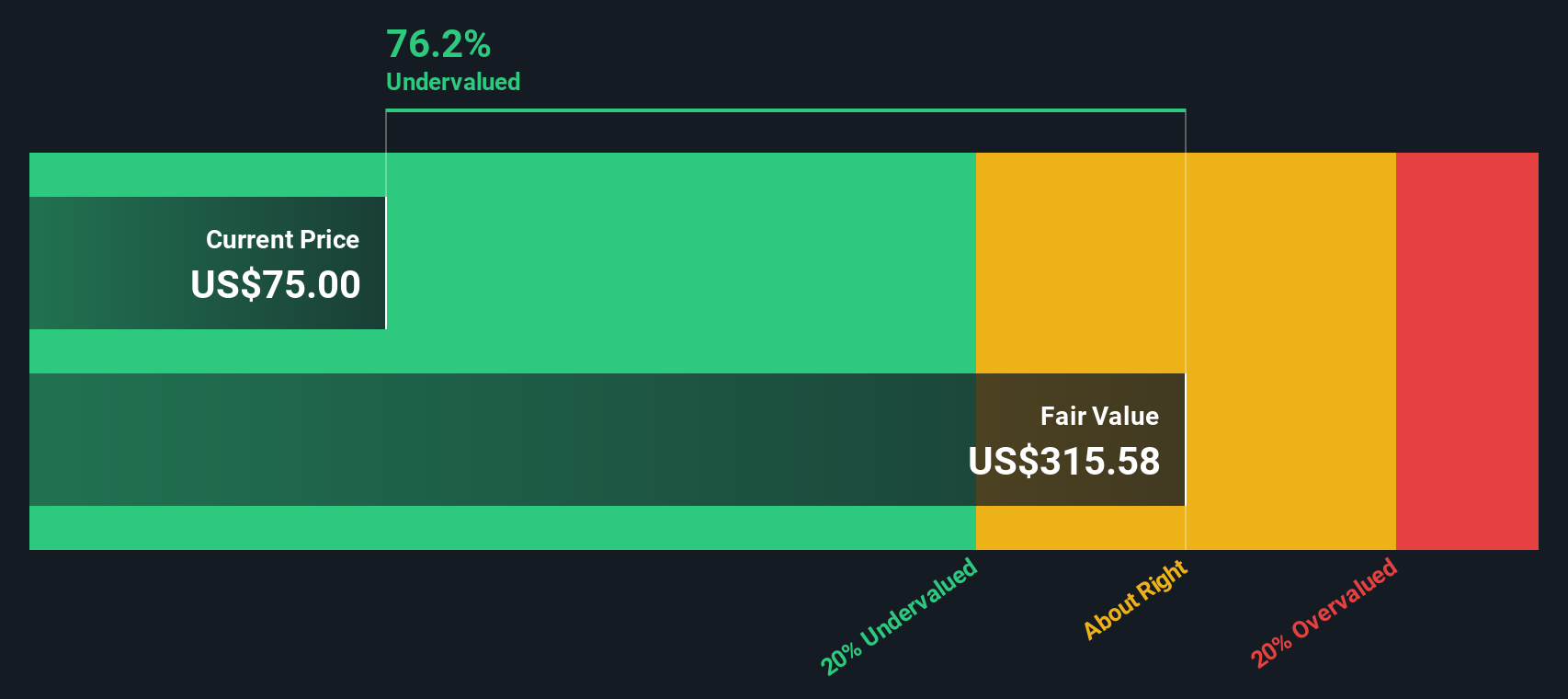

When all those excess returns are capitalised, the Excess Returns model indicates an intrinsic value that implies the shares are 77.3% undervalued versus the current price of US$77.40.

Result: UNDERVALUED

Our Excess Returns analysis suggests Kaspi.kz is undervalued by 77.3%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: Kaspi.kz Price vs Earnings

For a profitable business like Kaspi.kz, the P/E ratio is a straightforward way to link what you pay for each share to the earnings that back it. It lets you see, in simple terms, how many dollars the market is willing to pay for one dollar of earnings.

What counts as a “normal” P/E depends a lot on two things: growth expectations and risk. Higher expected earnings growth or lower perceived risk can justify a higher P/E, while slower expected growth or higher risk usually points to a lower P/E being more reasonable.

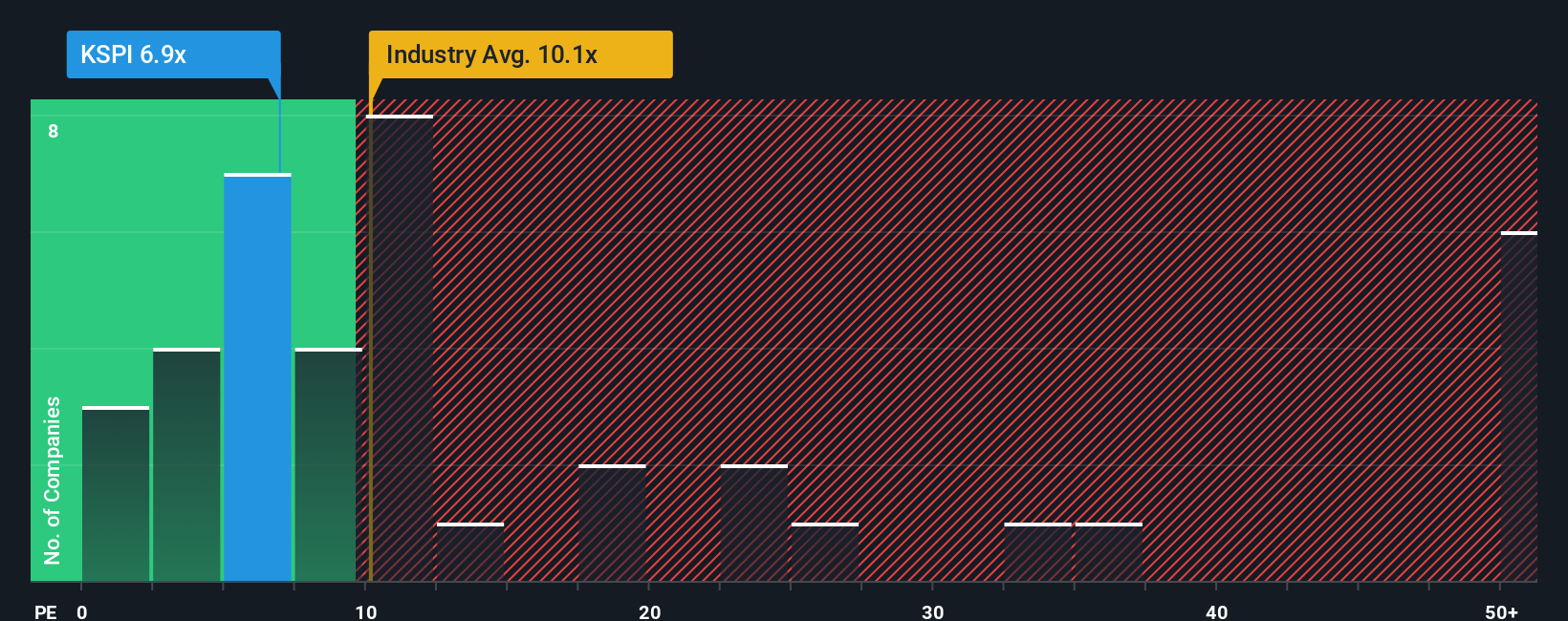

Kaspi.kz currently trades on a P/E of 6.81x. That sits below the Consumer Finance industry average of 8.98x and well below the peer group average of 26.78x. Simply Wall St’s Fair Ratio for Kaspi.kz is 17.71x, which is its proprietary estimate of a suitable P/E based on factors like earnings growth, profit margins, market cap, risk profile and the company’s industry.

Because the Fair Ratio adjusts for these company specific drivers, it gives a more tailored benchmark than a simple peer or industry comparison. Lining up the Fair Ratio of 17.71x against the current 6.81x P/E suggests Kaspi.kz trades below what this framework would indicate.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kaspi.kz Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St’s Community page you can use Narratives, where you describe your Kaspi.kz story in plain language, tie that story to your own forecasts for revenue, earnings and margins, translate those forecasts into a Fair Value, then compare that Fair Value with today’s price to decide whether the stock suits you. The Narrative automatically updates as new news or earnings data arrives. For example, one Kaspi.kz Narrative might lean toward the higher KZT130.73 price target while another leans toward the lower KZT86.54 target, reflecting how different investors can reasonably look at the same company and reach very different but clearly explained views.

Do you think there's more to the story for Kaspi.kz? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal