3 Promising Penny Stocks With Market Caps Under $300M

The U.S. stock market has recently been rattled by geopolitical tensions, with major indices experiencing declines amid tariff threats and surging bond yields. In such a volatile landscape, investors often turn their attention to smaller companies that might offer unique opportunities. Penny stocks, despite the outdated term, remain relevant as they represent smaller or newer firms that can provide significant value when backed by strong financials. This article highlights three penny stocks that stand out for their financial strength and potential for long-term success in today's challenging economic climate.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.61 | $559.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.79 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.825 | $141.09M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.00 | $504.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.73 | $614.03M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.31 | $912.62M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.91 | $6.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.90 | $88.36M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 334 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Scienjoy Holding (SJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scienjoy Holding Corporation operates mobile live streaming platforms in the People’s Republic of China and has a market cap of $37.50 million.

Operations: The company generates revenue primarily through its Internet Telephone segment, which accounted for CN¥1.31 billion.

Market Cap: $37.5M

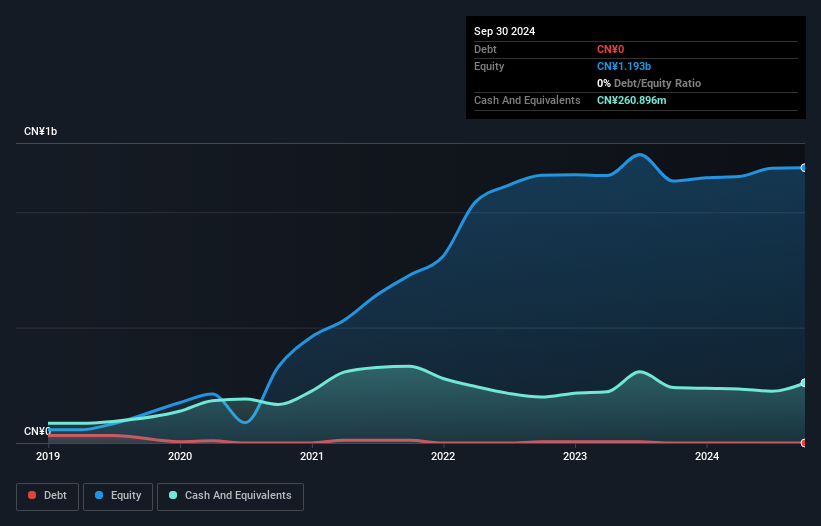

Scienjoy Holding Corporation, with a market cap of US$37.50 million, is navigating the competitive landscape of penny stocks with its innovative AI Vista Live! platform. Recent product launches in China and Dubai highlight its strategic focus on AI-driven solutions across healthcare, entertainment, and public services. Despite a decline in earnings over the past five years and recent financial challenges including lower profit margins and significant one-off losses, Scienjoy remains debt-free with strong short-term asset coverage. Its seasoned management team aims to leverage China's expanding AI market for future growth potential amidst high share price volatility.

- Dive into the specifics of Scienjoy Holding here with our thorough balance sheet health report.

- Examine Scienjoy Holding's past performance report to understand how it has performed in prior years.

Kaltura (KLTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kaltura, Inc. offers a range of software-as-a-service and platform-as-a-service solutions across multiple regions including the United States, Europe, the Middle East, and Africa, with a market cap of $242.32 million.

Operations: The company's revenue is primarily derived from two segments: Media & Telecom, contributing $47.94 million, and Enterprise, Education and Technology, which generates $132.98 million.

Market Cap: $242.32M

Kaltura, Inc., with a market cap of US$242.32 million, is actively engaged in the penny stock arena, leveraging its SaaS and PaaS offerings across diverse regions. The company reported third-quarter revenue of US$43.87 million, with a net loss reduction to US$2.63 million from the previous year. Despite being unprofitable, Kaltura maintains a strong cash position exceeding its debt and has not diluted shareholders over the past year. Recent executive changes include interim appointments following the CFO's resignation as Kaltura seeks to stabilize its financial leadership amidst high share price volatility and ongoing strategic initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of Kaltura.

- Gain insights into Kaltura's future direction by reviewing our growth report.

Magnachip Semiconductor (MX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magnachip Semiconductor Corporation designs, manufactures, and supplies analog and mixed-signal semiconductor solutions for various applications, including communications and automotive, with a market cap of approximately $0.11 billion.

Operations: The company generates revenue from its Power Solutions Business, specifically through Power Analog Solutions, amounting to $167.12 million.

Market Cap: $109.02M

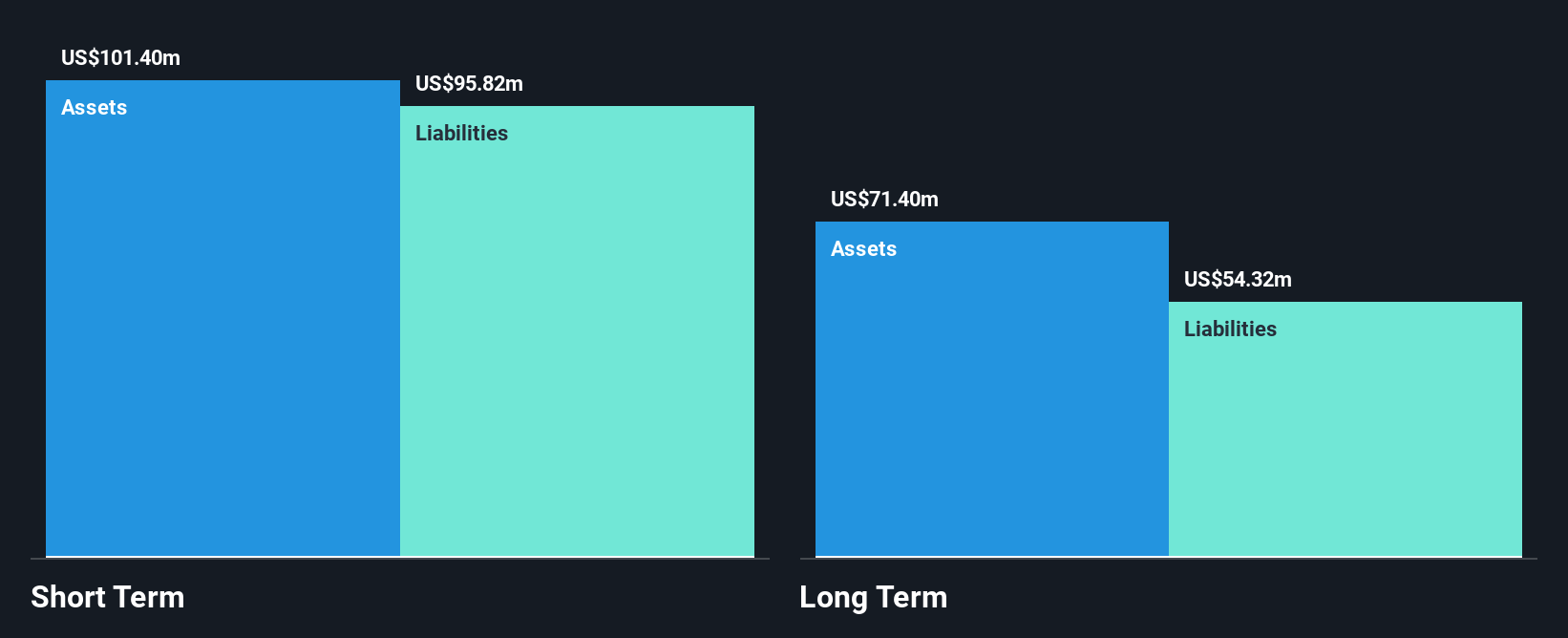

Magnachip Semiconductor, with a market cap of approximately US$0.11 billion, is navigating the penny stock landscape by focusing on its Power Solutions Business, generating US$167.12 million in revenue. Despite being unprofitable with increasing losses over five years, the company maintains a robust cash position exceeding its debt and has not diluted shareholders recently. Recent strategic moves include launching advanced IGBT products for solar inverters and energy storage systems to strengthen its power semiconductor market presence. Additionally, board changes aim to enhance governance as Magnachip seeks to stabilize amidst financial challenges and industry opportunities.

- Take a closer look at Magnachip Semiconductor's potential here in our financial health report.

- Evaluate Magnachip Semiconductor's prospects by accessing our earnings growth report.

Next Steps

- Click this link to deep-dive into the 334 companies within our US Penny Stocks screener.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal