Ameresco (AMRC) Valuation Check After New Nuclear MOU And Illinois Renewable Gas Milestone

Ameresco (AMRC) is back in focus after two project updates, including an MOU with NANO Nuclear Energy on modular micro reactors and a new renewable natural gas facility now operating in Illinois.

See our latest analysis for Ameresco.

The recent MOU around modular micro reactors and the new Illinois renewable natural gas facility arrive as momentum rebuilds, with a 1 month share price return of 11.88% and a year to date share price return of 8.05%. However, the 3 year total shareholder return of 46.33% and 5 year total shareholder return of 43.94% remain weak compared with the 43.77% total shareholder return over the last 12 months.

If this kind of clean energy project news has your attention, it could be a good moment to see what else is setting up in high growth tech and AI stocks.

With shares up in the short term but longer term returns still weak, and with the stock trading below analyst targets and some intrinsic value estimates, is Ameresco quietly sitting at a discount, or is the market already pricing in future growth?

Most Popular Narrative: 24.3% Undervalued

At a last close of US$33.14 versus a narrative fair value of US$43.78, Ameresco is framed as trading at a sizable discount, with that gap tied directly to long term growth and margin assumptions that extend beyond the latest project headlines.

Analysts have modestly raised their price target on Ameresco, lifting the implied fair value by about 5 percent to approximately $43.78 per share, citing slightly higher long term growth expectations, a marginally stronger profit outlook, and a richer future earnings multiple.

Curious what kind of revenue path, profitability lift, and future earnings multiple need to align in order to reach that valuation gap? The full narrative lays out those assumptions in detail.

Result: Fair Value of $43.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on supply chain reliability and stable clean energy policy, because equipment delays or incentive cuts could quickly challenge those long term earnings assumptions.

Find out about the key risks to this Ameresco narrative.

Another Way To Look At The Price

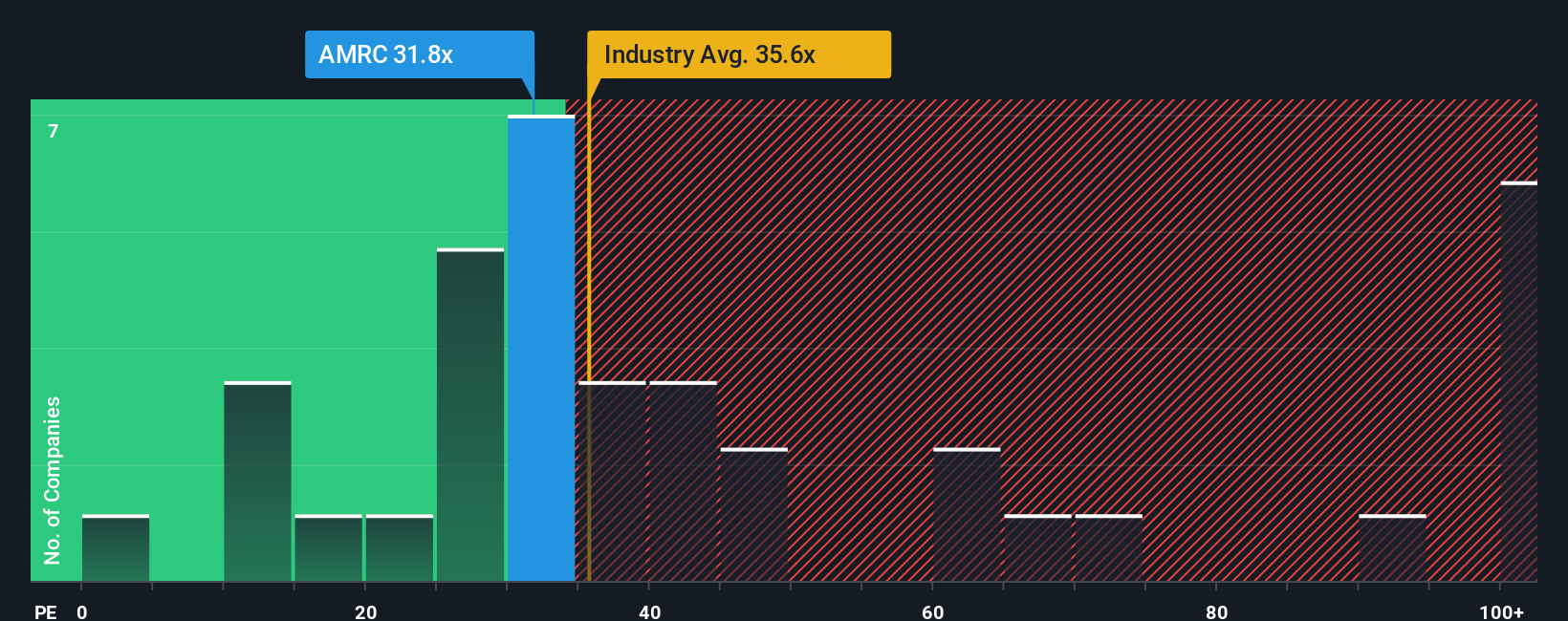

That 24.3% “undervalued” narrative sits alongside a very different message from simple earnings multiples. Ameresco trades on a P/E of 27.8x, richer than its peer average of 23.4x, yet below the industry’s 36.1x and our fair ratio estimate of 39.6x. So is this a cushion or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameresco Narrative

If you think the current story misses something or you simply prefer to test your own assumptions, you can build a complete view in minutes by starting with Do it your way.

A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ameresco has you thinking differently about where you put your money next, do not stop here, the Screener can quickly surface other opportunities that fit your style.

- Spot fresh growth stories early by checking out these 3529 penny stocks with strong financials that pair smaller market sizes with stronger fundamentals.

- Target market themes that matter to you by scanning these 873 undervalued stocks based on cash flows that align with discounted cash flow signals.

- Tap into future facing trends by reviewing these 80 cryptocurrency and blockchain stocks tied to blockchain, digital assets, and related infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal