A Look At Vistance Networks (VISN) Valuation After Rebrand And Strong Recent Share Price Performance

Vistance Networks (VISN) has drawn fresh attention after rebranding from CommScope Holding Company in January 2026. Investors are reassessing a business spanning connectivity, networking, and access solutions across multiple global regions.

See our latest analysis for Vistance Networks.

The rebrand arrives after a period of strong share price momentum, with a 90 day share price return of 25% and a very large 1 year total shareholder return of about 2.5x, suggesting investors are reassessing both growth prospects and risk.

If this shift in sentiment has you looking beyond a single stock, it could be an opportunity to see what else is moving in high growth tech and AI stocks.

With the share price up sharply over the past year, revenue growth of 17.19% and net income moving the other way, plus a market price below the average analyst target, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 21.2% Undervalued

Compared with the last close at US$19.10, the most followed narrative sees fair value closer to US$24.25, built on detailed long term forecasts.

The analysts have a consensus price target of $19.667 for CommScope Holding Company based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $6.7 billion, earnings will come to $139.1 million, and it would be trading on a PE ratio of 47.9x, assuming you use a discount rate of 12.3%.

Want to see what justifies that higher fair value? Revenue assumptions, margin shifts and a future earnings multiple all pull in the same direction. The details matter.

Result: Fair Value of $24.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can shift quickly if DOCSIS 4.0 upgrade cycles slow or if key ANS customers such as Comcast and Charter pull back on spending.

Find out about the key risks to this Vistance Networks narrative.

Another View: Our DCF Model Points the Other Way

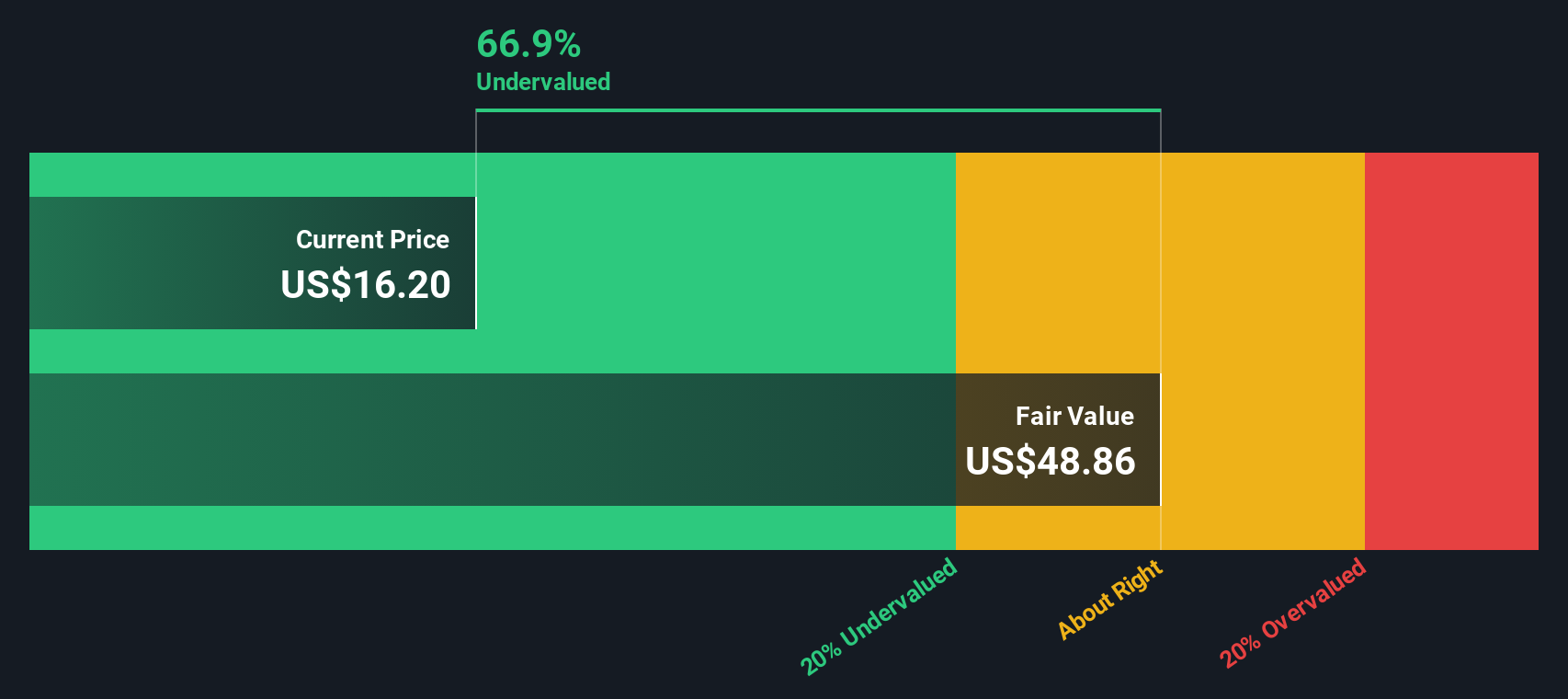

The popular narrative sees Vistance Networks trading 21.2% below fair value, but the Simply Wall St DCF model reaches a very different conclusion. On that view, VISN at US$19.10 sits far above an estimated fair value of US$3.88, which signals potential downside rather than upside. Which story do you think fits the risk you are willing to take?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vistance Networks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vistance Networks Narrative

If this view does not quite fit how you see Vistance Networks, or you would rather test the numbers yourself, you can build a complete narrative in just a few minutes with Do it your way.

A great starting point for your Vistance Networks research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more stock ideas?

If Vistance Networks has sharpened your thinking, do not stop here, use the Simply Wall St Screener to spot other opportunities before they slip past you.

- Target potential high-growth underdogs by scanning these 3539 penny stocks with strong financials that pair smaller market caps with solid fundamentals and clear financial data.

- Ride the AI wave with focus by zeroing in on these 24 AI penny stocks that are directly exposed to artificial intelligence themes and related demand.

- Hunt for value by checking these 868 undervalued stocks based on cash flows where prices sit below estimated cash flow based assessments, so you can prioritise ideas worth a closer look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal