Revenues Not Telling The Story For Topgolf Callaway Brands Corp. (NYSE:MODG) After Shares Rise 27%

Despite an already strong run, Topgolf Callaway Brands Corp. (NYSE:MODG) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 80% in the last year.

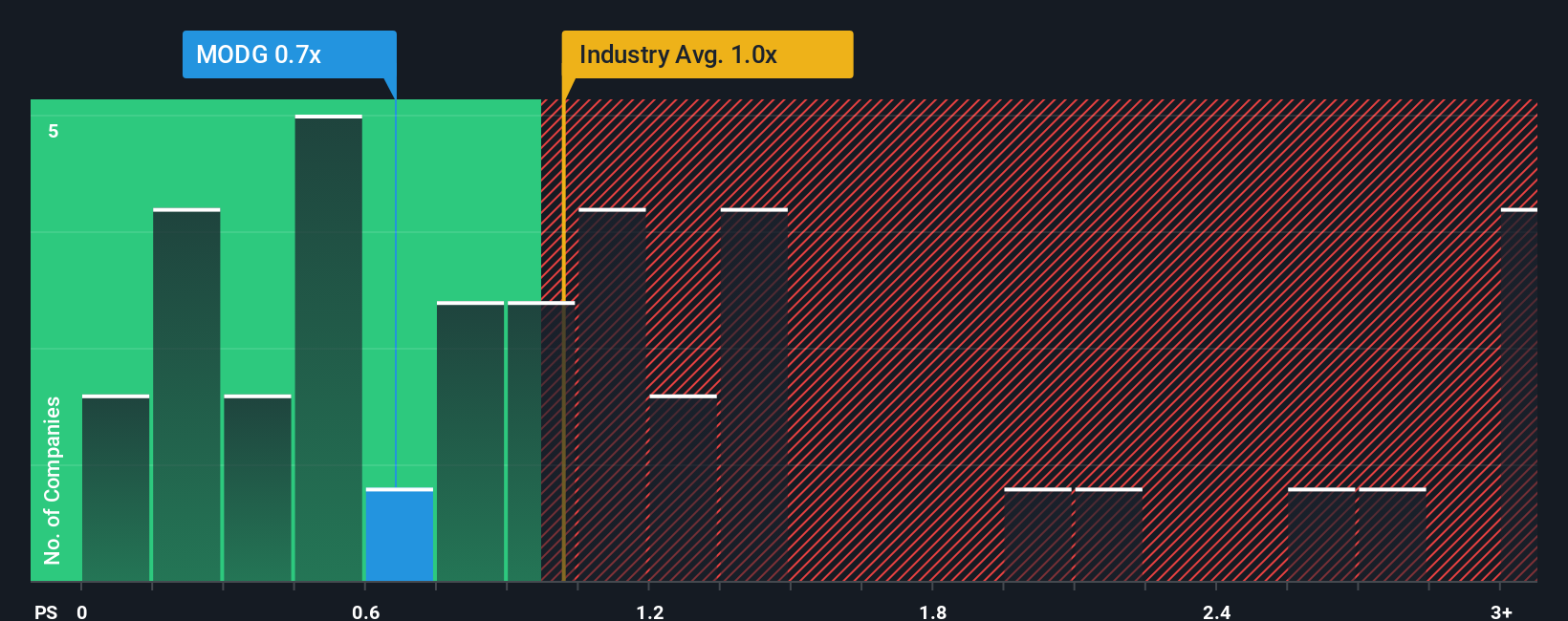

In spite of the firm bounce in price, it's still not a stretch to say that Topgolf Callaway Brands' price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Leisure industry in the United States, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Topgolf Callaway Brands

What Does Topgolf Callaway Brands' P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Topgolf Callaway Brands has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Topgolf Callaway Brands will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Topgolf Callaway Brands?

Topgolf Callaway Brands' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.6%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.3% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 37% during the coming year according to the two analysts following the company. With the industry predicted to deliver 2.7% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Topgolf Callaway Brands' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Topgolf Callaway Brands' P/S Mean For Investors?

Its shares have lifted substantially and now Topgolf Callaway Brands' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Topgolf Callaway Brands' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Topgolf Callaway Brands with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal