A Look At Topgolf Callaway Brands (MODG) Valuation After Strong Recent Share Price Momentum

Topgolf Callaway Brands (MODG) has drawn attention after recent share price moves. The stock closed at $14.15 as investors weigh its mix of golf venues, equipment, and active lifestyle brands.

See our latest analysis for Topgolf Callaway Brands.

That $14.15 share price comes after a strong run, with a 30 day share price return of 24.12% and a 90 day share price return of 52.15%. The 1 year total shareholder return of 73.83% contrasts with weaker 3 and 5 year total shareholder returns, suggesting momentum has picked up recently after a tougher multi year stretch.

If Topgolf Callaway Brands has you rethinking where growth could come from next, it might be a good time to look at fast growing stocks with high insider ownership as another source of ideas.

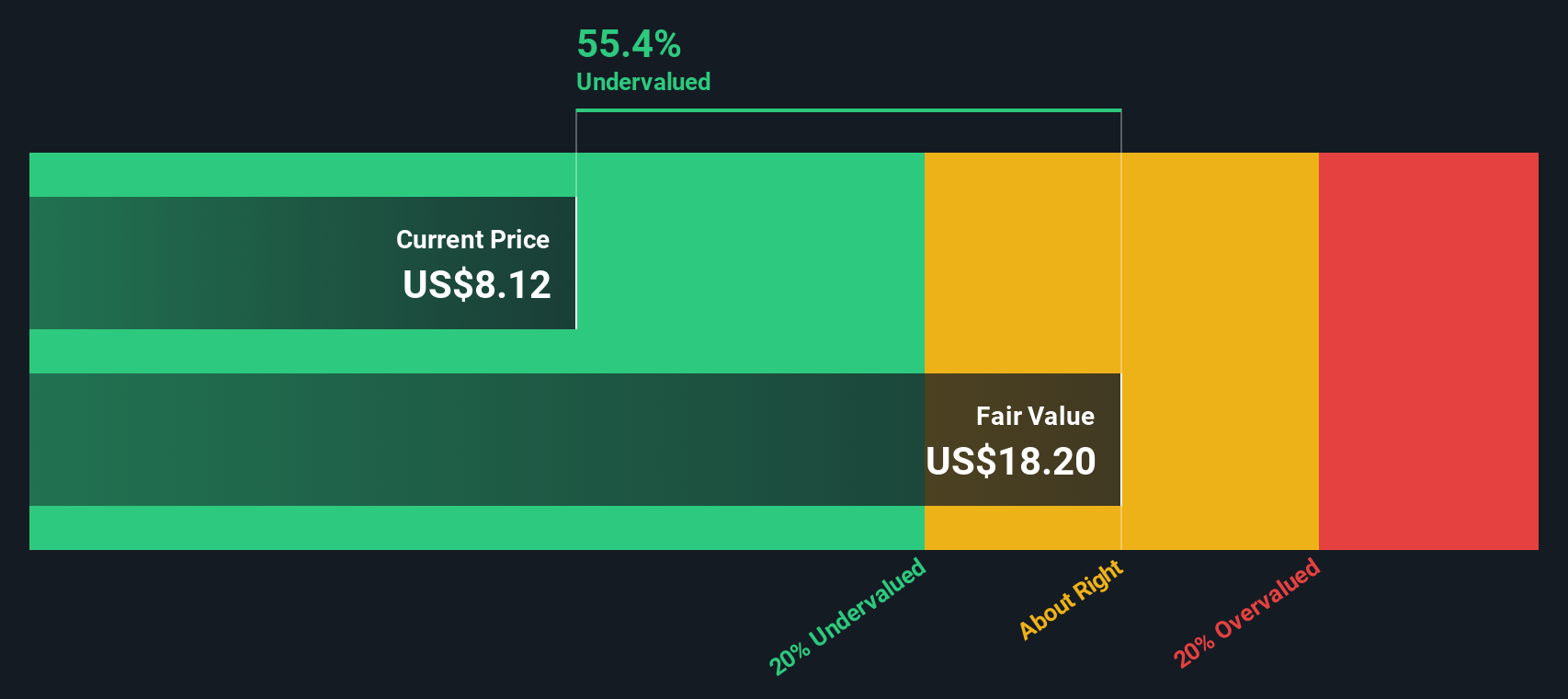

With the shares at $14.15, trading below the average analyst price target yet flagged with an intrinsic discount of around 37%, the key question now is whether this signals a genuine opportunity or whether the market already reflects future growth.

Most Popular Narrative: 13.2% Overvalued

At a last close of $14.15 against a narrative fair value of $12.50, the story frames Topgolf Callaway Brands as pricing in a premium that needs explaining.

Fair Value: Unchanged at $12.50 per share, indicating no revision to the intrinsic value estimate.

Discount Rate: Fallen slightly from 11.08 percent to 11.01 percent, reflecting a modestly lower required return.

Curious what keeps fair value anchored while the share price runs ahead? Revenue expectations, margin rebuild and a steep implied earnings ramp all sit at the core of this narrative. The full story is in how those moving parts line up over the next few years.

Result: Fair Value of $12.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still some clear pressure points, including Topgolf margin strain from heavy discounting and uncertainty around both the timing and the outcome of the planned Topgolf stake sale.

Find out about the key risks to this Topgolf Callaway Brands narrative.

Another View: Market Ratios Tell A Different Story

Our DCF model points to fair value of US$22.49 per share, which sits well above the current US$14.15 price and treats the stock as undervalued. That sits in clear tension with the narrative fair value of US$12.50 that labels the shares as 13.2% overvalued. Which lens do you trust more for a business that is still unprofitable today?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Topgolf Callaway Brands Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can quickly build a personalised view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Topgolf Callaway Brands.

Looking for more investment ideas?

If you are serious about sharpening your stock list, do not stop at one name. Use the Simply Wall Street Screener to spot fresh, high conviction ideas.

- Target growth potential at the smaller end of the market by scanning these 3534 penny stocks with strong financials that already show stronger financial footing.

- Focus your attention on companies tied to artificial intelligence themes by filtering for these 25 AI penny stocks that match your risk and return preferences.

- Hunt for value ideas by zeroing in on these 885 undervalued stocks based on cash flows where cash flow estimates suggest prices may sit below intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal