After Leaping 29% Wanguo Gold Group Limited (HKG:3939) Shares Are Not Flying Under The Radar

Wanguo Gold Group Limited (HKG:3939) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The annual gain comes to 224% following the latest surge, making investors sit up and take notice.

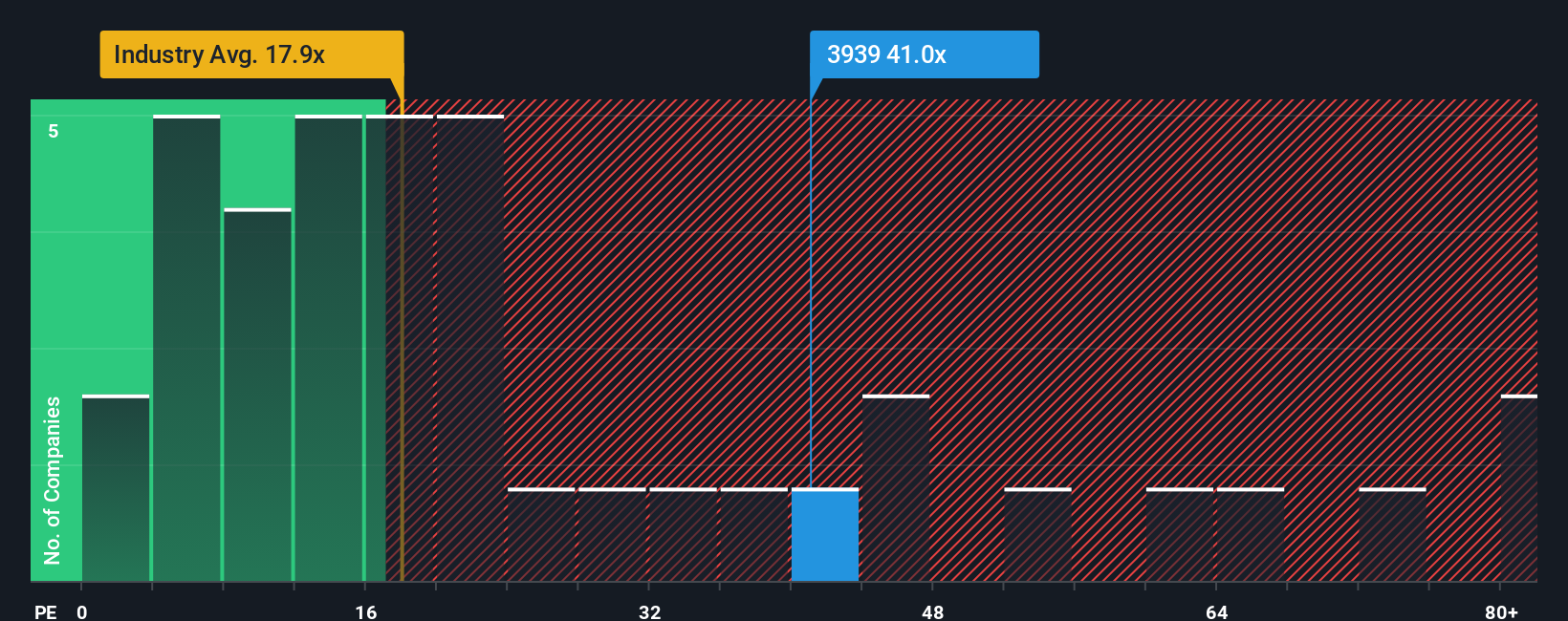

Following the firm bounce in price, Wanguo Gold Group's price-to-earnings (or "P/E") ratio of 41x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, Wanguo Gold Group has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Wanguo Gold Group

How Is Wanguo Gold Group's Growth Trending?

Wanguo Gold Group's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. The strong recent performance means it was also able to grow EPS by 245% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 35% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 14% per year, which is noticeably less attractive.

In light of this, it's understandable that Wanguo Gold Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Wanguo Gold Group have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Wanguo Gold Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Wanguo Gold Group that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal