Assessing Tetra Tech (TTEK) Valuation After Major Missile Defense Agency SHIELD Contract Win

Tetra Tech (TTEK) stock is in focus after the company secured a Missile Defense Agency SHIELD indefinite delivery, indefinite quantity contract with a ceiling of US$151b, expanding its potential defense related work.

See our latest analysis for Tetra Tech.

The SHIELD contract headlines a busy period for Tetra Tech, with the planned CEO transition to Roger Argus and upcoming first quarter 2026 results also in focus. A 7.17% one month share price return and a 41.41% five year total shareholder return indicate longer term holders have seen steadier gains than the recent 10.78% one year total shareholder return implies.

If this defense contract has you looking more broadly at security related names, it could be a good moment to scan other aerospace and defense stocks that fit your criteria.

With Tetra Tech trading at US$36.33 against an analyst target of US$42.50 and recent returns mixed, the key question is whether there is still potential upside available or if the market is already fully pricing in the company’s future growth prospects.

Most Popular Narrative: 14.5% Undervalued

With Tetra Tech last closing at US$36.33 against a narrative fair value of US$42.50, the current share price sits below that reference point and sets up a valuation story built around earnings power rather than revenue expansion.

Execution of a shift away from lower margin USAID and legacy work toward complex, higher value projects has already resulted in record high company margins, with management targeting ongoing annual margin expansion of 50+ basis points. This suggests further earnings leverage ahead.

Curious how a flat to slightly declining revenue path still supports a higher fair value? The narrative leans heavily on rising margins, faster earnings growth and a lower future P/E than many peers. Want to see how those moving pieces are combined into a US$42.50 fair value using a 7.11% discount rate?

Result: Fair Value of $42.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points, including reliance on non recurring disaster work and shifting U.S. federal budget priorities away from some of Tetra Tech’s core areas.

Find out about the key risks to this Tetra Tech narrative.

Another View: Multiples Point To A Richer Price

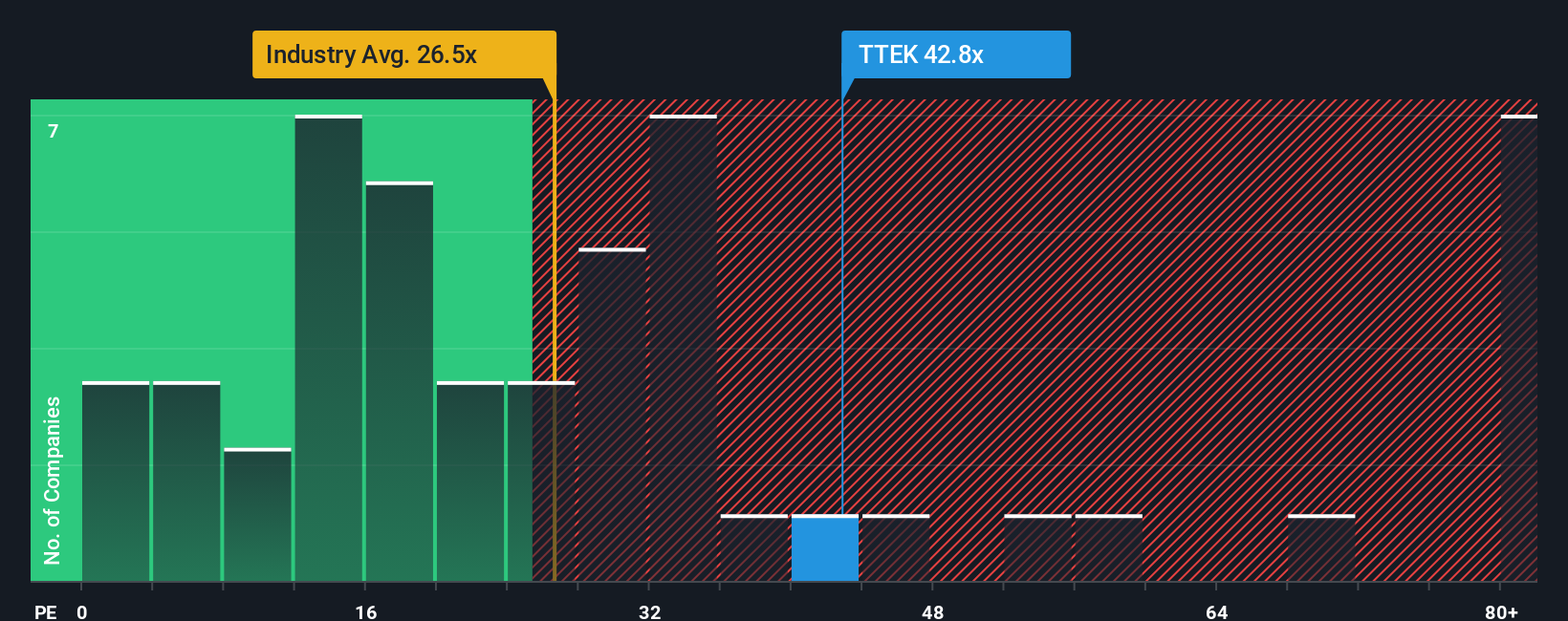

While the narrative fair value of US$42.50 frames Tetra Tech as 14.5% undervalued, the current P/E of 38.3x tells a different story. It sits above the US Commercial Services industry at 26.4x, the peer average at 34x, and even the fair ratio of 33.4x. This suggests valuation risk if expectations slip. Which signal do you trust more: the story on margins, or the price you are paying today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tetra Tech Narrative

If you are not fully on board with this view or prefer to weigh the numbers yourself, you can build your own narrative in a few minutes by starting with Do it your way.

A great starting point for your Tetra Tech research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing other angles the market offers. Consider widening your search and putting a few more ideas on your radar.

- Target potential mispricing by scanning these 877 undervalued stocks based on cash flows that may offer more attractive entry points based on current cash flow expectations.

- Ride structural shifts in technology by checking out these 28 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Tap into income potential by reviewing these 12 dividend stocks with yields > 3% that already offer yields above 3% on current estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal