A Look At Jamf Holding (JAMF) Valuation After Recent Share Price Rebound And Mixed Performance

Jamf Holding overview after recent performance shift

Jamf Holding (JAMF) has drawn fresh investor attention after a sharp return in the past 3 months, contrasting with weaker results over the past year and multi year period.

With shares last closing at US$13.02 and a value score of 5, the stock now sits against a backdrop of modest recent revenue and net income growth, alongside an intrinsic discount estimate of 43.28%.

See our latest analysis for Jamf Holding.

The recent 28.28% 90-day share price return stands in contrast to a 5.45% decline in 1-year total shareholder return, suggesting short-term momentum has picked up while longer-term performance remains weak against Jamf Holding's current valuation discount.

If Jamf's rebound has caught your eye, it could be a good moment to see what else is moving in software and security by checking out high growth tech and AI stocks.

With Jamf posting modest revenue and net income growth but trading at an estimated 43.28% intrinsic discount, you have to ask yourself: is this genuine undervaluation, or is the market already pricing in future growth?

Most Popular Narrative: 8.4% Overvalued

Against Jamf Holding's last close of US$13.02, the most followed narrative assigns a fair value of about US$12.01, framing the current price as slightly ahead of that estimate.

The accelerating global adoption of Apple devices in enterprise, education, healthcare, and specialized verticals continues to expand Jamf's total addressable market, especially as organizations shift to hybrid and mobile-first workplace models. This supports sustained multi-year revenue growth. Heightened organizational focus on cybersecurity and regulatory compliance is driving stronger demand for integrated security and identity management solutions, as demonstrated by 40% YoY growth in Security ARR and successful cross-sell momentum from the recent Identity Automation acquisition, positively impacting both revenue and net margin expansion.

Curious how a modest revenue growth outlook, improving margins, and a future earnings multiple are stitched together into that fair value? The key assumptions sit beneath the headline forecasts and connect projected profitability, share count changes, and a specific discount rate into one tight valuation story.

Result: Fair Value of $12.01 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can crack if Apple tightens ecosystem control, or if large bundled UEM suites squeeze Jamf on pricing and limit its ability to win standalone deals.

Find out about the key risks to this Jamf Holding narrative.

Another View: Multiples Paint a Very Different Picture

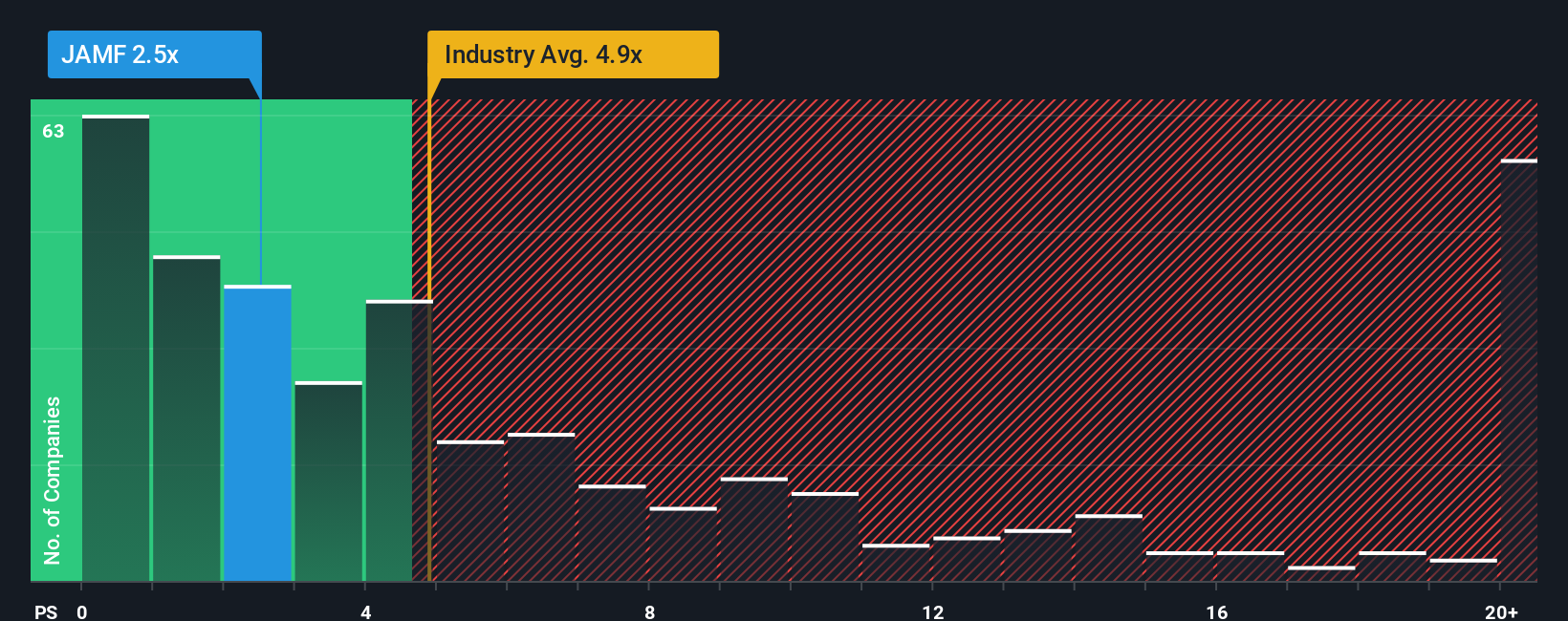

That 8.4% overvalued fair value of about US$12.01 sits awkwardly next to how the market is actually pricing Jamf on sales. The current P/S of 2.5x is well below peers at 5.8x, the US Software industry at 5x, and even a fair ratio of 3.9x that the market could move toward. That kind of gap suggests either a valuation cushion or a sign that investors still have big questions about Jamf's path to profitability.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jamf Holding Narrative

If the current narratives do not fully match your view, or you prefer to weigh the numbers yourself, you can put together your own in just a few minutes with Do it your way.

A great starting point for your Jamf Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Jamf has sharpened your interest, do not stop here. The real edge comes from lining up a few more quality candidates on your watchlist.

- Spot potential value plays early by scanning these 877 undervalued stocks based on cash flows built around cash flow focused metrics.

- Ride the next wave of automation by checking out these 28 AI penny stocks that are reshaping software, data and productivity tools.

- Add diversification with growth at lower price points by reviewing these 3541 penny stocks with strong financials that still meet disciplined financial criteria.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal