Assessing Alpha Metallurgical Resources (AMR) Valuation After Crocodile Capital’s New US$41 Million Position

Crocodile Capital Partners’ new US$41 million position in Alpha Metallurgical Resources (AMR), now the fund’s second largest holding, has drawn fresh attention to the stock alongside recent insider purchases and coal demand projections.

See our latest analysis for Alpha Metallurgical Resources.

Those fund inflows and insider purchases arrive as momentum in Alpha Metallurgical Resources has picked up sharply, with a 35.41% 1 month share price return feeding into a 51.43% 3 month share price return and a 37.16% 1 year total shareholder return. This suggests interest in the stock has been building rather than fading around the current US$242.32 share price.

If this kind of renewed attention has you thinking more broadly about where capital is moving, it could be a good moment to scan fast growing stocks with high insider ownership to identify other potential ideas on your radar.

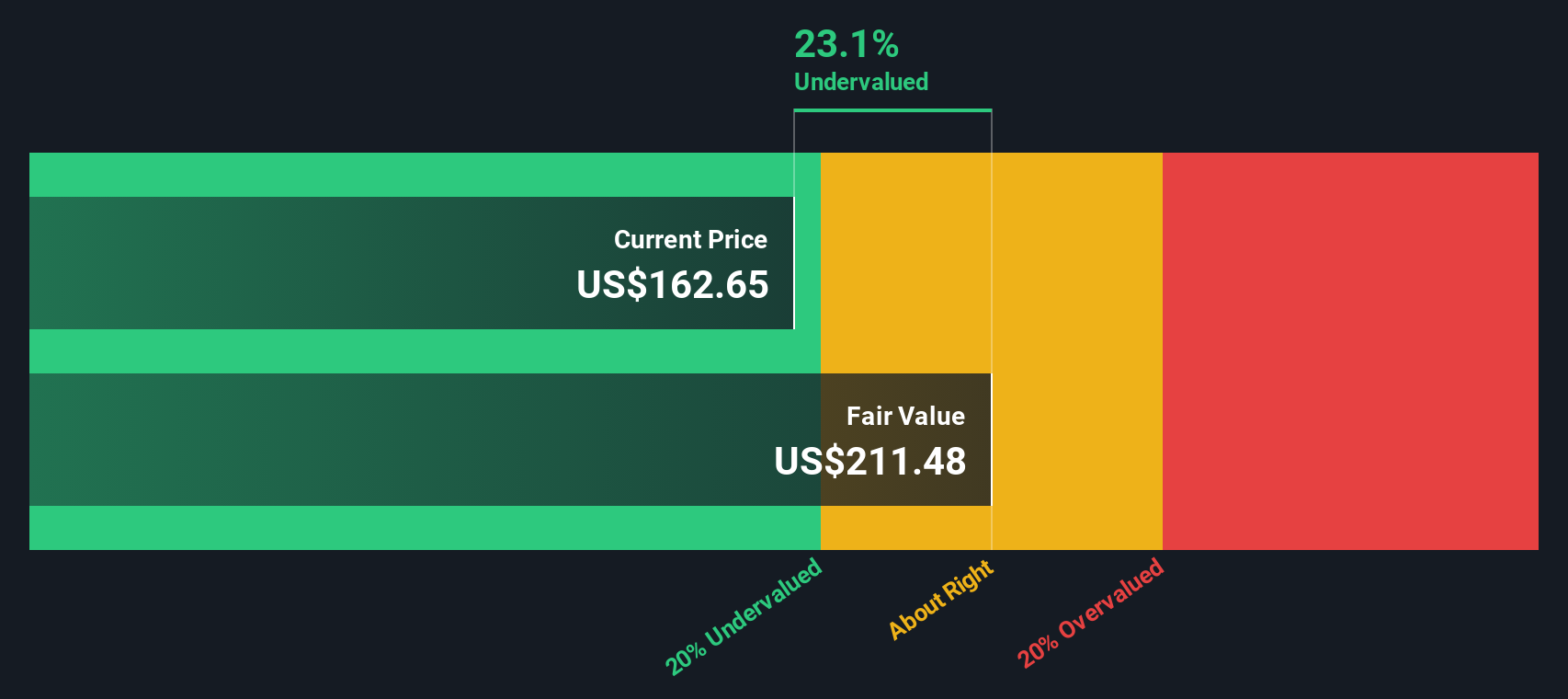

Yet with AMR trading around US$242.32 and carrying an estimated 48% discount to intrinsic value while also sitting above the current analyst price target, you have to ask whether this is a buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 31.3% Overvalued

With the most followed narrative placing fair value at US$184.50 against a US$242.32 share price, the gap between models and market is clear and invites a closer look at the assumptions doing the heavy lifting.

Global underinvestment and persistent supply constraints in metallurgical coal mining (compounded by recent industry idlings and bankruptcies) are described as factors that could elevate future prices and market share for well-capitalized producers like Alpha. This points to potential upside for future revenue and margins if demand recovers or steadies, particularly in markets such as India and Brazil.

Curious how a conservative profit multiple, rising margin expectations, and moderate revenue growth still combine to a higher fair value than analysts? The narrative leans on a detailed cash flow path, a specific earnings build, and a precise discount rate to bridge that gap. The full breakdown shows exactly which financial levers carry the most weight.

Result: Fair Value of $184.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to factor in risks such as weaker steel demand that pressures met coal pricing, and higher regulatory or environmental costs that squeeze profitability.

Find out about the key risks to this Alpha Metallurgical Resources narrative.

Another Angle on Valuation

The narrative pegs fair value at about US$184.50, which points to AMR being 31.3% overvalued against the current US$242.32 share price. Our SWS DCF model says something very different, with a fair value estimate of roughly US$465.81 and AMR trading at a 48% discount. When two methods disagree this much, which one feels more realistic to you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alpha Metallurgical Resources Narrative

If you look at the numbers and reach a different conclusion, or simply want to test your own assumptions, you can build a custom view in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alpha Metallurgical Resources.

Looking for more investment ideas?

If AMR has you thinking bigger about your portfolio, do not stop here. The real edge often comes from comparing a few strong, but different, ideas side by side.

- Target potential mispricings by scanning these 879 undervalued stocks based on cash flows that align with your view on cash flows and fundamentals.

- Ride powerful tech trends early by checking out these 28 AI penny stocks that sit at the intersection of software, data, and automation.

- Tap into income-focused opportunities by reviewing these 12 dividend stocks with yields > 3% that may complement more growth driven positions in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal