Assessing Williams Sonoma (WSM) Valuation After New Pottery Barn And Stoney Clover Lane Collaboration

Williams-Sonoma (WSM) is drawing fresh attention after its Pottery Barn Kids and Pottery Barn Teen brands launched a collaboration with accessories label Stoney Clover Lane, adding new bedding, décor, and travel products across kids and teen categories.

See our latest analysis for Williams-Sonoma.

The collaboration arrives during a period of solid momentum, with a 7 day share price return of 10.76% and a 30 day share price return of 9.60% helping extend a 3 year total shareholder return above 200%. This suggests recent news and steady earnings expectations are being reflected in how investors are pricing growth and risk.

If this kind of brand driven story has your attention, it can be a good time to see what else is shaping retail and consumer trends through fast growing stocks with high insider ownership.

With the shares up strongly in the past week and trading only about 1% below the average analyst price target and roughly 2% below one estimate of intrinsic value, you have to ask: Is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 0.5% Undervalued

With Williams-Sonoma closing at US$197.81 versus a narrative fair value of about US$199, the stock sits almost on top of that implied estimate.

Analysts expect earnings to reach $1.2 billion (and earnings per share of $10.65) by about September 2028, up from $1.1 billion today. The analysts are largely in agreement about this estimate.

Curious what justifies paying a higher future P/E than the broader specialty retail group, even with only modest revenue and margin shifts baked in? The full narrative explains how steady earnings, buybacks and a premium multiple work together in that fair value math.

Result: Fair Value of $199 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff volatility and softer housing demand could pressure margins and big ticket sales. This would challenge the case for Williams-Sonoma’s current premium P/E assumptions.

Find out about the key risks to this Williams-Sonoma narrative.

Another View: Multiples Point To A Richer Price

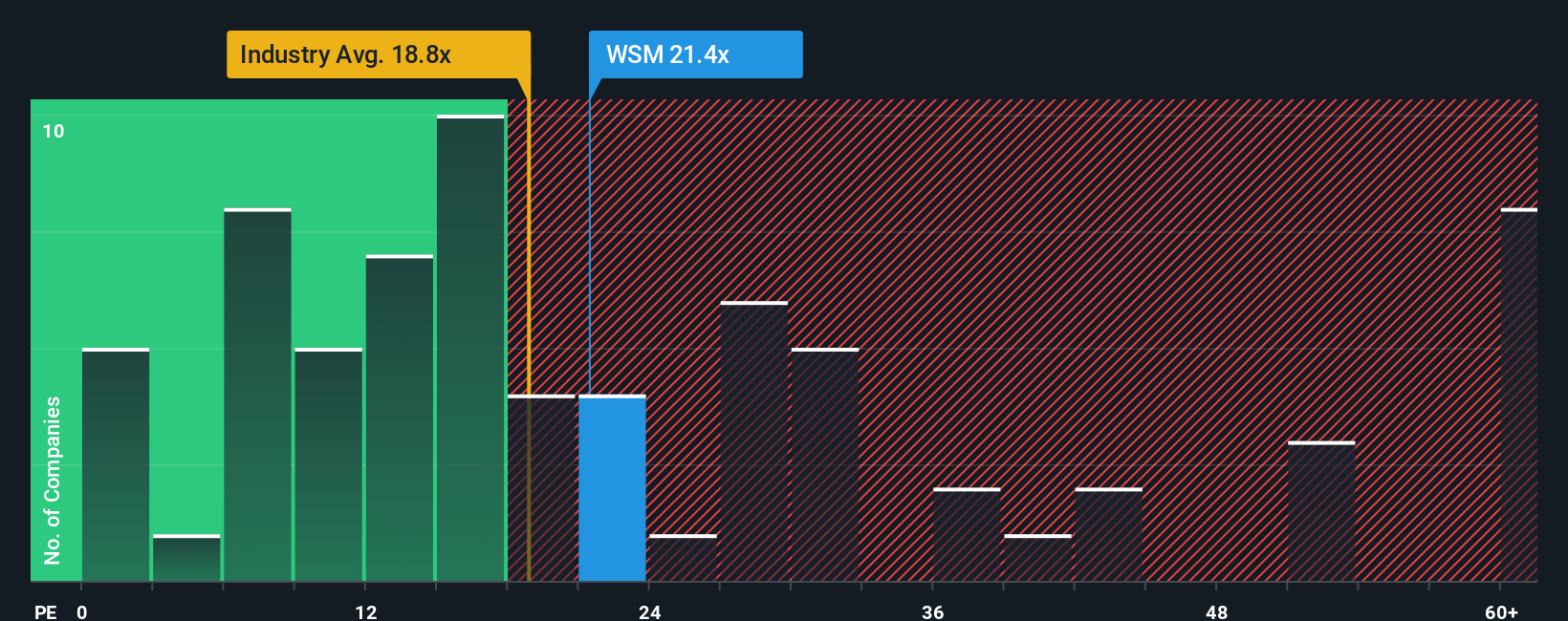

While the narrative fair value suggests Williams-Sonoma is about 2% below one estimate of intrinsic value, its current P/E of 20.9x tells a tougher story. That is above the estimated fair ratio of 16.3x and slightly above the US Specialty Retail average of 20.2x, even though it sits below the peer average of 25.4x.

In practice, that mix implies less margin for error if earnings or sentiment soften, because the share price is already leaning toward the higher end of what similar companies trade on. The question for you is whether Williams-Sonoma’s quality and track record are enough to keep supporting that richer P/E.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams-Sonoma Narrative

If you think the current story misses something, or you simply prefer to test the assumptions yourself, you can build a fresh view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Williams-Sonoma.

Looking for more investment ideas?

If Williams-Sonoma is on your radar, do not stop there. Widening your view with a few focused stock ideas can really sharpen your next move.

- Zero in on potential mispricing by scanning these 879 undervalued stocks based on cash flows that our models flag as trading below their estimated worth.

- Tap into next wave themes by checking out these 28 AI penny stocks that are tied to artificial intelligence trends.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal