Assessing Marqeta (MQ) Valuation After TransactPay Acquisition And Shifting Shareholder Returns

Event context and why Marqeta is on investors’ radar

Marqeta (MQ) is back in focus after recent trading left the stock at US$4.81, with a 1 day return of about a 1% decline, a slight gain over the past week, and mixed performance over the past 3 months and year.

See our latest analysis for Marqeta.

That combination of a 3.66% year to date share price return, a 25.26% total shareholder return over one year, and a 29.16% total shareholder loss over three years suggests momentum has picked up recently after a weaker multi year stretch.

If Marqeta has caught your eye, this can be a good moment to see what else is moving in payments and fintech by checking out high growth tech and AI stocks.

With Marqeta trading at US$4.81, sitting about 21% below the average analyst price target of US$5.80 and showing recent revenue and net income growth, you have to ask: is there real upside left here, or is the market already pricing in future growth?

Most Popular Narrative: 22.2% Undervalued

Compared to the last close at US$4.81, the most followed narrative points to a fair value of about US$6.18, implying a meaningful gap to its estimate.

The completed TransactPay acquisition gives Marqeta full program management and EMI capabilities in Europe, enabling entry into larger enterprise opportunities, uniformity of service across North America and Europe, and easier multi-market expansion for clients. This unlocks new revenue streams, increases take rates, and improves earnings scalability.

Curious what kind of revenue ramp, margin shift, and earnings multiple are baked into that valuation gap? The narrative leans on ambitious growth, rising profitability, and a premium P/E that assumes Marqeta earns a place alongside higher rated fintech names. The full story is in how those three levers work together.

Result: Fair Value of $6.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if a major customer like Block reduces volumes, or if rising compliance and competitive pressures squeeze pricing and margins.

Find out about the key risks to this Marqeta narrative.

Another angle on Marqeta’s valuation

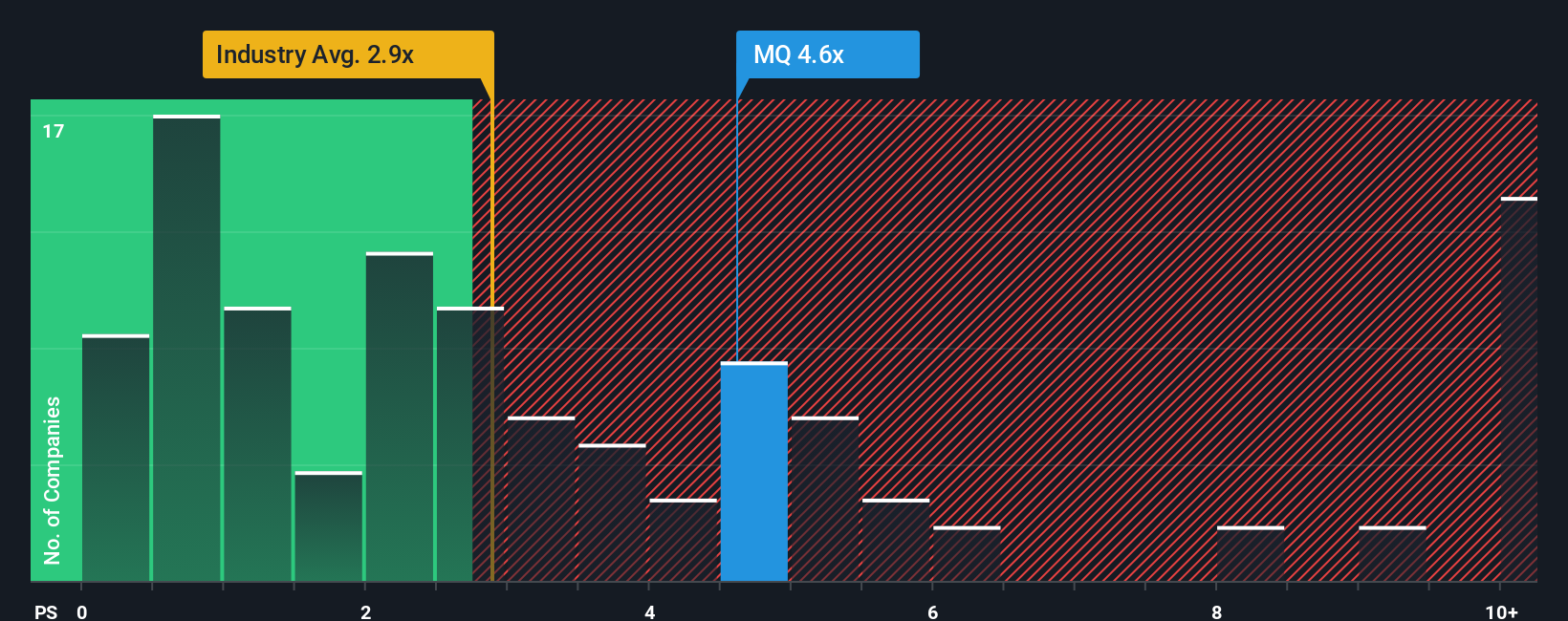

The most popular narrative leans on future earnings and a high implied P/E, but the current P/S of 3.6x tells a different story. It sits above the US Diversified Financial industry at 2.6x and well above peers at 1.4x, and even exceeds a fair ratio of 2.5x. This points to valuation risk if growth or margins slip. So is the market already paying up for the story that is still being written?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If you see the data differently or just prefer to test your own assumptions, you can build a custom Marqeta story yourself in a few minutes: Do it your way.

A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond Marqeta?

If you stop with just one stock, you could miss out on other opportunities that fit your style far better, so widen your search before you move on.

- Spot potential value in smaller names by checking out these 3545 penny stocks with strong financials that pair low share prices with solid fundamentals and room for market attention.

- Target the intersection of medicine and machine learning through these 29 healthcare AI stocks that focus on companies using AI to reshape diagnostics, treatment, and patient outcomes.

- Hunt for companies where price and cash flow expectations differ by reviewing these 881 undervalued stocks based on cash flows that might not yet be fully reflected in market pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal