A Look At TETRA Technologies (TTI) Valuation As Investor Conferences Highlight Energy Services And Lithium Projects

Conference spotlight and why TETRA is on investor radar

TETRA Technologies (TTI) is drawing fresh attention as senior management heads into the Needham Growth Conference and CJS Securities New Ideas for the New Year event, putting its energy services and lithium projects in front of more investors.

See our latest analysis for TETRA Technologies.

The upcoming conference appearances come after a period of strong momentum, with a 90 day share price return of 77.46% and a very large 5 year total shareholder return of 629.41% pointing to interest that has built over time rather than overnight.

If this kind of move has your attention, it could be a good moment to see what else is gaining traction in the market through fast growing stocks with high insider ownership.

With TETRA trading at US$9.92 against a consensus target of US$10.50 and an indicated intrinsic discount of around 61%, the key question is whether this reflects a genuine mispricing or a market that has already factored in future growth.

Most Popular Narrative Narrative: 8.2% Overvalued

With TETRA Technologies trading at US$9.92 against a narrative fair value of US$9.17, the most followed view sees the shares slightly ahead of that estimate while still tying a lot of weight to long term energy storage demand.

Long term targets to roughly double revenues by 2030 and materially expand free cash flow are seen as achievable based on assumptions for project ramp ups and strong end market demand.

Curious what sits behind those ambitious revenue targets and higher valuation multiple? The narrative leans on shifting margins, slower profit growth, and a much richer future earnings multiple. Want to see how those moving parts add up to that fair value call.

Result: Fair Value of $9.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh up real pressure points, such as reliance on deepwater projects and ambitious capex that could disappoint if energy storage demand underwhelms.

Find out about the key risks to this TETRA Technologies narrative.

Another Angle on Value

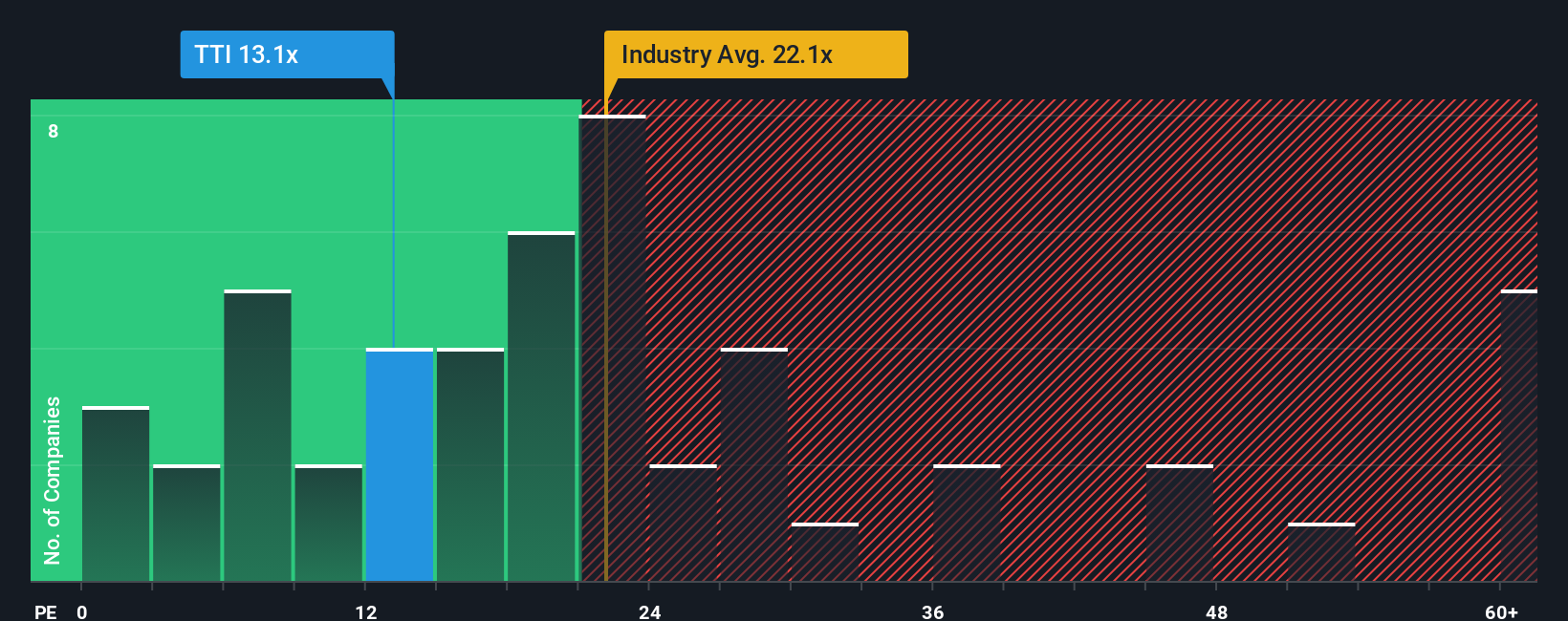

The narrative model flags TETRA as about 8.2% overvalued at US$9.92, yet our fair ratio work using the P/E tells a different story. TETRA trades on 10.9x earnings versus a 19.8x industry average, a 29.9x peer average and a 9.8x fair ratio. That gap suggests both upside potential and mispricing risk. Which way do you think it closes first?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TETRA Technologies Narrative

If the current fair value story does not quite fit how you see TETRA, you can test the numbers yourself and build a fresh thesis in just a few minutes, starting with Do it your way.

A great starting point for your TETRA Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If TETRA has you thinking bigger about your portfolio, do not stop here. Use focused screeners to quickly surface other opportunities that fit your style.

- Explore potential opportunities by scanning these 3544 penny stocks with strong financials that pair lower share prices with stronger financial footing.

- Review these 28 AI penny stocks that are involved in areas such as automation and data analytics.

- Focus on value by examining these 881 undervalued stocks based on cash flows that may provide more cash flow for every dollar you invest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal