Asian Growth Companies With High Insider Ownership To Watch

As the Asian markets navigate a landscape marked by modest improvements in manufacturing and cautious economic optimism, investors are increasingly turning their attention to growth companies with significant insider ownership. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate a strong alignment of interests between company executives and shareholders, potentially offering stability amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Phison Electronics (TPEX:8299) | 10.8% | 29.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Modetour Network (KOSDAQ:A080160) | 12.7% | 41.8% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

We're going to check out a few of the best picks from our screener tool.

Jinhong GasLtd (SHSE:688106)

Simply Wall St Growth Rating: ★★★★☆☆

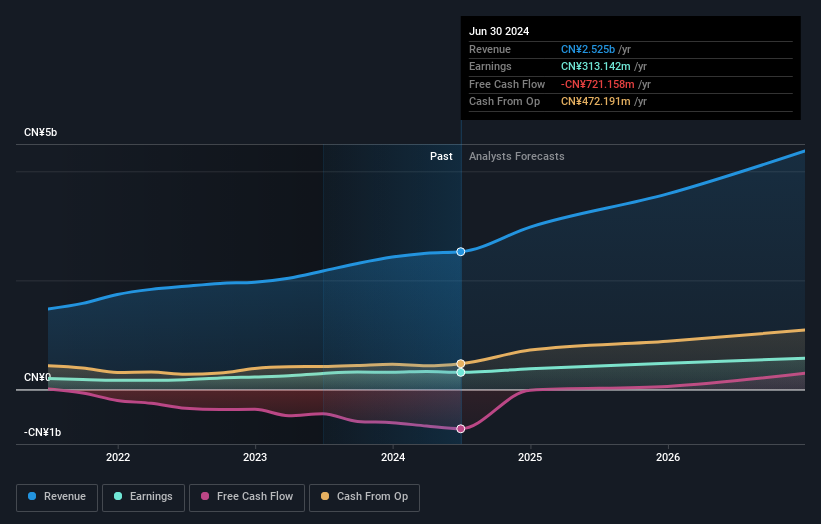

Overview: Jinhong Gas Co., Ltd. is a Chinese company that produces and sells bulk, special, and natural gas products, with a market cap of CN¥11.55 billion.

Operations: The company's revenue segments include bulk gas at CN¥1.50 billion, special gas at CN¥2.25 billion, and natural gas products generating CN¥3.75 billion.

Insider Ownership: 35.1%

Earnings Growth Forecast: 42.2% p.a.

Jinhong Gas Ltd. shows significant earnings growth potential, with forecasts indicating a 42.2% annual increase, outpacing the Chinese market's average. However, its profit margins have declined to 4% from last year's 10.6%, and its revenue growth at 18.7% annually is below the threshold for high growth but exceeds the market average of 14.5%. Despite these mixed financials, insider ownership remains stable without recent substantial trading activity.

- Take a closer look at Jinhong GasLtd's potential here in our earnings growth report.

- Our valuation report here indicates Jinhong GasLtd may be overvalued.

BrightGene Bio-Medical Technology (SHSE:688166)

Simply Wall St Growth Rating: ★★★★☆☆

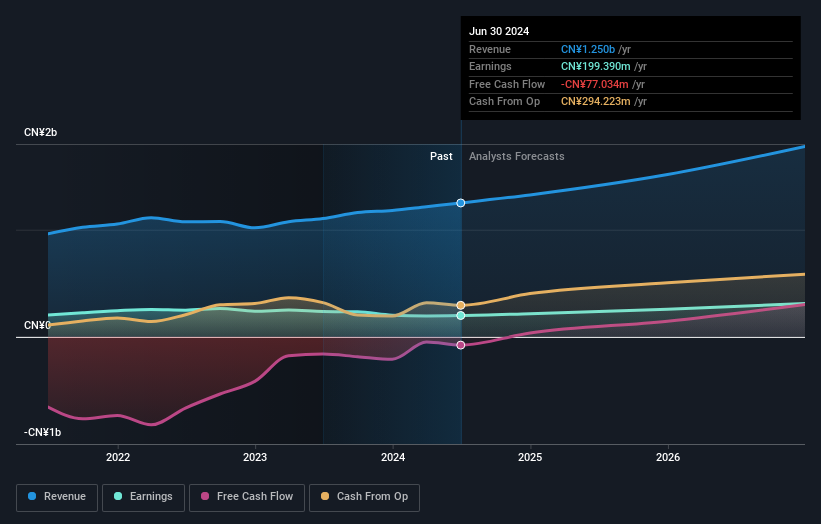

Overview: BrightGene Bio-Medical Technology Co., Ltd. is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥22.63 billion.

Operations: BrightGene Bio-Medical Technology Co., Ltd. generates revenue through its activities in the research, development, production, and sale of pharmaceutical products across domestic and international markets.

Insider Ownership: 32.2%

Earnings Growth Forecast: 43.6% p.a.

BrightGene Bio-Medical Technology is positioned for robust earnings growth, with forecasts predicting a 43.6% annual increase, surpassing the Chinese market average. However, its profit margins have decreased to 5.3% from last year's 15.2%, and revenue growth at 18.3% annually is slower than high-growth benchmarks yet above the market average of 14.5%. Recent share buybacks totaling CNY 10.04 million reflect strategic insider confidence despite mixed financial results.

- Get an in-depth perspective on BrightGene Bio-Medical Technology's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, BrightGene Bio-Medical Technology's share price might be too optimistic.

Ginlong Technologies (SZSE:300763)

Simply Wall St Growth Rating: ★★★★☆☆

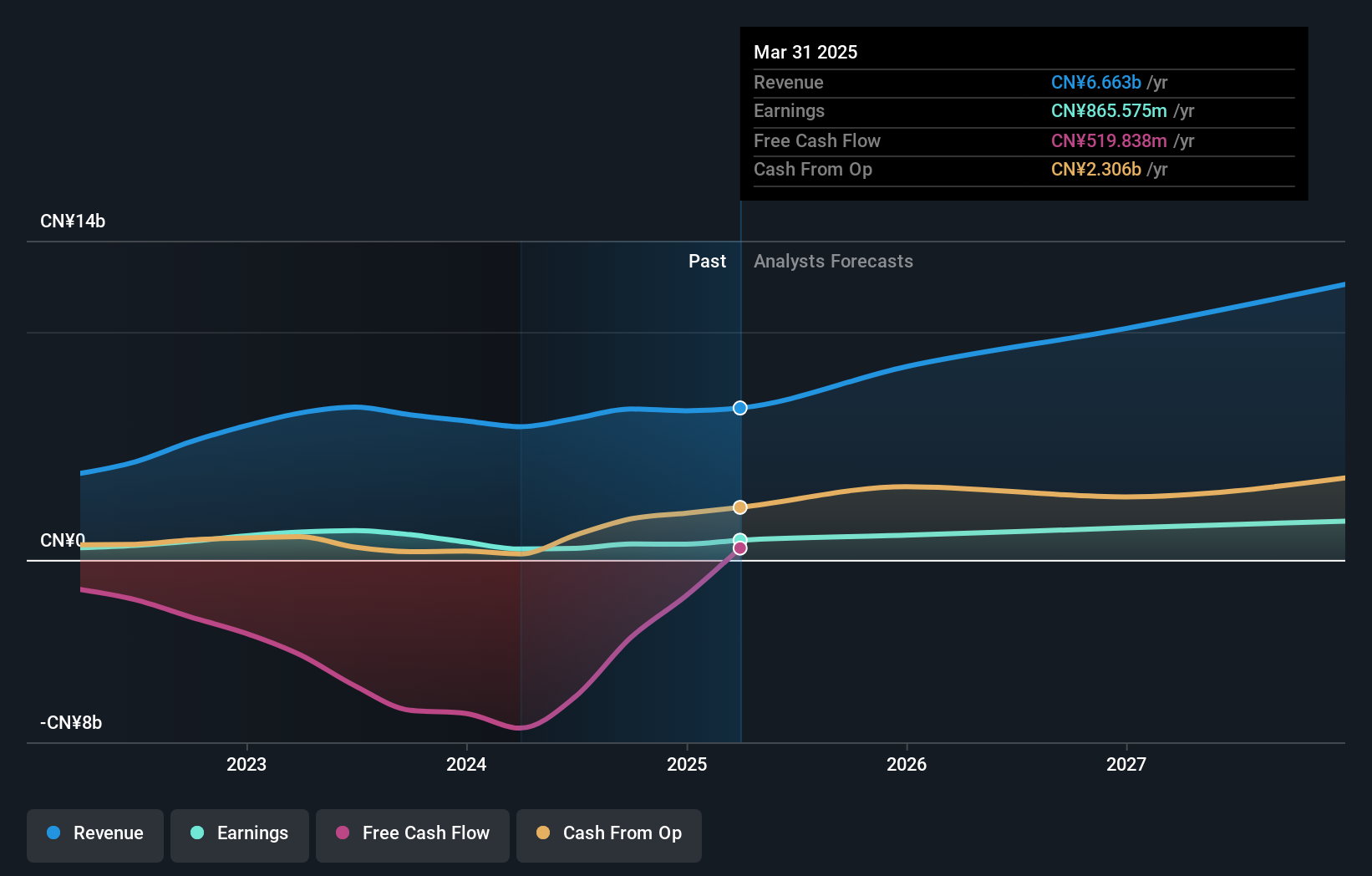

Overview: Ginlong Technologies Co., Ltd. is involved in the research, development, production, service, and sale of string inverters globally and has a market cap of CN¥30.34 billion.

Operations: Ginlong Technologies Co., Ltd. generates revenue through its global operations focused on the research, development, production, service, and sale of string inverters.

Insider Ownership: 38.2%

Earnings Growth Forecast: 26.7% p.a.

Ginlong Technologies is experiencing significant earnings growth, with a forecasted annual increase of 26.72%, though slightly below the Chinese market average. Revenue is expected to rise by 20.4% annually, outpacing both high-growth benchmarks and the market average. Despite a low future return on equity forecast and high debt levels, its price-to-earnings ratio of 34.2x suggests good value compared to peers. Recent amendments to company bylaws highlight ongoing strategic adjustments amidst robust financial performance improvements.

- Unlock comprehensive insights into our analysis of Ginlong Technologies stock in this growth report.

- Our valuation report here indicates Ginlong Technologies may be undervalued.

Summing It All Up

- Delve into our full catalog of 623 Fast Growing Asian Companies With High Insider Ownership here.

- Curious About Other Options? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal