Agilent Technologies (A) Valuation Check After Evercore ISI Upgrade And Growing Analyst Optimism

Agilent Technologies (A) has come back into focus after Evercore ISI raised its rating on the stock to Outperform, a shift that aligns with increasingly positive views from several other research firms.

See our latest analysis for Agilent Technologies.

The upgrade comes after a period of steady share price momentum, with a 7-day share price return of 8.63% and a 90-day share price return of 5.50%. The 1-year total shareholder return of 8.76% contrasts with a modest 3-year total shareholder return decline of 4.45%, which indicates that sentiment has recently improved even if longer term performance has been mixed.

If Agilent has you looking closer at lab tools and diagnostics, it could be a good time to scan a broader set of healthcare stocks for fresh ideas.

So with Agilent trading at $147.81 versus an average analyst target of about $168.59 and recent returns turning positive, is the market still underestimating the story here, or is it already pricing in the next leg of growth?

Most Popular Narrative: 12.8% Undervalued

With Agilent closing at $147.81 against a narrative fair value of about $169.44, the widely followed view leans toward upside still being on the table.

Strategic investments in higher margin recurring revenue streams including consumables, software, services, and digital platforms are gaining traction, with CrossLab and services delivering consistent mid single digit growth and high customer satisfaction, indicating further margin expansion and greater earnings stability in future periods.

Curious what kind of revenue mix shift could support that higher valuation? The narrative focuses on expanding recurring sales, firmer margins, and a richer earnings multiple. Want to see exactly how those pieces fit together in the model?

Result: Fair Value of $169.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are real pressure points here, including tariff-driven cost risks and potential funding cuts in academic and government labs that could unsettle the current upbeat narrative.

Find out about the key risks to this Agilent Technologies narrative.

Another View: DCF Sends a Different Signal

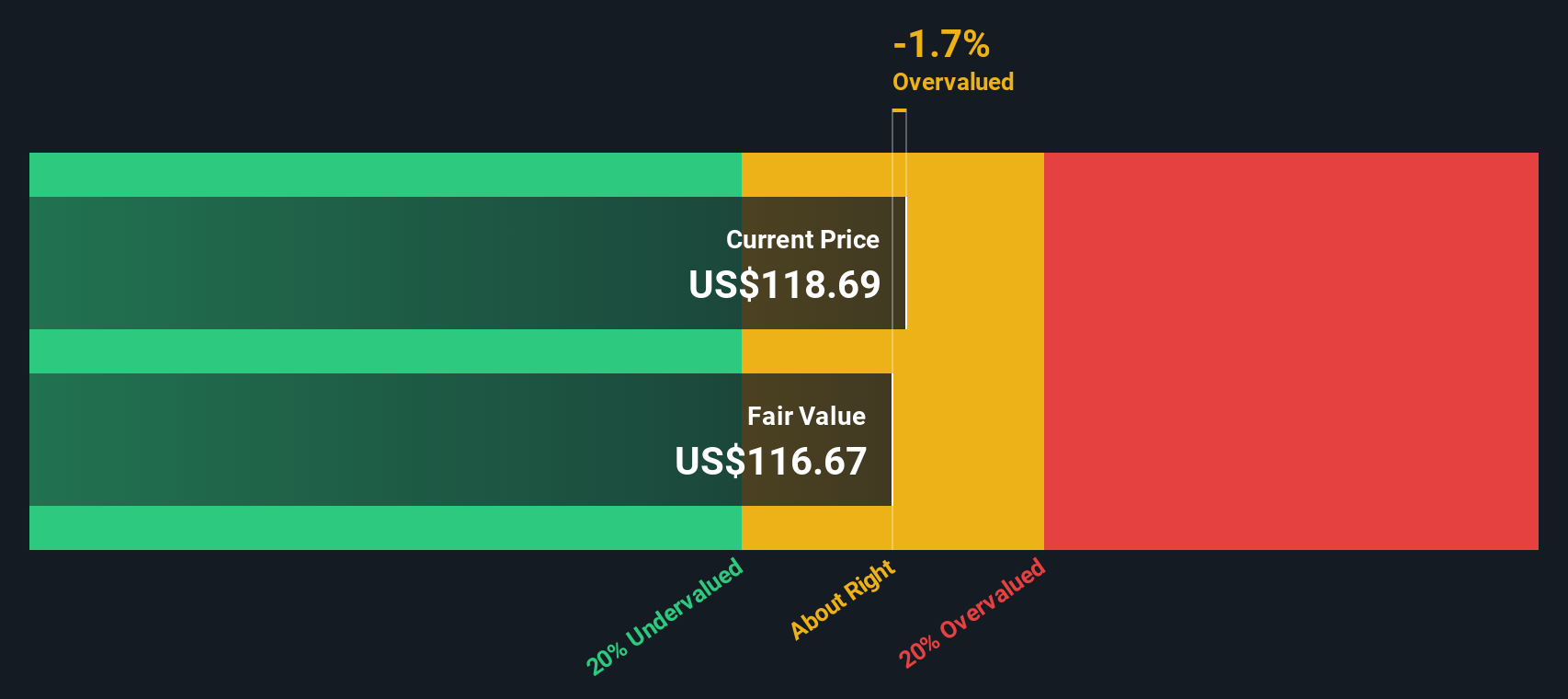

There is a twist when you set the upbeat narrative fair value of about $169.44 against our DCF model. The SWS DCF model points to a fair value closer to $113.57, which would make Agilent look expensive at $147.81. So which story do you think deserves more weight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Agilent Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Agilent Technologies Narrative

If you see the story differently or prefer to test the numbers yourself, you can build a full view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Agilent Technologies.

Looking for more investment ideas?

If Agilent has sharpened your interest in opportunities, do not stop here. Use these focused stock ideas to keep your watchlist working harder for you.

- Target potential value by scanning these 883 undervalued stocks based on cash flows that currently trade at prices the market might not fully appreciate.

- Ride fast changing tech trends by checking out these 27 AI penny stocks positioned around artificial intelligence themes.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal