Celsius (CELH) Is Up 12.2% After Renewed Analyst Optimism On PepsiCo-Backed Distribution Expansion

- In recent days, analysts including Needham have reaffirmed their positive views on Celsius Holdings, highlighting its energy drink portfolio and outsourced manufacturing model supported by PepsiCo-led distribution.

- What stands out is the emphasis on accelerating sales across Celsius, Alani Nu, and Rockstar Energy, with analysts pointing to expanded PepsiCo distribution and new product launches as key drivers of improved reach and operational efficiency.

- With this renewed analyst enthusiasm around Celsius’s PepsiCo partnership, we’ll now examine how the news reshapes the company’s investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Celsius Holdings Investment Narrative Recap

To own Celsius, you need to believe its health focused energy brands can keep gaining shelf space and consumer loyalty while protecting profitability. The latest analyst enthusiasm around PepsiCo led distribution supports the near term sales acceleration story, but it does not remove key risks around margin pressure from Alani Nu integration, higher spending, and reliance on major distributors.

Among recent announcements, the US$300,000,000 share repurchase plan stands out alongside this bullish analyst sentiment. A buyback of that size can matter for per share metrics and market perception, but it also sits against a backdrop of compressed net margins and large one off items, which keeps execution on cost discipline and integration a central near term catalyst.

Yet behind the upbeat distribution story, investors should be aware of how concentration in a few major partners could...

Read the full narrative on Celsius Holdings (it's free!)

Celsius Holdings' narrative projects $3.7 billion revenue and $532.9 million earnings by 2028. This requires 30.1% yearly revenue growth and about a $437 million earnings increase from $95.9 million.

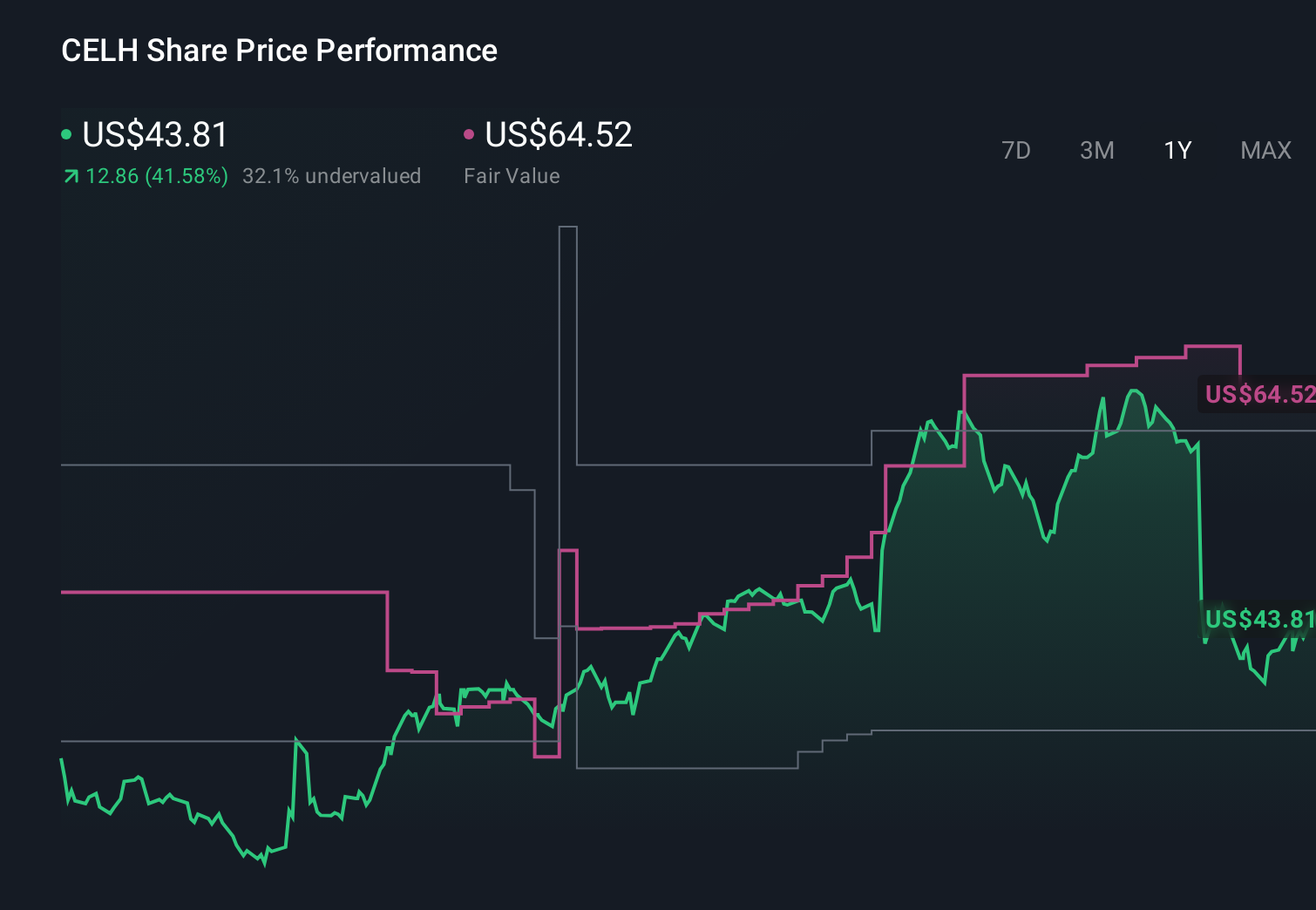

Uncover how Celsius Holdings' forecasts yield a $64.52 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Across 27 fair value estimates from the Simply Wall St Community, Celsius is valued between US$38.18 and US$80, reflecting a wide spread of expectations. When you weigh those views against the reliance on PepsiCo and other large distributors as a key catalyst and risk, it underlines why many market participants look at several viewpoints before forming a view on the company’s potential performance.

Explore 27 other fair value estimates on Celsius Holdings - why the stock might be worth 26% less than the current price!

Build Your Own Celsius Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celsius Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Celsius Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celsius Holdings' overall financial health at a glance.

No Opportunity In Celsius Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal