Is UWM Holdings (UWMC) Pricing Reflect Recent Mortgage Market Focus And Lofty Earnings Multiple

- If you have been wondering whether UWM Holdings at around US$4.63 is a bargain or a value trap, you are not alone, and the answer depends on how you look at its fundamentals and price together.

- The stock has had a mixed run, with a 5.7% return over the last 7 days, a 17.9% decline over 30 days, a 5.0% gain year to date, and an 11.8% decline over the last year, while the 3 year return sits at 48.4% and the 5 year return at a 47.2% decline.

- Recent coverage around UWM Holdings has focused on its position in the US mortgage market and how investors are weighing that against broader conditions for financial stocks. This context helps frame why sentiment and trading activity have been shifting around the name.

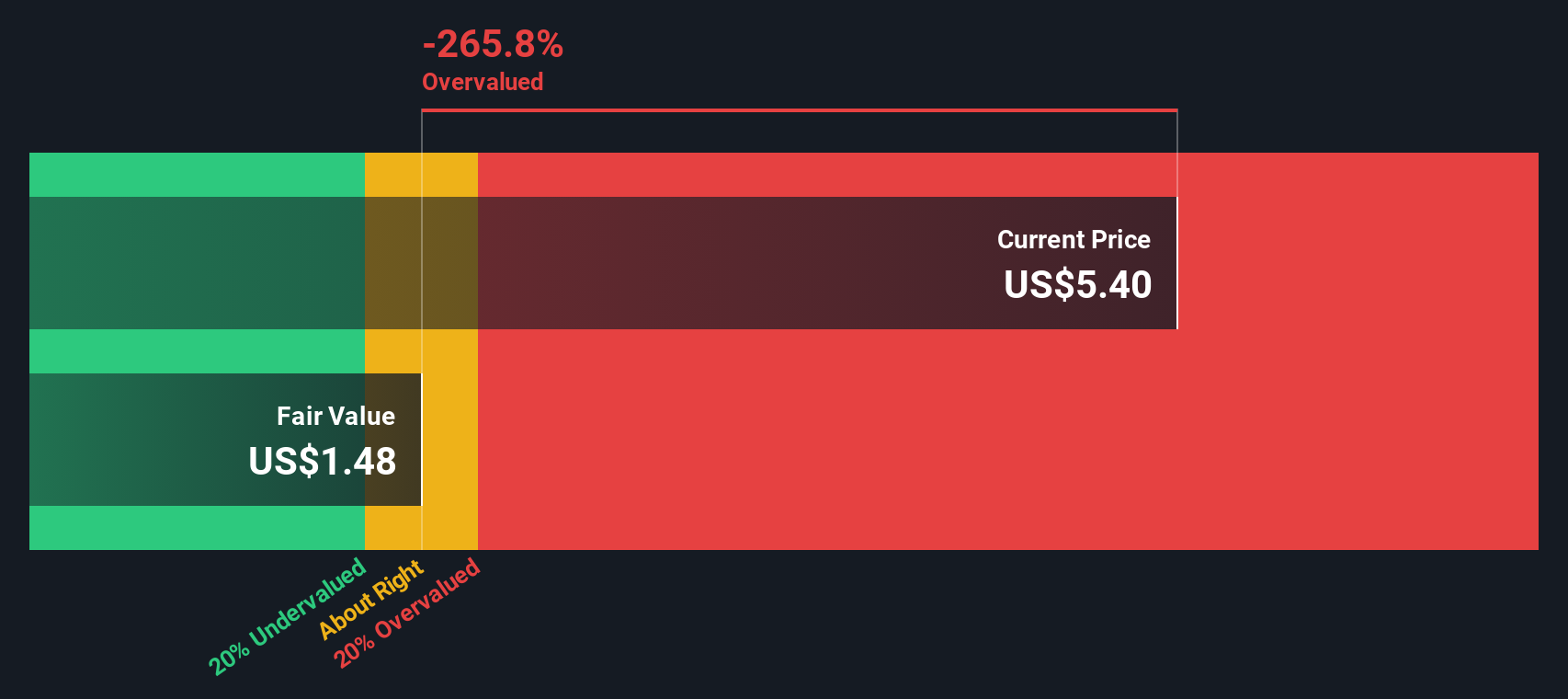

- Right now, UWM Holdings scores 0/6 on our valuation checks, as shown by its valuation score. Next, we will compare different valuation approaches and then finish with a way to think about value that goes beyond the usual models.

UWM Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: UWM Holdings Excess Returns Analysis

The Excess Returns model looks at how much profit a company is expected to earn on its equity above the return that shareholders require, then capitalizes those excess profits into an estimated value per share.

For UWM Holdings, the starting point is a Book Value of US$0.76 per share and a Stable EPS of US$0.12 per share, based on the median return on equity from the past 5 years. The model uses a Cost of Equity of US$0.09 per share, which implies an Excess Return of US$0.03 per share. The average Return on Equity is 10.15%, and analysts see a Stable Book Value of US$1.18 per share, based on weighted future book value estimates from 4 analysts.

Putting these inputs together, the Excess Returns model produces an intrinsic value of about US$1.89 per share. Compared with the recent share price of around US$4.63, this framework suggests the stock is 144.7% above this model-derived estimate.

Result: OVERVALUED

Our Excess Returns analysis suggests UWM Holdings may be overvalued by 144.7%. Discover 883 undervalued stocks or create your own screener to find better value opportunities.

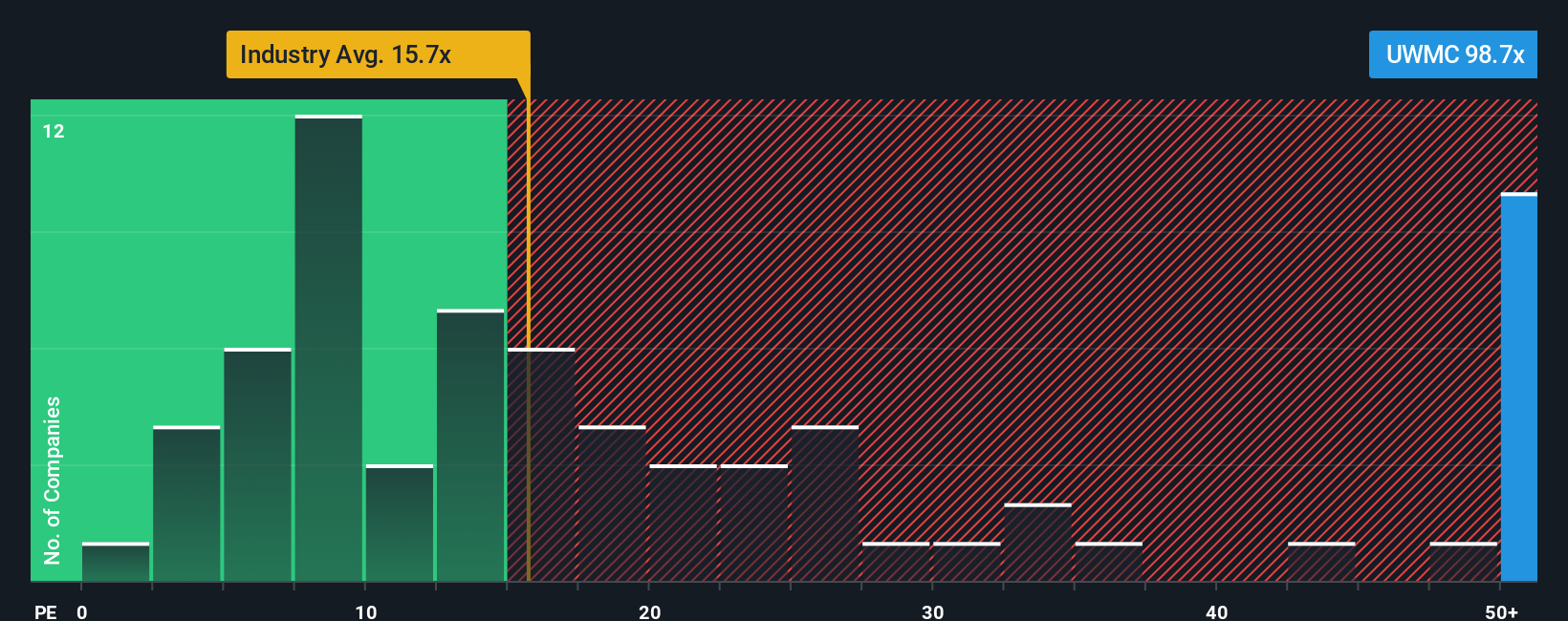

Approach 2: UWM Holdings Price vs Earnings

For a profitable company, the P/E ratio is a straightforward way to see how much investors are paying for each dollar of earnings. It ties the share price directly to the bottom line, which is usually what ultimately matters to shareholders.

What counts as a “normal” P/E depends on what investors expect for future growth and how risky they think those earnings are. Higher expected growth or lower perceived risk can justify a higher P/E, while lower growth or higher risk tends to support a lower P/E.

UWM Holdings currently trades on a P/E of 73.59x. That is well above the Diversified Financial industry average P/E of 14.20x and also above the peer average of 10.06x. Simply Wall St’s Fair Ratio for UWM Holdings is 27.22x, which is its view of a more appropriate P/E given factors such as earnings growth, industry, profit margin, market cap and specific risks.

The Fair Ratio can be more useful than a simple peer or industry comparison because it adjusts for the company’s own characteristics rather than assuming all financial stocks deserve similar multiples. Setting 27.22x against the current 73.59x suggests the shares are pricing in a higher level of optimism than this framework supports.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UWM Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let me introduce you to Narratives, where you tell the story behind your numbers by linking your view of UWM Holdings future revenue, earnings, margins and fair value to a simple forecast that the Simply Wall St platform, used by millions of investors through the Community page, can turn into a live fair value that you can compare with the current share price to help frame buy or sell decisions, with each Narrative updating automatically when new news or earnings land and different investors potentially landing far apart, such as one Narrative anchoring closer to a fair value around US$4.50, another closer to about US$10.00, all sitting alongside the current model fair value of about US$6.59 so you can see exactly how different stories translate into different numbers.

Do you think there's more to the story for UWM Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal