Is Dow (DOW) Recasting Its Innovation Edge By Merging Technology And Sustainability Leadership?

- Dow Inc. announced that long-time Chief Technology Officer A.N. Sreeram will retire in June 2026, with Andre Argenton assuming the newly combined role of Chief Technology and Sustainability Officer from January 1, 2026, while director Rebecca B. Liebert resigned after becoming Chair of Occidental Chemical Corporation’s board.

- This reshuffle elevates sustainability and safety oversight into Dow’s top technology role, signaling a tighter link between innovation, environmental performance, and boardroom priorities.

- We’ll now examine how consolidating technology and sustainability leadership under Andre Argenton may influence Dow’s existing investment narrative and risk profile.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Dow Investment Narrative Recap

To own Dow today, you need to be comfortable with a cyclical, capital intensive chemicals business that is working to stabilize margins, protect cash and eventually return to profitability. The CTO succession and board change do not materially alter the near term focus on cost cuts, asset reviews and cash inflows, while key risks remain elevated feedstock and energy costs, weak demand and delayed growth projects.

The most relevant recent development alongside these leadership changes is Dow’s plan to unlock liquidity, including the expected US$2.4 billion from selling a minority stake in U.S. Gulf Coast infrastructure assets. For investors watching the new combined technology and sustainability role, that extra financial flexibility sits alongside the expanded European asset review, which is intended to tighten the portfolio and support the cost reduction target.

Yet investors should be aware that extended delays to projects like Path2Zero could...

Read the full narrative on Dow (it's free!)

Dow's narrative projects $43.6 billion revenue and $1.5 billion earnings by 2028. This requires 1.4% yearly revenue growth and an earnings increase of about $2.5 billion from -$994.0 million today.

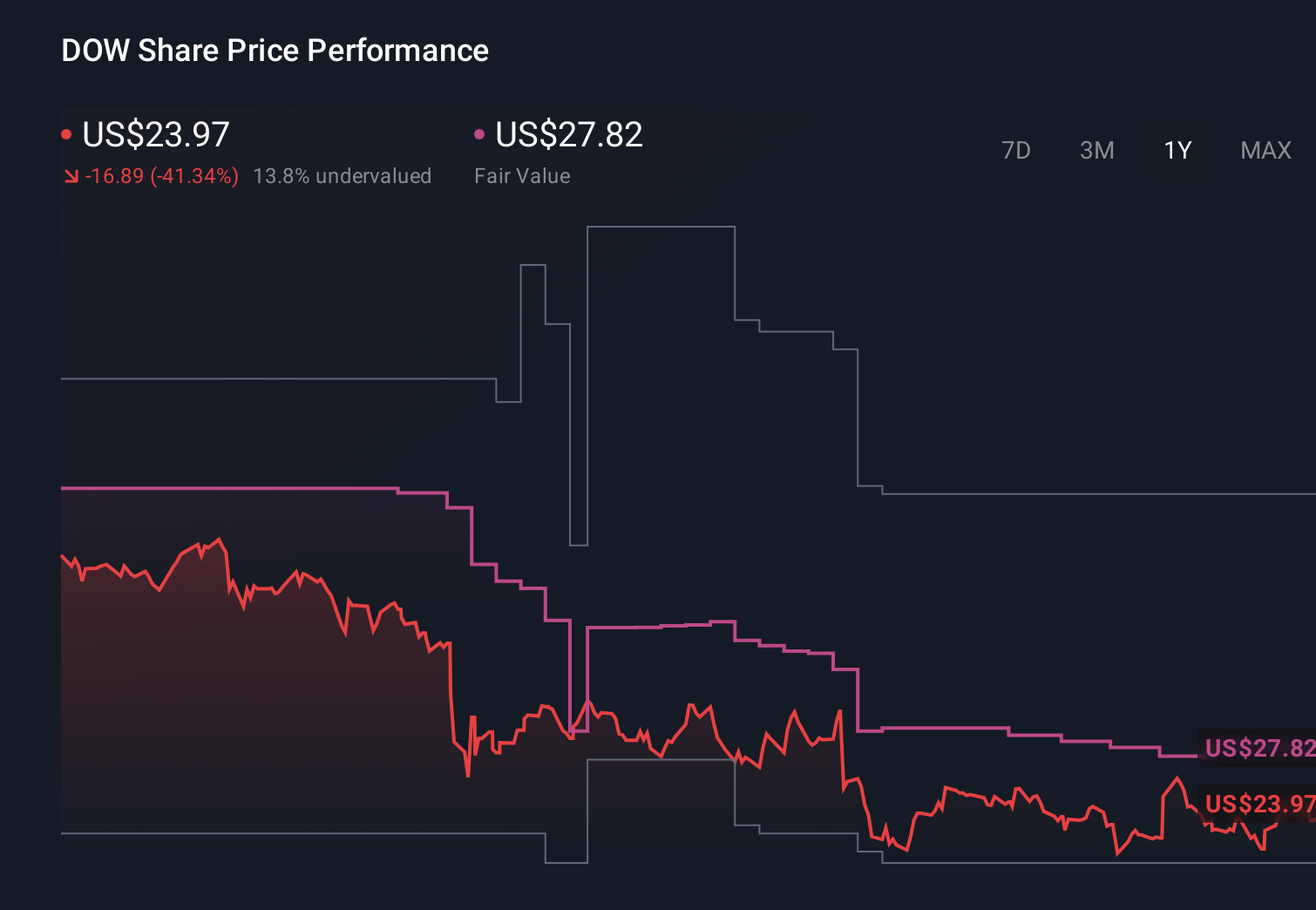

Uncover how Dow's forecasts yield a $27.82 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community span roughly US$12.52 to US$41.52 per share, underlining how far opinions can differ. Against this backdrop, many will weigh those views against Dow’s effort to conserve cash by delaying projects and reassessing European assets, and may want to compare several of these perspectives before deciding how this aligns with their own expectations for the business.

Explore 10 other fair value estimates on Dow - why the stock might be worth as much as 67% more than the current price!

Build Your Own Dow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dow's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal