Assessing Scotts Miracle-Gro (SMG) Valuation As Recent Choppy Returns Draw Investor Attention

Why Scotts Miracle-Gro is on investors’ radar today

Scotts Miracle-Gro (SMG) has attracted fresh attention after recent share price moves, with the stock closing at $58.92 and showing mixed performance over the past month and past 3 months.

See our latest analysis for Scotts Miracle-Gro.

Recent trading has been choppy, with a 1 day share price return of a 3.54% decline following a 30 day share price return of 12.49%. The 1 year total shareholder return of an 8.42% decline contrasts with a 3 year total shareholder return of 11.85%. This suggests momentum has been rebuilding in the shorter term after a tougher stretch.

If Scotts Miracle-Gro has you reassessing your watchlist, this could be a good moment to scan fast growing stocks with high insider ownership for other potential opportunities catching investors’ attention.

With Scotts Miracle-Gro trading at $58.92, recent returns mixed and its value score at 2, the key question is whether the current price leaves any margin for error or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 20.1% Undervalued

The most followed narrative puts Scotts Miracle-Gro’s fair value at about $73.71, compared with the last close at $58.92, framing a sizeable valuation gap to unpack.

Significant ongoing investments in supply chain technology, automation, and process efficiencies are unlocking approximately $75 million in cost savings for fiscal '25 and another approximately $75 million planned for '26/'27. This is directly driving gross margin recovery (with an internal aim for 35%+), supporting EBITDA, and contributing to improvements in long-term net margins.

Curious what kind of revenue path, margin rebuild, and future earnings multiple need to come together to support that higher value tag? The narrative spells it out in detail.

Result: Fair Value of $73.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Hawthorne’s separation and margin rebuild staying on track, and both weather swings and retailer decisions could quickly challenge that story.

Find out about the key risks to this Scotts Miracle-Gro narrative.

Another View on Scotts Miracle-Gro’s Valuation

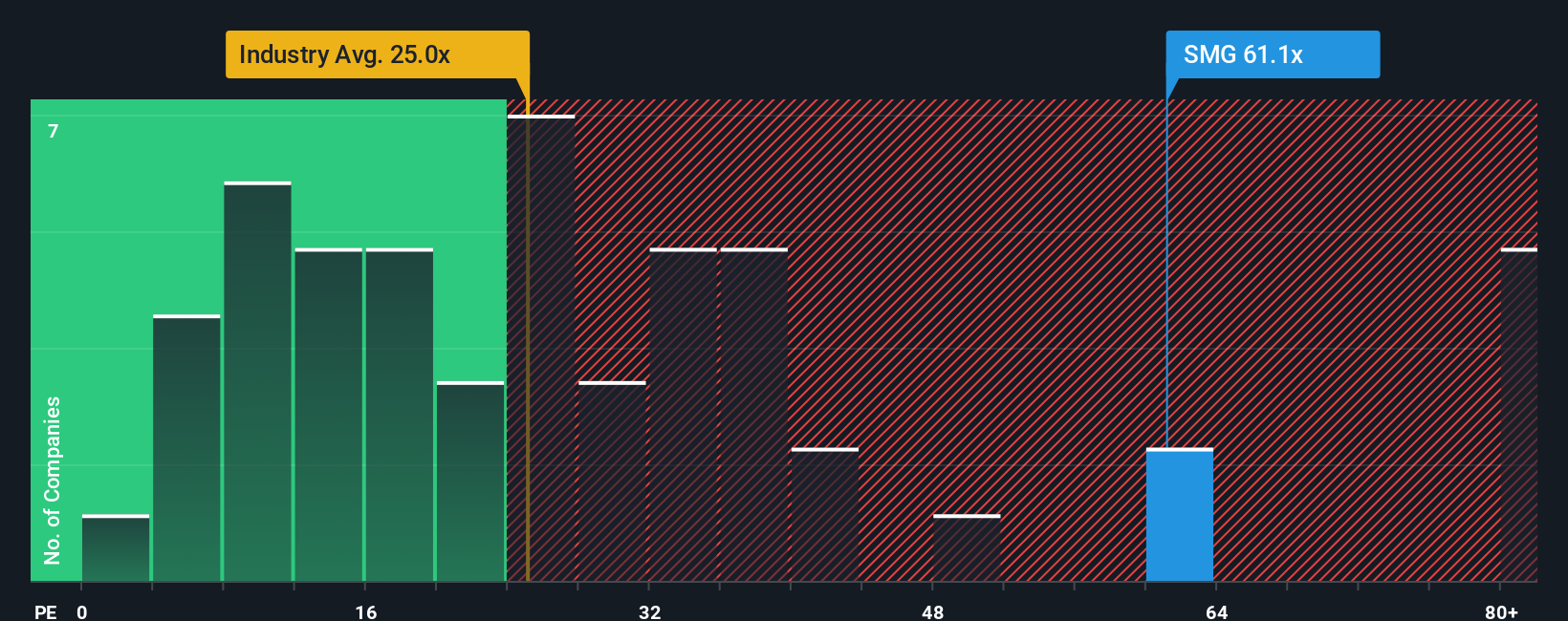

The narrative points to a fair value of $73.71 and a 20.1% discount, yet the current P/E of 23.5x tells a tighter story. It sits above the peer average of 10.9x and above the fair ratio of 20.7x, which hints at less room for error if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Scotts Miracle-Gro Narrative

If you interpret the numbers differently or prefer to test your own assumptions, you can build a fresh narrative in minutes with Do it your way.

A great starting point for your Scotts Miracle-Gro research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Scotts Miracle-Gro has sharpened your interest, do not stop here. Use this momentum to line up a few more ideas that fit your style.

- Spot potential value candidates by scanning these 882 undervalued stocks based on cash flows built from cash flow focused metrics that can help you prioritise where to spend your research time.

- Zero in on growth themes by checking out these 27 AI penny stocks that tap into artificial intelligence trends and may suit a higher risk, higher potential approach.

- Add a different angle to your watchlist with these 79 cryptocurrency and blockchain stocks that target companies linked to digital assets and blockchain related businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal