ASX Stocks Possibly Trading Below Fair Value In January 2026

As the Australian market navigates through a period of mixed performance, with materials experiencing a sell-off despite rising iron ore futures and healthcare leading gains, investors are keenly observing potential opportunities. In this environment, identifying stocks that may be trading below their fair value can offer intriguing possibilities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$1.205 | A$2.26 | 46.7% |

| NRW Holdings (ASX:NWH) | A$5.30 | A$8.95 | 40.8% |

| LGI (ASX:LGI) | A$4.09 | A$7.76 | 47.3% |

| Kogan.com (ASX:KGN) | A$3.94 | A$6.87 | 42.6% |

| Guzman y Gomez (ASX:GYG) | A$21.50 | A$38.31 | 43.9% |

| Cromwell Property Group (ASX:CMW) | A$0.46 | A$0.85 | 46.1% |

| Betmakers Technology Group (ASX:BET) | A$0.20 | A$0.34 | 40.5% |

| Alkane Resources (ASX:ALK) | A$1.37 | A$2.39 | 42.6% |

| Airtasker (ASX:ART) | A$0.325 | A$0.63 | 48.3% |

| 29Metals (ASX:29M) | A$0.655 | A$1.29 | 49.2% |

Let's explore several standout options from the results in the screener.

29Metals (ASX:29M)

Overview: 29Metals Limited is a mining company that focuses on copper and other base and precious metals, with operations in Australia and Chile, and has a market capitalization of A$898.88 million.

Operations: The company generates revenue from its operations primarily through Golden Grove, contributing A$573.88 million, and Capricorn Copper, which adds A$5.15 million.

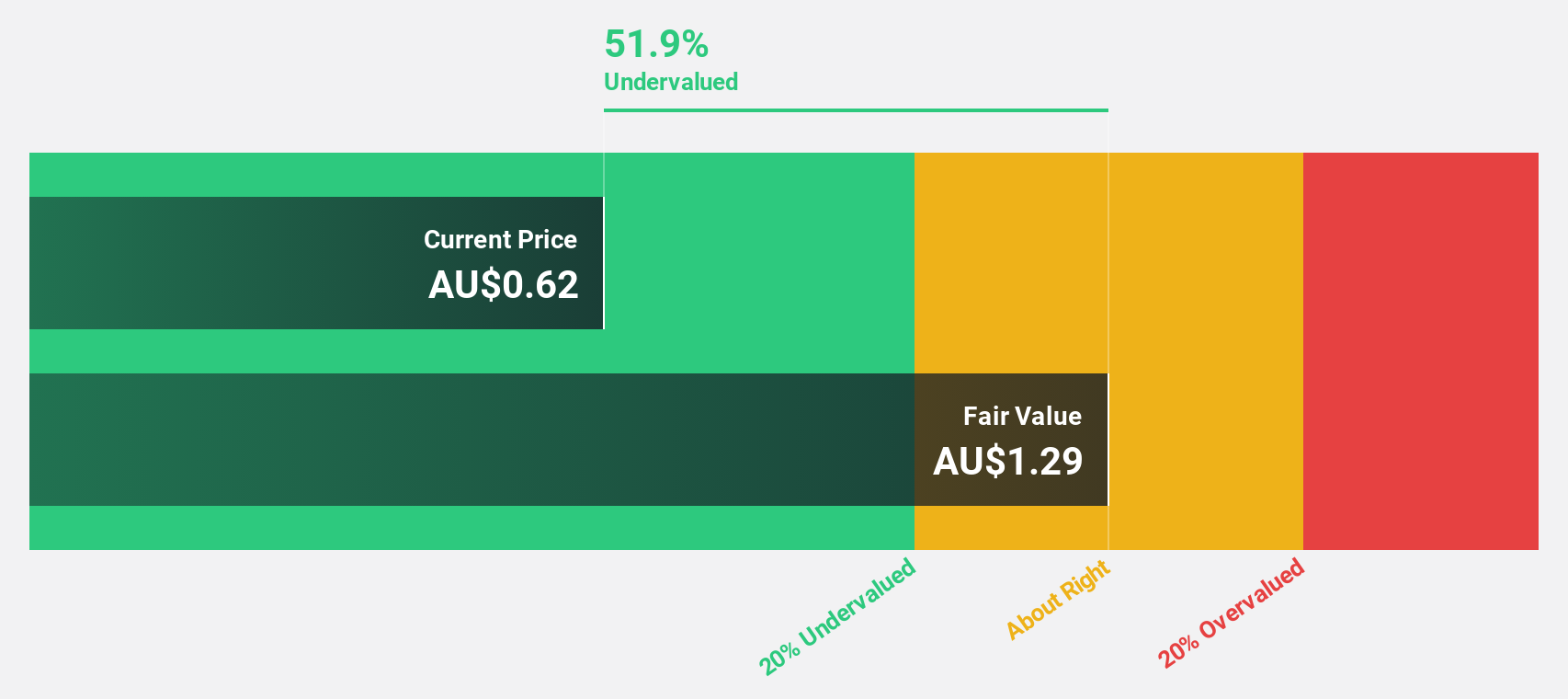

Estimated Discount To Fair Value: 49.2%

29Metals is trading at A$0.66, significantly below its estimated fair value of A$1.29, indicating potential undervaluation based on cash flows. The company is forecast to achieve annual profit growth above the market average and become profitable within three years, with earnings expected to grow substantially each year. Recent board changes include the appointment of Nick Cernotta, bringing extensive mining experience that could enhance operational efficiencies and cost management in challenging environments.

- Our growth report here indicates 29Metals may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of 29Metals stock in this financial health report.

Nickel Industries (ASX:NIC)

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron, cobalt, and nickel matte, with a market cap of A$4.17 billion.

Operations: The company's revenue segments include $120.89 million from nickel ore mining in Indonesia, $109.25 million from HPAL projects in Indonesia and Hong Kong, and $1.50 billion from RKEF projects in Indonesia and Singapore.

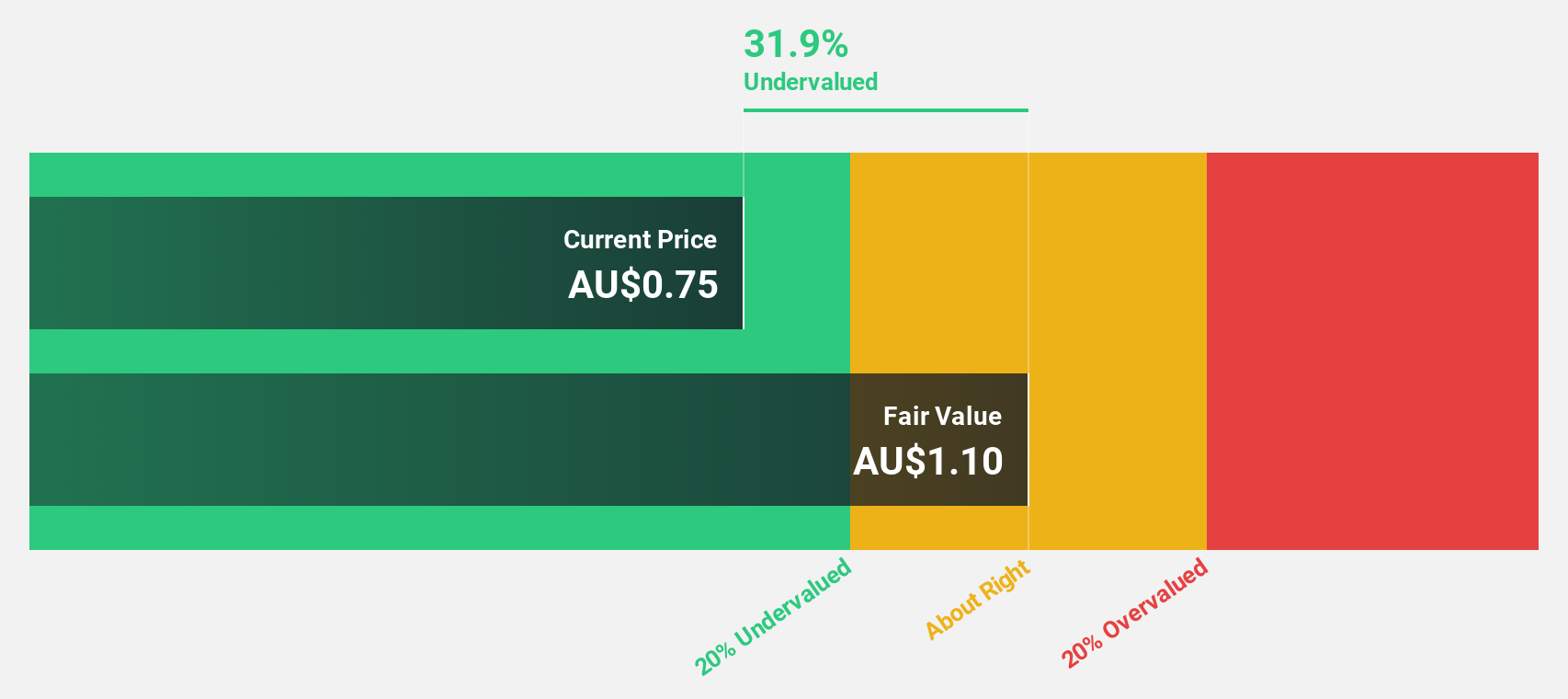

Estimated Discount To Fair Value: 14.0%

Nickel Industries is trading at A$0.96, below its estimated fair value of A$1.12, suggesting it may be undervalued based on cash flows. The company is forecast to achieve above-average market profit growth and become profitable within three years, with earnings expected to grow significantly annually. While revenue growth of 14.3% per year outpaces the Australian market average, its return on equity is projected to remain low in the future.

- The growth report we've compiled suggests that Nickel Industries' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Nickel Industries.

SKS Technologies Group (ASX:SKS)

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$429.01 million.

Operations: The company generates revenue of A$261.66 million from its operations in the lighting and audio-visual markets.

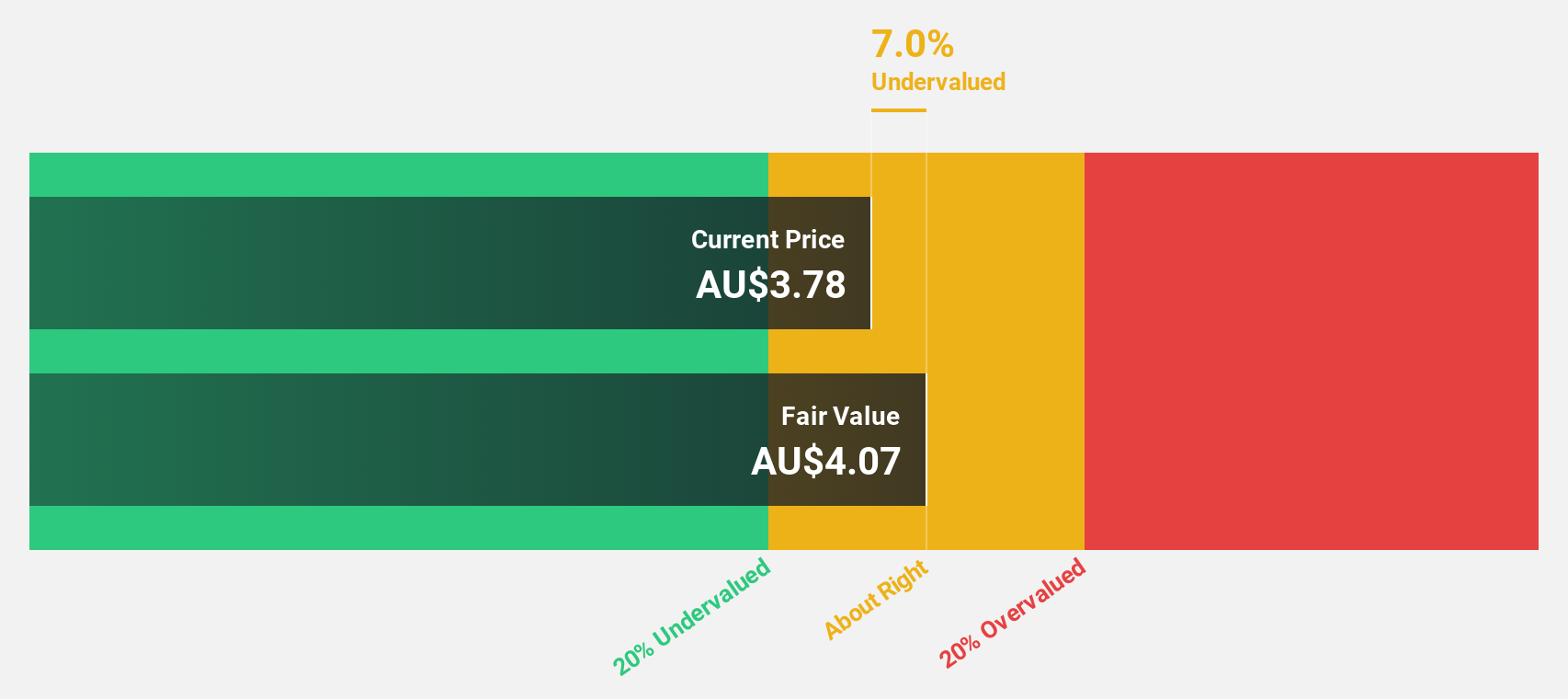

Estimated Discount To Fair Value: 10.1%

SKS Technologies Group, trading at A$3.74, is below its fair value estimate of A$4.16, reflecting potential undervaluation based on cash flows. With forecasted earnings growth of 23.8% annually and revenue growth outpacing the market at 13.4%, SKS shows strong profit expansion prospects. Recently achieving a substantial earnings increase of 111.8%, its return on equity is projected to reach a high level in three years, enhancing its investment appeal despite modest undervaluation.

- Upon reviewing our latest growth report, SKS Technologies Group's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in SKS Technologies Group's balance sheet health report.

Seize The Opportunity

- Reveal the 36 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal