Trinity Industries (TRN) Valuation After Railcar Partnership Overhaul And Higher 2025 Earnings Guidance

Why Trinity Industries is back on investors’ radar

Trinity Industries (TRN) is drawing fresh attention after it overhauled railcar investment partnerships with Napier Park, raised 2025 earnings guidance, and flagged a sizeable non-cash gain tied to its Triumph Holdings exit.

See our latest analysis for Trinity Industries.

The guidance upgrade and restructuring news came after a mixed period, with a 7.01% year to date share price return but a 13.67% decline in 1 year total shareholder return. Recent momentum is tentatively rebuilding from a weaker long-term base.

If this kind of turnaround story interests you, it can be worth widening the lens to see which other companies are gaining attention, including aerospace and defense stocks.

With 2025 EPS now guided to $3.05 to $3.20, a recent 10% price jump, and the stock at $28.84, is Trinity still trading at a discount, or has the market already priced in the restructuring gains and potential future growth?

Most Popular Narrative: 13.1% Overvalued

With Trinity Industries last closing at US$28.84 against a narrative fair value of US$25.50, the current pricing sits above that central estimate and hinges on a detailed set of cash flow and earnings assumptions that use a 9.17% discount rate.

The analysts have a consensus price target of $28.5 for Trinity Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $207.4 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 12.3%.

Curious what holds this above fair value despite modest growth assumptions and a lower future earnings multiple than many peers? The full narrative sets out the earnings path, margin shift, and valuation bridge that need to line up for this price to make sense.

Result: Fair Value of $25.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that storyline can stumble if cyclical end markets stay soft or if higher maintenance and steel costs squeeze margins more than analysts currently factor in.

Find out about the key risks to this Trinity Industries narrative.

Another View: Market Ratio Signals A Different Story

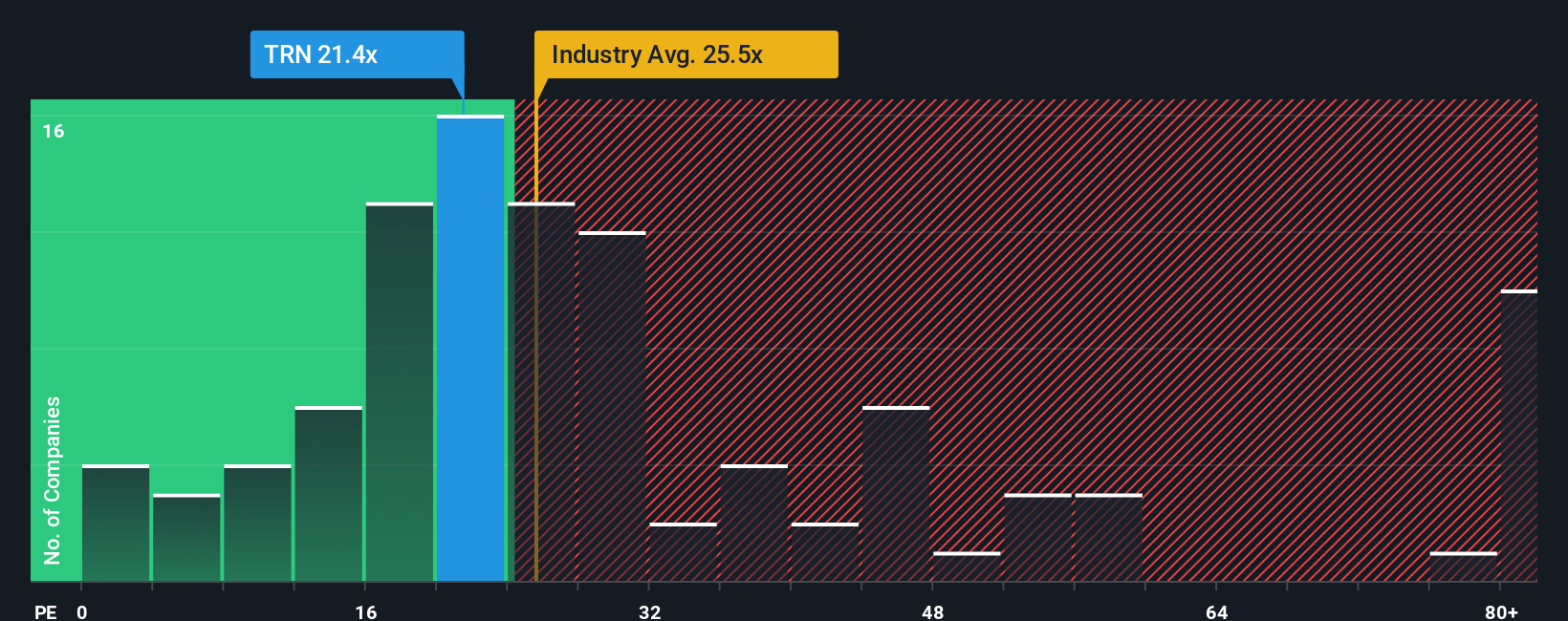

Our SWS fair ratio work paints a more cautious picture. Trinity trades on a P/E of 22.4x, which sits above both the Machinery industry average of 26x and the peer average of 19.1x, while the fair ratio is 18.4x. That gap suggests limited room if sentiment cools or earnings disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trinity Industries Narrative

If you are not fully convinced by this take or prefer to weigh the assumptions yourself, you can build a custom view in a few minutes using Do it your way.

A great starting point for your Trinity Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Trinity has caught your interest, do not stop here. Widen your watchlist with other focused stock ideas that could fit different goals and risk levels.

- Target higher income potential by reviewing these 12 dividend stocks with yields > 3% that may appeal if you prioritize regular cash returns.

- Spot potential mispricings by checking out these 883 undervalued stocks based on cash flows, where valuations and cash flows line up more tightly.

- Lean into structural tech shifts by scanning these 27 AI penny stocks that are tied to artificial intelligence themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal