Micron (MU) Stock Drops In Market Pullback, But AI Memory Demand Stays Hot

Micron Technology Inc (NASDAQ:MU) shares are down on Thursday as the company faces pressure from a broader market pullback, despite strong demand for memory chips amid rising artificial intelligence needs.

This decline comes as the semiconductor sector is experiencing mixed performance, with some companies thriving while others struggle, as highlighted in a recent report on the industry driven by AI demand.

- Micron Technology stock is among today’s weakest performers. Why is MU stock falling?

Unpacking Micron’s Remarkable Growth Surge

Micron Technology is seeing significant fluctuations as it reported a remarkable 225% increase over the past year, reflecting investor optimism around memory chips that power AI systems. The company is also expanding its U.S. footprint with plans to break ground on a massive New York megafab in January 2026, aiming to capture long-term growth in the AI-driven market.

The semiconductor industry is witnessing a surge in demand, particularly for DRAM chips, which are essential for AI applications. Analysts predict that DRAM prices, which have already risen significantly, are expected to climb another 40% through the second quarter of 2026, further solidifying the pricing power of memory manufacturers like Micron.

The broader market is experiencing mixed results, with the Nasdaq-100 down 0.58% today, contributing to Micron’s decline.

Will AI Demand Sustain Micron’s Momentum?

The stock is currently trading 17.4% above its 20-day simple moving average (SMA) and 58.8% above its 100-day SMA, indicating strong short-term momentum. Over the past 12 months, shares have increased by 226.95% and are positioned closer to their 52-week highs than lows, reflecting robust long-term performance.

The RSI is at 74.54, which is considered overbought, suggesting that the stock may be due for a pullback. Meanwhile, MACD is above its signal line, indicating bullish momentum, but the overbought RSI may warrant caution for traders.

The combination of an overbought RSI and bullish MACD suggests mixed momentum, indicating that while there is upward pressure, the stock may also be vulnerable to a correction.

- Key Resistance: $346.30

Navigating Micron’s Premium Valuation Risks

Investors are looking ahead to the next earnings report on March 19, 2026.

- EPS Estimate: $8.08 (Up from $1.56 YoY)

- Revenue Estimate: $18.72 billion (Up from $8.05 billion YoY)

- Valuation: P/E of 32.3x (Indicates premium valuation)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $325.17. Recent analyst moves include:

- UBS: Buy (Raised Target to $400.00)

- Piper Sandler: Overweight (Raised Target to $400.00)

- Citigroup: Buy (Raised Target to $330.00)

Valuation Insight: While the stock trades at a premium P/E multiple, the strong consensus and 418% expected earnings growth suggest analysts view this growth as justification for the 0% upside to analyst targets.

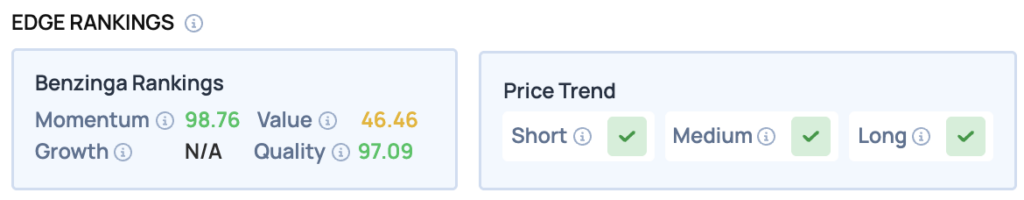

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Micron, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 98.76/100) — Stock is outperforming the broader market.

- Quality: Strong (Score: 97.09/100) — Balance sheet remains healthy.

- Value: Risk (Score: 46.46/100) — Trading at a steep premium relative to peers.

The Verdict: Micron Technology, Inc.’s Benzinga Edge signal reveals a strong momentum setup, indicating that the stock is currently outperforming the market. However, the relatively low value score suggests that investors should be cautious, as the stock is trading at a premium, which could pose risks if market conditions shift.

Top ETF Exposure

- iShares Semiconductor ETF (NASDAQ:SOXX): 7.39% Weight

- Invesco AI and Next Gen Software ETF (NYSE:IGPT): 7.48% Weight

- REX FANG & Innovation Equity Premium Income ETF (NASDAQ:FEPI): 6.70% Weight

Significance: Because MU carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

Price Action

MU Price Action: Micron Technology shares were down 3.57% at $327.43 at the time of publication on Thursday, according to Benzinga Pro data.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal