Trade Route Disruptions And Flexible Capacity Needs Might Change The Case For Investing In GSL

- Recent geopolitical shifts have reshaped global shipping patterns, with trade disruptions and rerouted flows increasing demand for containership capacity in the past months, benefiting asset owners such as Global Ship Lease.

- As containerized trade fragments and supply chains grow more complex, midsize and smaller vessels at the heart of Global Ship Lease’s fleet appear increasingly relevant for meeting flexible, diversified transport needs.

- We’ll now examine how heightened trade-route disruption and demand for flexible containership capacity may influence Global Ship Lease’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Global Ship Lease Investment Narrative Recap

To own Global Ship Lease, you need to believe that ongoing supply chain complexity and shifting trade routes will keep midsize containerships meaningfully utilized, supporting contracted cash flows and asset values. The latest geopolitical disruptions appear to reinforce the short term catalyst of firm demand for flexible capacity, while also underscoring the key risk that any sharp reversal in charter markets or normalization of disrupted routes could quickly compress rates and profitability.

Against this backdrop, the recent decision to lift the quarterly Class A common dividend to US$0.625 per share for Q3 2025 stands out, as it directly links current cash generation to higher shareholder returns. This move sits alongside the existing contracted revenue backlog and reflects how recent trading conditions interact with Global Ship Lease’s income focused appeal, but it still leaves the company exposed if utilization or charter pricing were to soften more abruptly than expected.

Yet investors should be aware that if charter markets reset quickly from today’s disruption driven tightness, Global Ship Lease’s earnings profile could...

Read the full narrative on Global Ship Lease (it's free!)

Global Ship Lease's narrative projects $621.0 million revenue and $270.6 million earnings by 2028. This implies a 5.3% yearly revenue decline and an earnings decrease of $112.4 million from $383.0 million today.

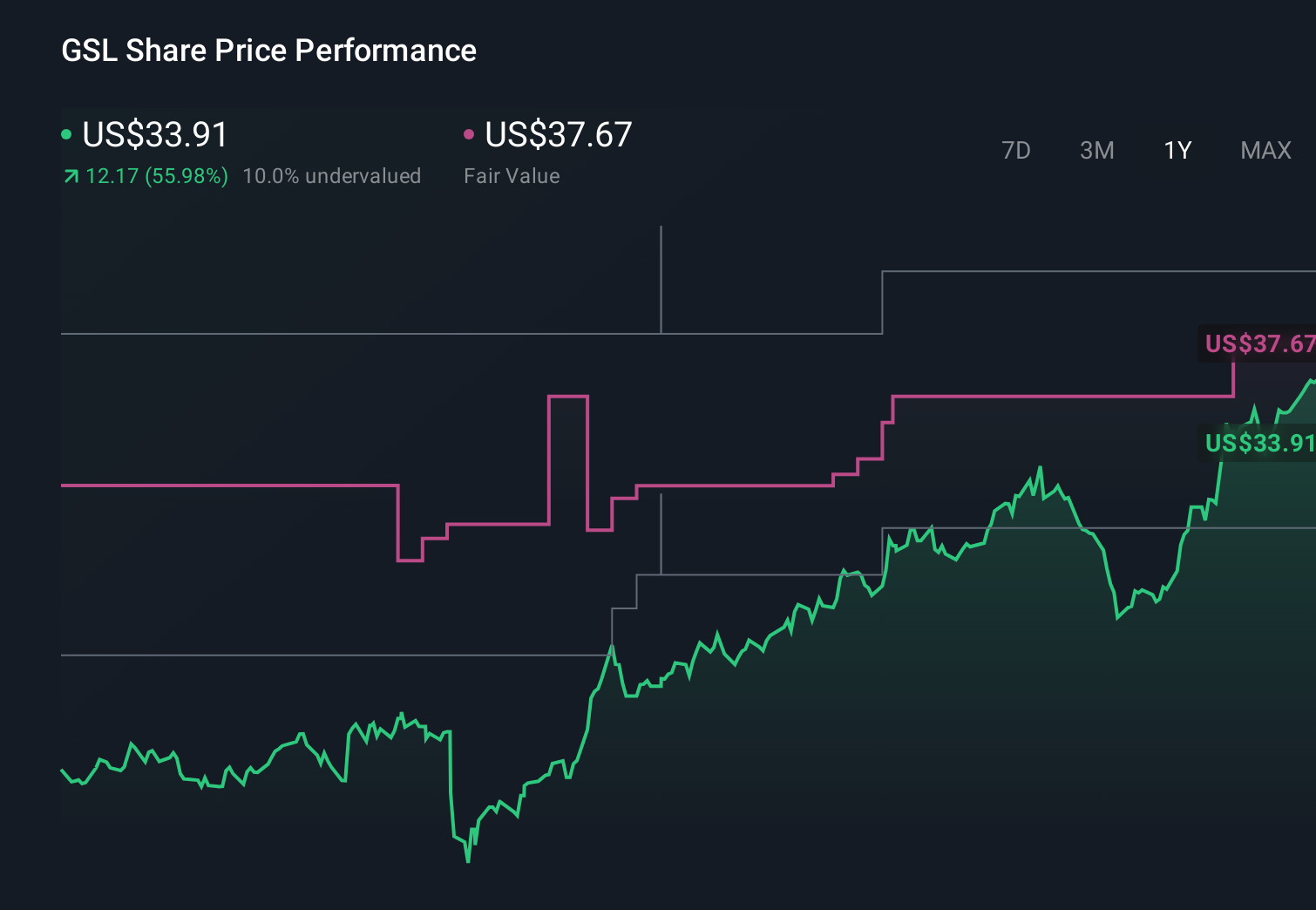

Uncover how Global Ship Lease's forecasts yield a $37.67 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$23.59 to US$101.17, showing how far apart individual views can be. You should weigh those against the risk that a sharp correction in charter rates could pressure both earnings and perceived value, and then explore how different scenarios might affect your own expectations for Global Ship Lease.

Explore 9 other fair value estimates on Global Ship Lease - why the stock might be worth 35% less than the current price!

Build Your Own Global Ship Lease Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Ship Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Ship Lease research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Ship Lease's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal