Assessing UFP Industries (UFPI) Valuation After Declining Sales And Earnings Pressure

UFP Industries (UFPI) is under the microscope after two consecutive years of declining unit sales, a 20.4% annual drop in earnings per share, and weakening returns on capital that together raise questions about the stock’s underlying momentum.

See our latest analysis for UFP Industries.

At a share price of US$92.77, UFP Industries has a 30 day share price return of 3.04%. The 1 year total shareholder return shows a decline of 14.41%, compared with a gain of 73.68% over five years. This suggests that long term momentum has moderated recently.

If UFP Industries’ recent wobble has you reassessing your ideas, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

So with earnings under pressure but the share price still reflecting a multi year gain of 74%, is UFP Industries quietly offering value today, or is the current price already factoring in any future recovery?

Most Popular Narrative: 15.2% Undervalued

With UFP Industries last closing at US$92.77 against a narrative fair value of US$109.40, the current share price sits below that reference point and puts the focus on what is being assumed about future earnings power and profitability.

The company's $60 million cost reduction program, restructuring activities (such as consolidating/closing underperforming facilities and exiting less profitable lines), and automation investments are projected to materially lower the cost structure by 2026, driving net margin expansion even if industry conditions remain mixed.

Curious how a business facing softer volumes can still support a higher value? The narrative leans heavily on steadier margins, measured revenue growth, and a future earnings multiple that sits below the broader industry. Want to see exactly how those moving parts fit together into that US$109.40 figure?

According to the most widely followed narrative, the fair value estimate of US$109.40 is built on modest revenue growth assumptions, higher long run profit margins, a slight uplift in earnings over several years, and a discount rate of about 8.5% to bring those expected cash flows back to today.

Result: Fair Value of $109.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on housing and construction demand remaining stable, and on UFP Industries successfully shifting toward higher value products rather than losing share to competitors.

Find out about the key risks to this UFP Industries narrative.

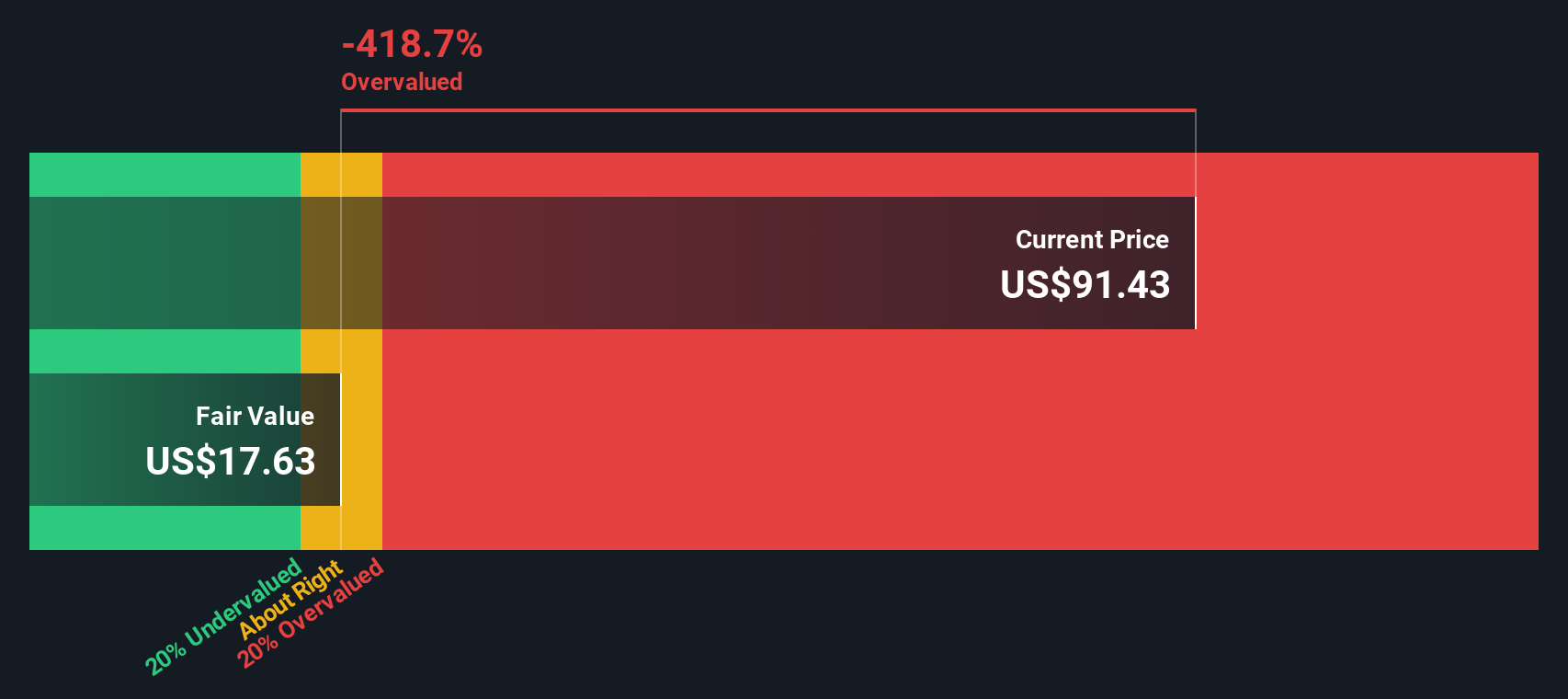

Another View: When Our DCF Points the Other Way

The popular fair value narrative of US$109.40 suggests UFP Industries is 15.2% undervalued, but our DCF model tells a different story. On those cash flow assumptions, fair value sits closer to US$68.99, which would put today’s US$92.77 share price in overvalued territory.

Two models, two very different answers. This raises the real question: which set of assumptions do you find more realistic for cash flows and risk over the next few years?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UFP Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UFP Industries Narrative

If the assumptions here do not quite match your own view, or you would rather test the numbers yourself, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your UFP Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If UFP Industries has you thinking more carefully about where you put your money, do not stop here. Broaden your search before the next move passes you by.

- Target potential mispricing by scanning these 884 undervalued stocks based on cash flows that line up current prices against underlying cash flow strength.

- Identify emerging themes by filtering for these 26 AI penny stocks that are tying artificial intelligence to real business models and revenues.

- Build your income shortlist with these 12 dividend stocks with yields > 3% that focus on yields above 3% while still highlighting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal