IPO News | Sonny Sendi reports that the Hong Kong Stock Exchange's “black light factory” has officially started production

The Zhitong Finance App learned that, according to the Hong Kong Stock Exchange's disclosure on January 8, Sunnisendi (Hunan) Group Co., Ltd. (abbreviation: Sunnisendi) submitted a listing application to the main board of the Hong Kong Stock Exchange, with Goldman Sachs and CICC as co-sponsors.

Company profile

According to the prospectus, Sonisendi is a technology-driven IP toy company dedicated to reshaping traditional toy manufacturing methods. The company's patented technology can combine multiple colors and materials in a single molding process to achieve integrated molding in toy production, reduce processes, and maintain consistent high quality. According to Frost & Sullivan, Sonisendi is the only IP toy company in the world that uses such technology.

Sonny Sendi's products use environmentally friendly materials such as ABS and TPR to replace traditional PVC materials, and reduce the use of painting processes to meet food contact grade and product safety standards. In addition, the company's “black light factory” has been officially put into production, achieving 7x24 hour fully automated toy production, greatly improving production efficiency, product consistency and capacity expansion. It is the first batch of “black light factories” in the world.

In September 2025, Sonny Sendi obtained a global license from the International Football Federation to design, develop, manufacture and distribute 2026 FIFA World Cup mascot-themed figures in more than 60 countries and regions. The partnership highlighted the company's world-class design, production and delivery capabilities, and became a strategic opportunity for the company to reach more mainstream global retail channels and enhance its international influence.

Sonny Sendi is committed to promoting Guochao culture and creativity to global consumers. Through cooperation with top Guochao cultural and creative IPs such as “The Demon Boy in the Sea”, “The Monster of Langlang Mountain” and “The Rise of Daisheng”, the company incorporates traditional and contemporary Chinese elements into IP toys to convey the unique charm of Guochao culture and creativity to the younger generation in China and the global audience. According to Frost & Sullivan, in terms of sales volume for the nine months ended September 30, 2025, Sonny Sendi is the largest Guochao cultural and creative IP toy company.

Relying on proprietary patented technology and industry-leading intelligent manufacturing capabilities, Sonysendi launched the two core businesses of IP toys and the IP toy solution “IP Toys+” to provide high-quality products with excellent cost ratio. According to Frost & Sullivan, the company has established a leading position in the IP toys and IP solutions industry. In terms of total sales volume for the nine months ended September 30, 2025, the company has become the second-largest Chinese company in this industry.

Financial data

revenue

In 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately RMB 107 million, RMB 245 million, and RMB 386 million, respectively.

Mōri

In 2023, 2024, and 2025 for the nine months ending September 30, the company achieved gross profit of 18.05 million yuan, 56.884 million yuan, and 136 million yuan respectively.

gross profit margin

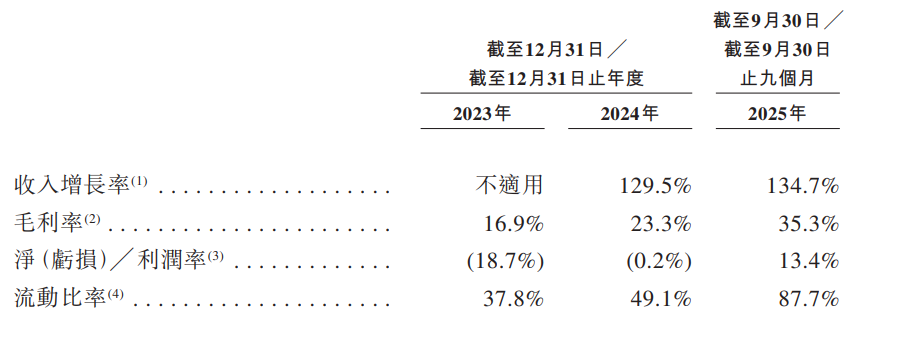

In 2023, 2024, and 2025 for the nine months ended September 30, the company's gross margins were 16.9%, 23.3%, and 35.3%, respectively.

Industry Overview

In recent years, the global IP toy industry has continued to expand steadily, driven by multiple factors such as continuous iteration of production technology, the emergence of more and more high-quality IPs, increased consumer desire, and a growing consumer base.

IP can be divided into animation IP, video IP, sports IP, game IP, cultural and creative IP, and other types of IP (including designer IP, self-developed IP, fashion IP, and celebrity IP). According to Frost & Sullivan, in terms of retail sales, the global IP toy industry market has grown from RMB 362.9 billion in 2019 to RMB 589.3 billion, and is expected to grow at a CAGR of 12.5% between 2024 and 2030.

In the IP toy industry, companies with rich IP portfolios can achieve more diverse creative designs and meet the diverse needs of consumer groups with different preferences. With strong IP operation capabilities and rich experience accumulated over many years, the company continues to expand the IP categories it covers. According to Frost & Sullivan's data, as of January 2, 2026, the IP categories operated by the company include Guochao cultural and creative, sporting events, animation, and video game IPs. According to Frost & Sullivan, as of January 2, 2026, Sunnisendi is the IP toy company with the widest coverage of IP categories in China.

According to product pricing, IP toys can be divided into: (i) affordable IP toys, that is, IP toys with a unit retail price of RMB 50.0 and below; (ii) mid-range IP toys, that is, IP toys with a unit retail price between RMB 50.0 and RMB 100.0; and (iii) high-end IP toys, that is, IP toys with a unit retail price of RMB 100.0 and above.

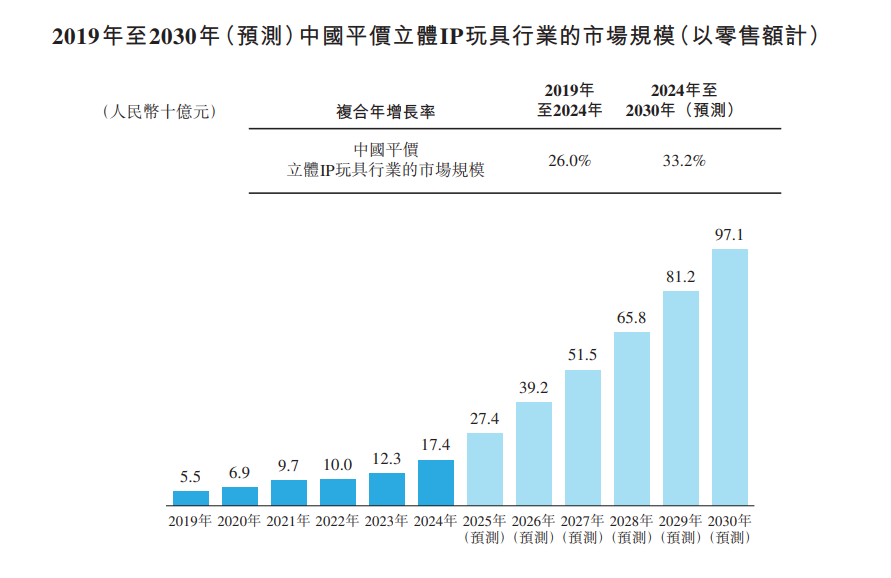

According to Frost & Sullivan, in terms of retail sales, the market size of China's affordable IP toy industry has grown from RMB 9.2 billion in 2019 to RMB 29 billion in 2024, with a compound annual growth rate of about 25.8%, and is expected to grow at a CAGR of 27.7% between 2024 and 2030, becoming an important segment driving the expansion of the IP toy industry in China.

According to Frost & Sullivan's data, based on the stereoscopic nature of the product, IP toys can be divided into three-dimensional IP toys and flat IP toys. In terms of retail sales, the market size of China's three-dimensional IP toy industry will reach RMB 70.6 billion in 2024, accounting for 80.8% of China's IP toy industry. In the three-dimensional IP toy industry, thanks to continuous supply-side improvements and continuous growth in consumer demand, affordable products have also become a field of rapid growth. According to Frost & Sullivan, in terms of retail sales, the market size of China's affordable 3D IP toy industry will reach RMB 17.4 billion in 2024, and is expected to grow at a compound annual growth rate of 33.2% between 2024 and 2030, reaching RMB 97.1 billion in 2030.

Furthermore, in terms of retail sales, the size of the affordable 3D IP toy segment priced at RMB 20.0 and below is expected to grow at a compound annual growth rate of 55.2% from 2024 to 2030, accounting for nearly 40% of China's affordable 3D IP toy industry by 2030.

Board Information

The board of directors of the company will be composed of 7 directors, including 2 executive directors, 2 non-executive directors and 3 independent non-executive directors. According to the articles of association, the term of office of company directors is 3 years, and they can be re-elected.

Shareholding structure

As of January 2, 2026, Mr. Yang has beneficial interests in 14,850,000 shares, equivalent to 50.99% of the company's share capital, and is able to exercise 66.29% of the company's voting rights through shares held by Ms. Zhang and the Employee Incentive Platform through voting agency agreements.

Intermediary team

Co-sponsors: Goldman Sachs (Asia) Limited, China International Finance Hong Kong Securities Limited

Company Legal Adviser: On Hong Kong and US Law: Dawei Law Firm; On Chinese Law: Jingtian Gongcheng Law Firm

Co-sponsor Legal Adviser: On Hong Kong and US Law: Gao Weishen & Co.; On Chinese Law: Commerce Law Firm

Auditors and reporting accountants: Ernst & Young

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Compliance Advisor: Zibo Capital Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal