Roblox (RBLX) Valuation Check As Facial Age Verification Transforms User Safety And Chat Access

Roblox (RBLX) has just rolled out mandatory facial age verification for all users to access chat, a first for a major gaming platform and a meaningful shift in both user experience and regulatory risk.

See our latest analysis for Roblox.

That safety push comes at a time when Roblox’s recent 30 day share price return of a 21.73% decline and 90 day share price return of a 39.56% decline contrast with a 1 year total shareholder return of 23.16% and a very large 3 year total shareholder return, suggesting short term momentum has cooled even as longer term holders remain in the green.

If this kind of policy change has you thinking more broadly about digital platforms, it could be a good moment to scan other high growth tech names through high growth tech and AI stocks.

With the stock down sharply over the last 30 and 90 days, yet still showing a positive 1-year and very large 3-year total return, investors are left asking: Is Roblox now undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 47.5% Undervalued

The most followed narrative puts Roblox’s fair value at US$145.63 versus the last close of US$76.42, framing a large gap the narrative tries to justify.

The evolving digital economy on Roblox, including expanded monetization opportunities like digital goods, Rewarded Video ads, and a systematized IP licensing marketplace, is expected to unlock new high-margin revenue streams and enhance net margins as adoption matures.

Curious how that kind of shift in margins could support such a big fair value gap? Revenue growth, earnings power, and a steep valuation multiple all play key roles. The narrative spells out how they fit together.

Result: Fair Value of $145.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case still leans on assumptions that could break, including heavy infrastructure and developer spending that may pressure margins, and viral hits that may prove tough to repeat.

Find out about the key risks to this Roblox narrative.

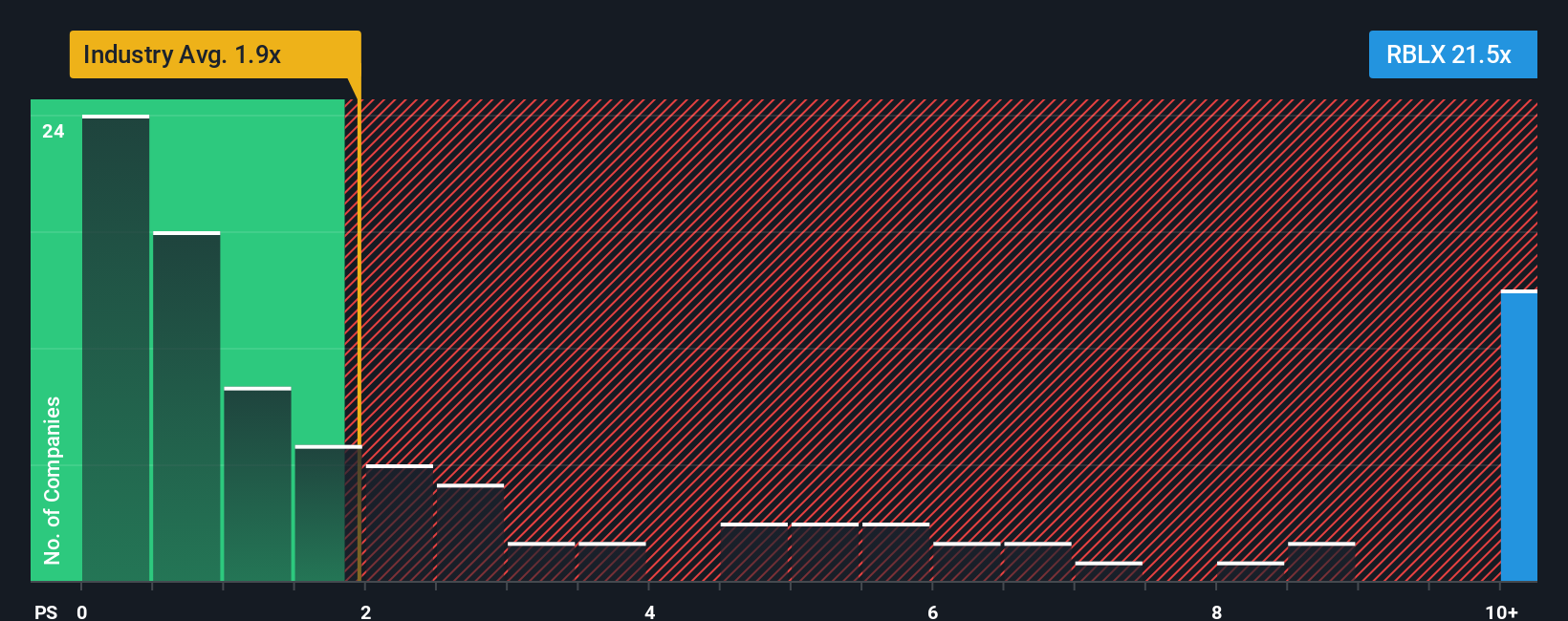

Another View: What The P/S Ratio Is Telling You

The popular narrative focuses on a rich future earnings story, but today’s pricing sends a different signal. Roblox trades on a P/S of 12x versus 5.4x for peers and 1.6x for the US Entertainment industry. Our fair ratio sits at 4x, which suggests meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roblox Narrative

If you are not fully on board with these narratives or simply prefer to weigh the numbers yourself, you can build your own version in minutes with Do it your way.

A great starting point for your Roblox research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Roblox is already on your radar, do not stop there. The Screener can quickly surface other companies that match the kind of opportunities you care about most.

- Hunt for potential mispricings by scanning these 884 undervalued stocks based on cash flows that could line up better with your expectations.

- Zero in on growth potential in artificial intelligence through these 26 AI penny stocks and see which names might deserve a closer look.

- Lean into secular themes in medicine by checking these 29 healthcare AI stocks before the next wave of ideas gets crowded.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal