Did BridgeBio’s Insider Selling and Phase 3 Infigratinib Webinar Just Reframe BBIO’s Investment Narrative?

- BridgeBio Pharma recently announced an investor webinar held on January 9, 2026, to discuss achondroplasia and Phase 3 PROPEL 3 data for infigratinib, alongside upcoming presentations at the J.P. Morgan Healthcare Conference.

- This focus on late-stage clinical progress comes as analysts highlight BridgeBio’s growing commercial footprint with Attruby and its broader rare disease pipeline, while investors scrutinize insider selling activity.

- We’ll now examine how the insider selling and upcoming Phase 3 infigratinib readout might influence BridgeBio Pharma’s existing investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

BridgeBio Pharma Investment Narrative Recap

To own BridgeBio Pharma, you need to believe that Attruby can support the business while its late-stage rare disease pipeline, including infigratinib for achondroplasia, adds meaningful value over time. The upcoming Phase 3 PROPEL 3 readout remains the key near term catalyst, while high cash burn and reliance on future trial success stay central risks. The latest webinar and J.P. Morgan presentations do not materially change that balance, but they sharpen market focus on near term clinical and sentiment drivers.

The January 9 investor webinar on achondroplasia and Phase 3 PROPEL 3 data for infigratinib is the most relevant recent announcement here, as it directly ties into BridgeBio’s largest near term pipeline catalyst. With topline results expected in Q1 2026, this event helps frame expectations around a program that could diversify revenue beyond Attruby and influence how investors weigh ongoing insider selling and continued operating losses.

Yet while the story around Attruby and infigratinib is front and center, investors should also be aware of how sustained operating losses could...

Read the full narrative on BridgeBio Pharma (it's free!)

BridgeBio Pharma's narrative projects $1.7 billion revenue and $297.7 million earnings by 2028.

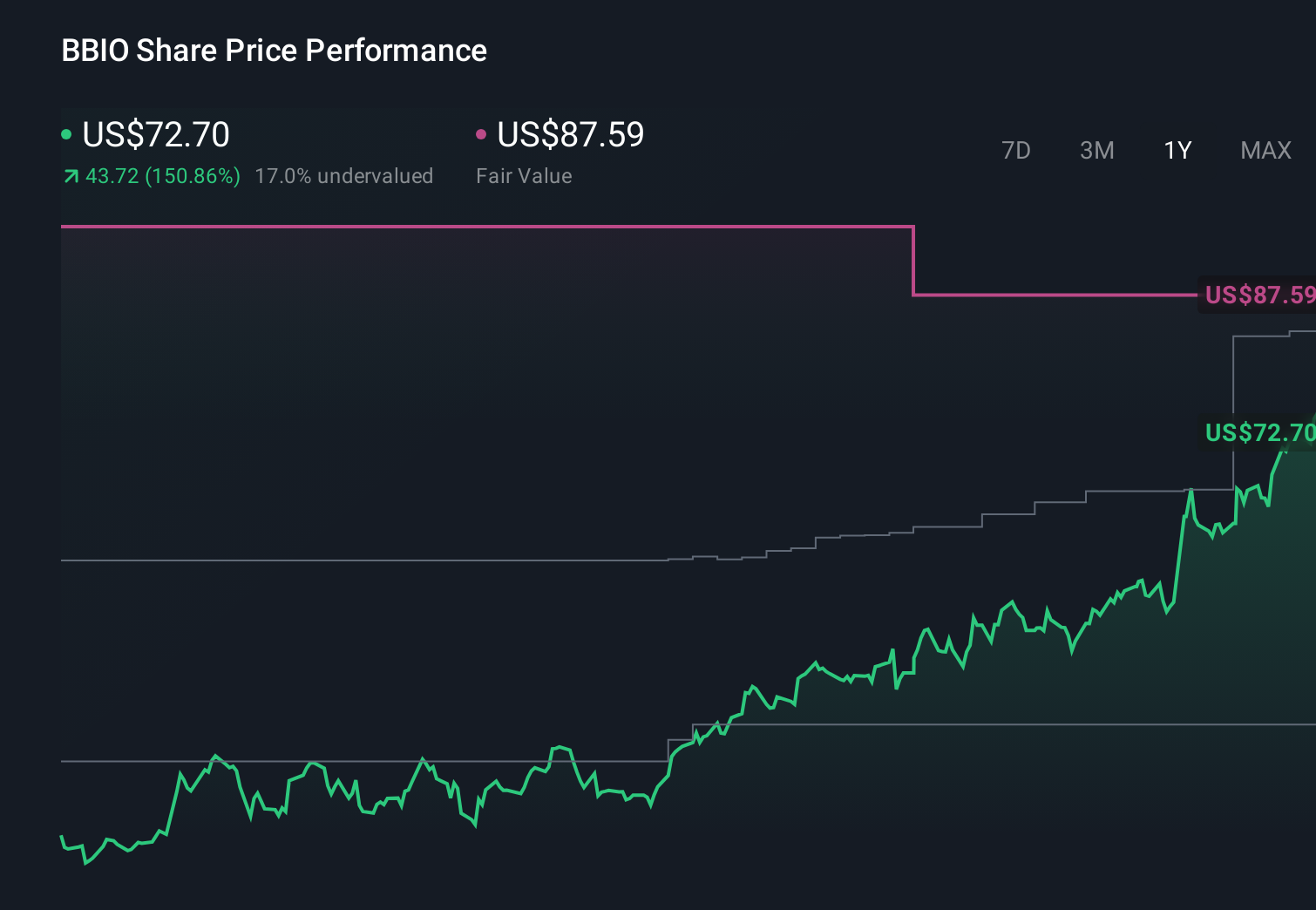

Uncover how BridgeBio Pharma's forecasts yield a $84.65 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community value BridgeBio between US$14 and about US$275 per share, showing wide disagreement on upside potential. You can weigh those views against the company’s continued heavy losses and dependence on late stage trial outcomes to judge how much uncertainty you are comfortable with.

Explore 8 other fair value estimates on BridgeBio Pharma - why the stock might be worth over 3x more than the current price!

Build Your Own BridgeBio Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BridgeBio Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BridgeBio Pharma's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal