Assessing Nokia Oyj (HLSE:NOKIA) Valuation After New Telit Cinterion Industrial Connectivity Partnership

Interest in Nokia Oyj (HLSE:NOKIA) is picking up after a new collaboration with Telit Cinterion that links Nokia’s Cognitive Digital Mine platform with multi-network communication modules for mission-critical industrial use cases.

See our latest analysis for Nokia Oyj.

The Telit Cinterion tie-up comes after a strong run, with Nokia’s 90 day share price return of 29.76% and 1 year total shareholder return of 33.15% pointing to building momentum. The latest €5.77 share price leaves longer term total shareholder returns of 38.54% over three years and 100.30% over five years firmly in focus.

If this kind of industrial connectivity story interests you, it could be a good moment to look beyond a single name and check out high growth tech and AI stocks.

With Nokia’s recent gains, a €5.77 share price and mixed signals from value screens and analyst targets, the key question now is simple: is the stock still undervalued or is the market already pricing in future growth?

Most Popular Narrative Narrative: 6.2% Overvalued

The most followed narrative puts Nokia Oyj’s fair value at €5.43 per share, slightly below the €5.77 last close, which frames the current debate around upside potential.

Scalable operational improvements, ongoing cost discipline, and rapid integration of recent acquisitions (e.g., Infinera) are positioned to enhance operating leverage and expand net margins over time as revenue mix shifts towards higher margin portfolios.

Curious what kind of revenue runway and margin lift would need to line up for that valuation to hold? The narrative leans on steady top line progress, rising profitability and a future earnings multiple that steps down from today’s level. Want to see exactly how those moving parts add up to that fair value line in the sand?

Result: Fair Value of €5.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still watchpoints, including currency swings affecting earnings and ongoing uncertainty around telecom capital expenditures, which could challenge those revenue and margin assumptions.

Find out about the key risks to this Nokia Oyj narrative.

Another View: What The Earnings Multiple Is Saying

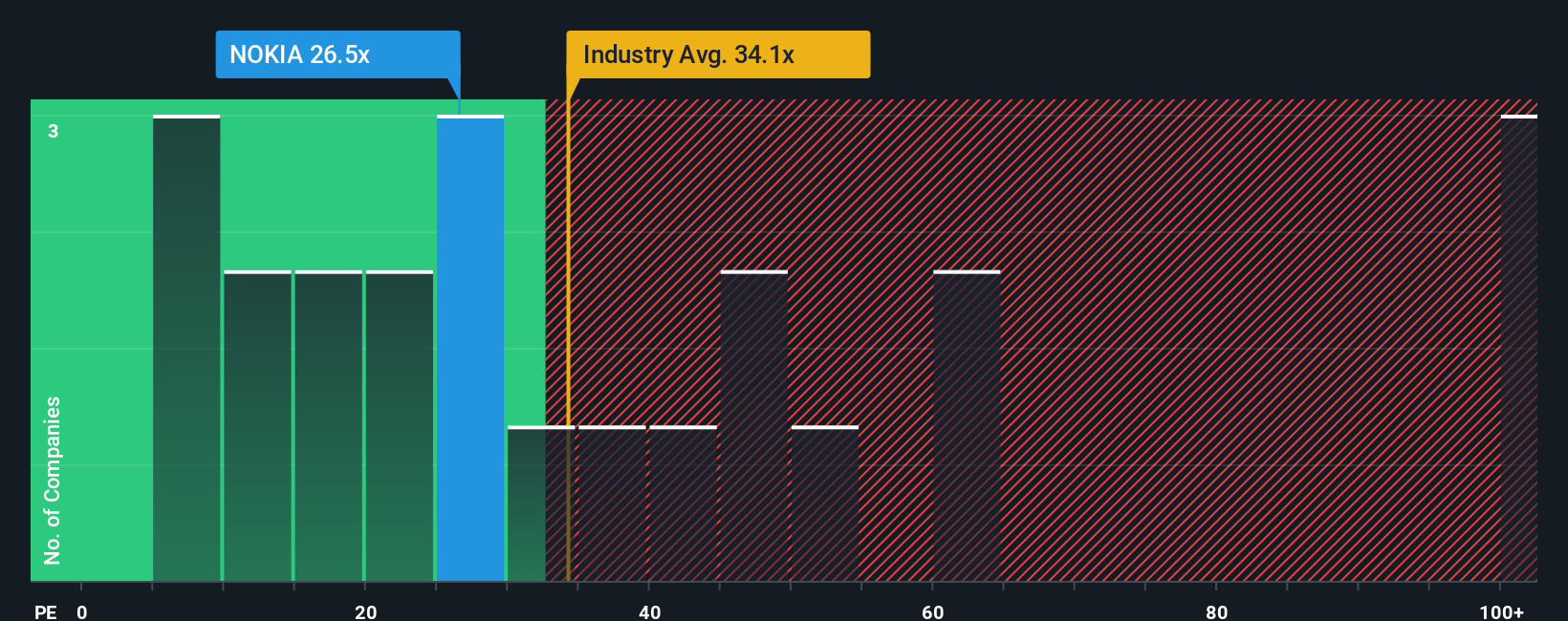

That €5.43 fair value from the narrative is built on detailed cash flow assumptions, but the earnings multiple paints a slightly different picture. Nokia trades on a 38x P/E, below the European Communications group at 42.9x, yet above peer average at 29.4x and its own fair ratio of 32.3x.

So while it looks cheaper than the wider industry, the gap to peers and the fair ratio suggests some valuation risk if expectations cool, especially after the recent share price run. Which of these anchors matters more for you: the relative discount to the sector, or the premium to peers and the fair ratio the market could move toward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nokia Oyj Narrative

If you see the numbers differently or just prefer to test your own assumptions, you can spin up a custom Nokia view in minutes. Then Do it your way.

A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If you stop at just one stock, you risk missing other opportunities that may better fit your goals. Consider widening your search with a few focused screens.

- Target potential mispricing by checking out these 884 undervalued stocks based on cash flows that line up with your preferred fundamentals and return profile.

- Ride the AI trend more deliberately by scanning these 26 AI penny stocks that tie real revenues to artificial intelligence themes rather than just headlines.

- Add an income angle by reviewing these 12 dividend stocks with yields > 3% that might suit a portfolio focused on regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal