The “hottest racetrack” of AI hardware is being questioned by the soul: How long can memory chip stocks stay popular?

The Zhitong Finance App notes that the hottest sector of the stock market in 2025 will still be hot in the new year, but this uninterrupted momentum has made some Wall Street professionals wonder whether a reversal of the market is imminent.

Memory chip makers were the best-performing sector in the S&P 500 index last year, as massive capital used to build artificial intelligence infrastructure gradually penetrated some of the traditionally quiet sectors of the technology industry. The sector, led by companies such as SanDisk (SNDK.US), Western Digital (WDC.US), Seagate Technology (STX.US), and Micron Technology (MU.US), continued to lead the index in early 2026.

After Nvidia CEO Wong In-hoon emphasized that the AI ecosystem needed more memory and storage, SanDisk soared 16% on the first trading day of the year and surged 28% again on Tuesday. The stock rose 1.1% on Wednesday, with a cumulative increase of 49% over the first four trading days of the year. Meanwhile, Western Digital, Seagate, and Micron all recorded double-digit gains at the start of 2026, but all three stocks declined on Wednesday.

SanDisk's stock price soared 559% in 2025, leading the S&P 500 index, followed by Western Digital, Micron, and Seagate, taking the top four positions in the index's growth list.

Storage and memory stocks rose

However, as a transformative technology evolves in real time, “it is extremely difficult to model” the growth prospects of these companies, according to Jessica Nowiskis, an outsourcing chief portfolio strategist at Marquette Consulting. The company manages around $29 billion in assets.” There may be retail investors who are in a hurry to miss this wave of gains, so they are in a hurry to seek medical treatment.”

The main driving force behind the rise in memory chip stocks is the boom in AI infrastructure spending and the surge in demand, leading to a rise in the price of components such as memory chips. However, many investors are questioning whether such a huge increase is justified, and in particular, more and more are questioning whether AI-related capital spending can continue at the current rate without any significant signs of return.

Peter Anderson, chief investment officer of Anderson Capital Management, which manages $4.5 billion in assets, said, “Given the general context of AI data center construction, the recent strong performance is ostensibly reasonable, but I am increasingly concerned that the market's expectations for future demand are too far ahead of schedule, and underestimate the risk of historical cyclicality and overcapacity and price pressure.”

This rally may be difficult to sustain in the short term. For example, SanDisk and Micron's 14-day Relative Strength Index both exceeded 70. Some technical strategists see this as a sign that stocks are overbought.

Relative valuations are still low

The sector's valuation is often lower than other tech companies, and on the surface, it still seems relatively cheap. Micron's price-earnings ratio based on expected earnings is only 10 times, and SanDisk is about 20 times. Both Seagate and Western figures are below 25 times, and the Nasdaq 100 is at this level.” The expected price-earnings ratio of the “Big Seven US stocks” is about 29 times.

However, although these stocks may seem cheap, continuing concerns about the factors driving the rise (AI spending and strong demand) have deterred some professional investors.

“If you agree with me that AI infrastructure is overbuilt, then you should avoid it,” Anderson said. If one company says they will slow down spending, that could trigger a wave of sell-offs.”

Of course, many Wall Street analysts remain optimistic that major AI spenders such as Microsoft, Amazon, Alphabet, and Meta will stick to their plans. The big four tech giants have all outlined aggressive capital expenditure plans in their latest earnings reports, indicating that this trend will continue for at least most of 2026. Micron's earnings report last month showed an optimistic outlook, triggering a considerable increase.

Bank of America analyst Wamsey Mohan wrote in a January 4 report: “As multi-modal AI becomes more popular, we expect the amount of data generated to increase significantly, which should drive the growth in demand for low-cost storage”, which will benefit Seagate and Western Digital. At the same time, “the need to store more data on edge devices and the need to access data quickly can drive more use of NAND storage”, which will benefit SanDisk.

Similarly, Needham anticipates that the high-bandwidth memory chips produced by Micron will “continue to be the 'king of AI memory' for the next 5-10 years.” The company upgraded Kexieu to a relevant investment target and expressed optimism about Kangte Technology, Onto Innovation, and Cullisofa Industries, all of which performed strongly in 2026.

For investors, the question is which side of risk they are on, and it's not an easy question. For example, Marquette Consulting's Noviskis remains positive about the AI topic. But she is also worried that if the market narrative begins to rift, such a huge increase will cause these companies to have more room to fall back.

“This story is probably true, and some stocks did rise too fast and too fast,” Noviskis said. The problem is we don't know which are the former and which are the latter.”

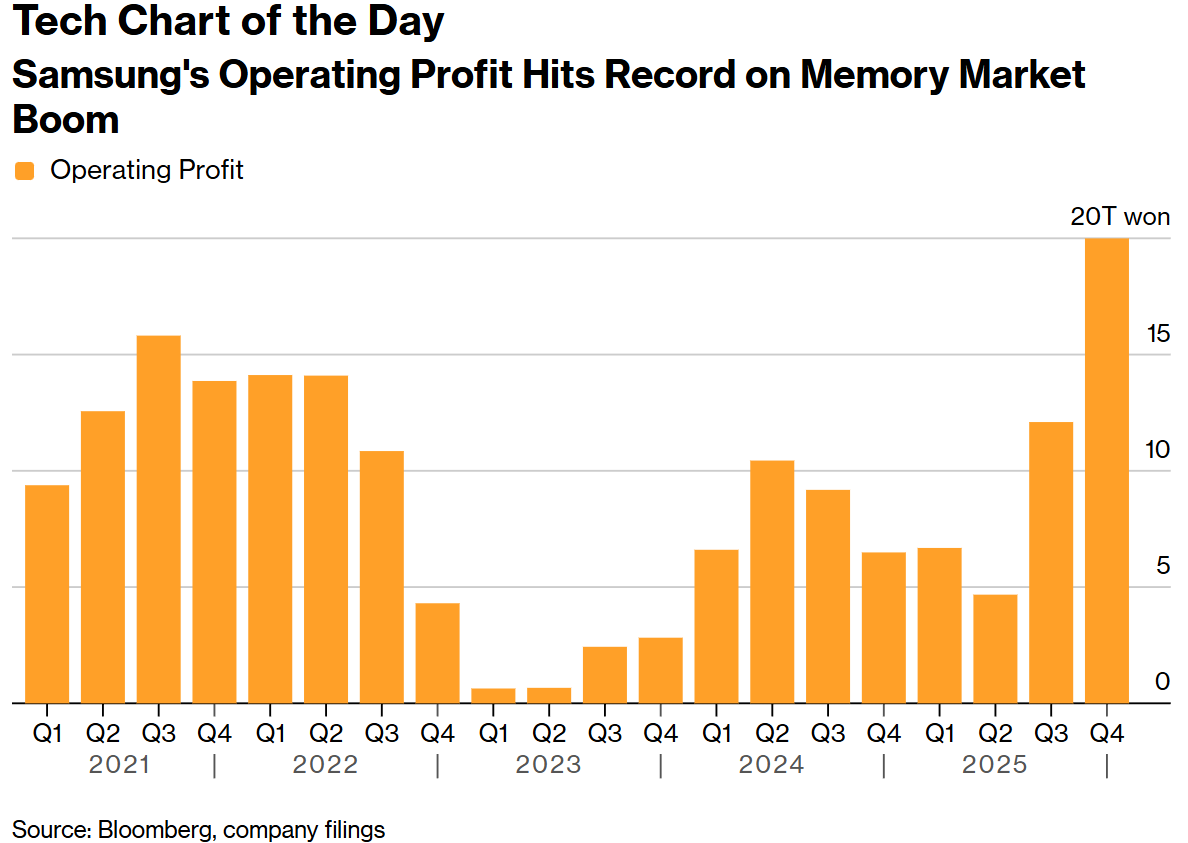

Samsung's operating profit reached a record high due to the boom in the memory market

The surge in global demand for artificial intelligence servers has boosted the price of memory chips, and Samsung Electronics' quarterly profit has more than tripled, reaching a record high. South Korea's largest company reported an initial operating profit of 20 trillion won for the three months ending December, up 208% year over year, exceeding analysts' average expectations.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal