TSX Penny Stocks To Watch In January 2026

As we step into 2026, investors are encouraged to reassess the health of the Canadian and U.S. economies, considering how recent data disruptions have impacted market expectations. With interest rates significantly lower than their peak, many are looking towards stocks and bonds for potentially better returns. While the term "penny stocks" might seem dated, these smaller or newer companies can still offer intriguing opportunities when backed by strong financials. In this article, we'll explore three penny stocks that stand out for their balance sheet resilience and potential for growth in today's evolving market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.18 | CA$55.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Cannara Biotech (TSXV:LOVE) | CA$1.83 | CA$173.82M | ✅ 3 ⚠️ 0 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.37 | CA$256.22M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.26 | CA$130.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.44 | CA$3.43M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$51.65M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.33 | CA$891.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.16 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.40 | CA$171.92M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$182.35M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 379 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and international markets with a market cap of CA$1.42 billion.

Operations: The company's revenue of $132.36 million is generated from the cultivation, manufacture, and marketing of cannabis and cannabis-derived products.

Market Cap: CA$1.42B

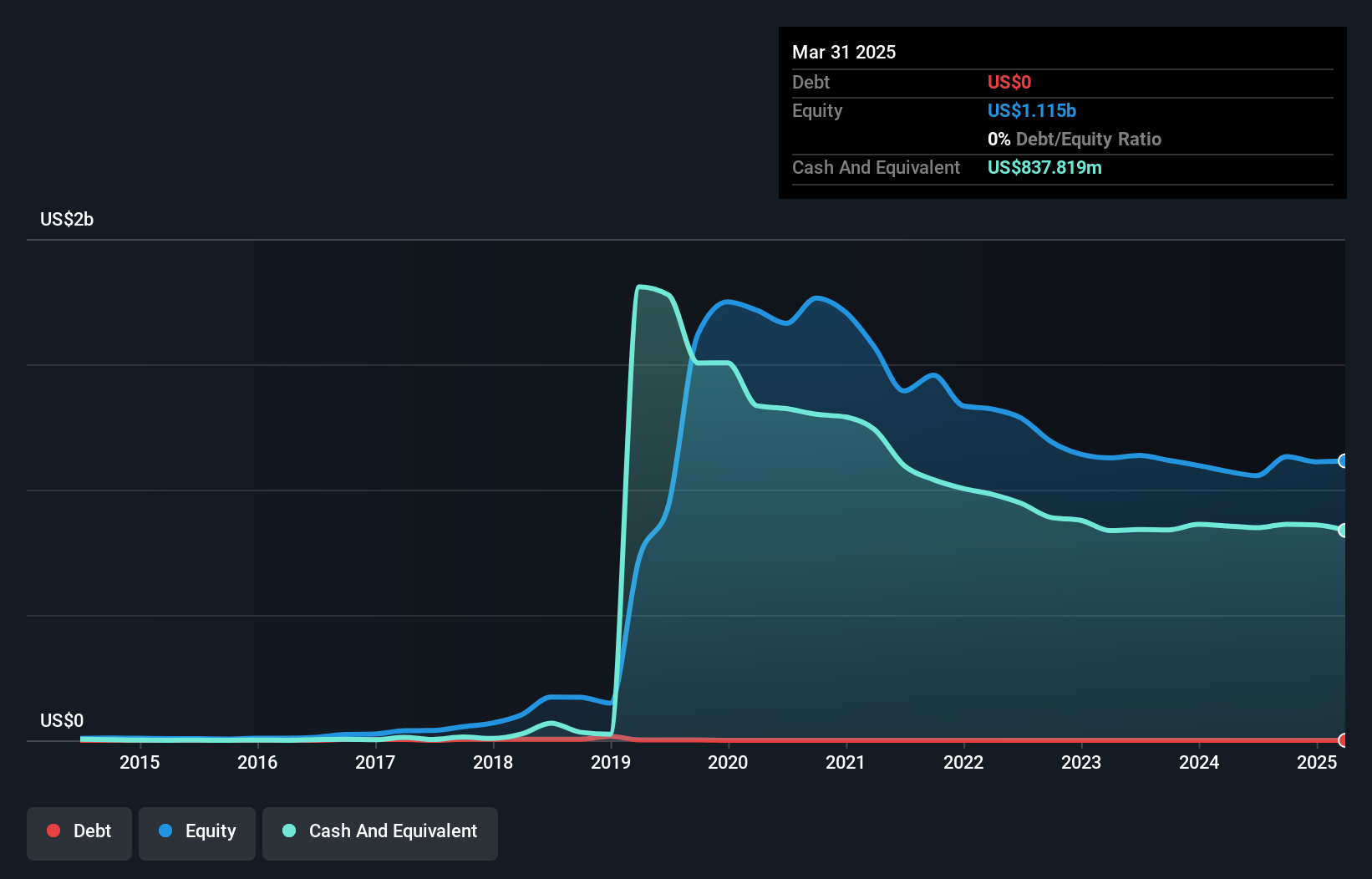

Cronos Group Inc., with a market cap of CA$1.42 billion, has recently expanded its product offerings with the introduction of Lord Jones Live Resin Fusions™ pre-rolls in Canada, emphasizing premium cannabis quality. The company's third-quarter earnings reported a net income of US$25.96 million, highlighting profitability and growth compared to the previous year. Cronos remains debt-free, with robust short-term assets significantly exceeding liabilities, indicating financial stability. However, its Return on Equity at 3.7% is low by industry standards. The management team is experienced but the board's tenure suggests recent changes in leadership dynamics.

- Get an in-depth perspective on Cronos Group's performance by reading our balance sheet health report here.

- Learn about Cronos Group's future growth trajectory here.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Majestic Gold Corp. is a mining company that engages in the exploration, development, and operation of mining properties in China, with a market cap of CA$164.22 million.

Operations: The company generates $82.65 million from its activities related to the exploration, development, and operation of mining properties.

Market Cap: CA$164.22M

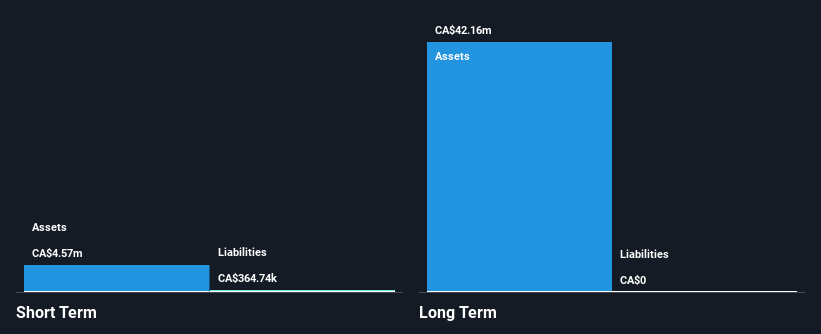

Majestic Gold Corp., with a market cap of CA$164.22 million, demonstrates financial stability as its short-term assets of $116.3 million exceed both short-term and long-term liabilities. The company's operating cash flow effectively covers its debt, and it has more cash than total debt, ensuring solid liquidity. Despite a decline in gold production and net income over the past year, sales increased to US$63.66 million for the nine months ended September 30, 2025. Recent operational disruptions at the Songjiagou Underground Mine due to permit issues have been resolved with operations resuming post-renewal of safety permits.

- Click to explore a detailed breakdown of our findings in Majestic Gold's financial health report.

- Explore historical data to track Majestic Gold's performance over time in our past results report.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wealth Minerals Ltd. focuses on the acquisition, exploration, and development of mineral properties in Canada, Chile, Peru, and Mexico with a market cap of CA$30.80 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$30.8M

Wealth Minerals Ltd., with a market cap of CA$30.80 million, is pre-revenue and focuses on lithium projects in South America. The company recently received approval for a Special Lithium Operating Contract for its Kuska Project in Chile, which has significant estimated lithium resources. Wealth Minerals has explored direct lithium extraction technologies and published a preliminary economic assessment indicating attractive profitability potential. While the company faces high volatility and short cash runway challenges, it maintains experienced management and board teams. Despite previous setbacks in business expansion efforts, Wealth continues to pursue diversification into precious metals projects.

- Navigate through the intricacies of Wealth Minerals with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Wealth Minerals' track record.

Make It Happen

- Access the full spectrum of 379 TSX Penny Stocks by clicking on this link.

- Curious About Other Options? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal