A Look At Jabil (JBL) Valuation As Shares Consolidate After Strong Long Term Returns

Why Jabil is on investors' radar today

Jabil (JBL) continues to attract attention after recent trading, with shares last closing at $224.45. With mixed short term returns and stronger longer term figures, many investors are reassessing what the current price implies.

See our latest analysis for Jabil.

The recent consolidation around $224.45 comes after a 9.64% 90 day share price return. Meanwhile, the 1 year total shareholder return of 46.04% and 5 year total shareholder return of 413.09% suggest that longer term momentum has been much stronger than the shorter term pullback.

If Jabil has caught your attention, it can be useful to see what else is moving in related areas, including high growth tech and AI stocks that could fit a similar thesis or offer a contrast.

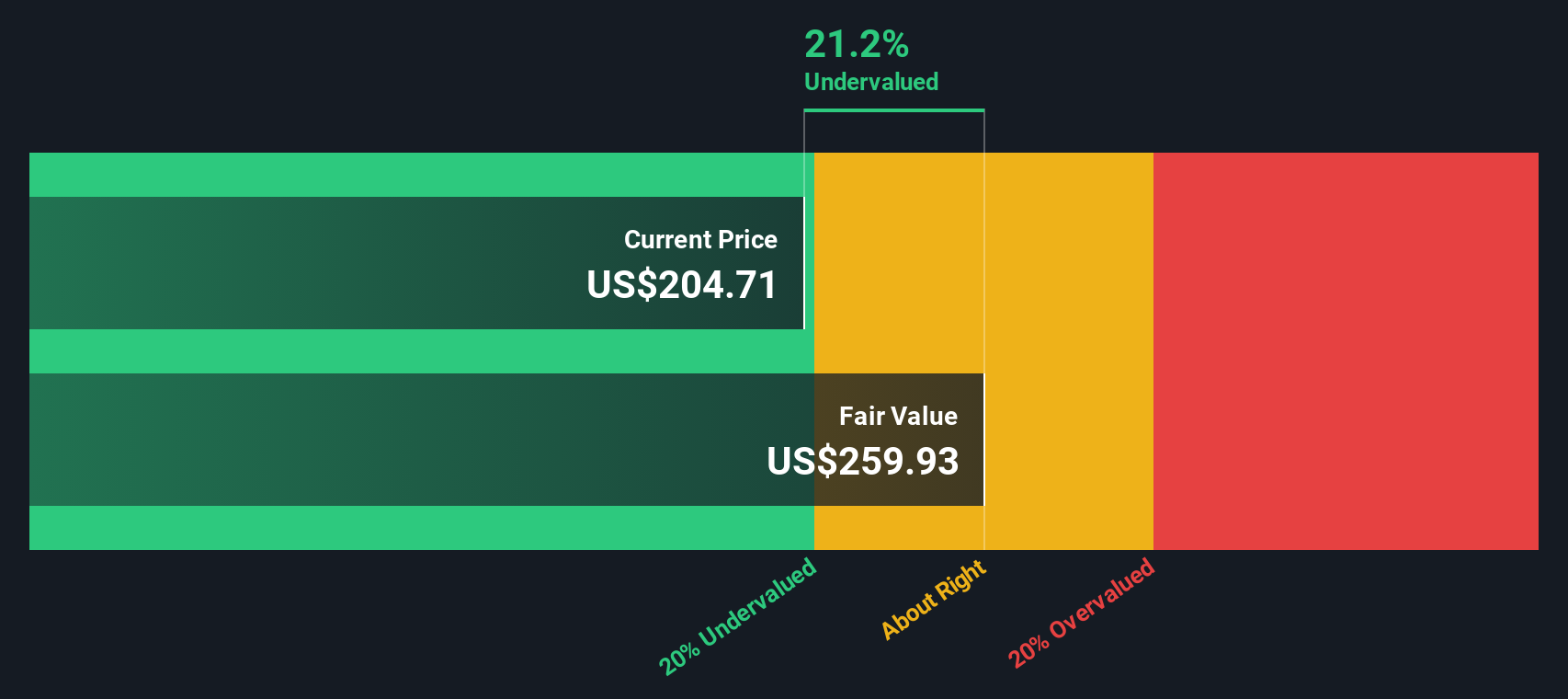

With Jabil trading at $224.45 against an analyst price target of $259.25 and an estimated intrinsic discount of 35.77%, the key question is whether this represents a genuine value opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 13.4% Undervalued

Against Jabil's last close of $224.45, the most followed narrative anchors on a higher fair value, built around growth, margins, and capital returns.

The anticipated $1.2 billion in free cash flow generation suggests sound financial health, providing flexibility for share buybacks or strategic investments to further enhance earnings per share growth.

Curious what kind of revenue curve, margin lift, and earnings multiple need to line up to reach that higher value? The full narrative sets out a detailed roadmap for growth, profitability and valuation that goes well beyond simple P/E comparisons.

Result: Fair Value of $259.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on weaker segments such as Connected Living and Regulated Industries stabilising, and on tariff or EV market pressures not putting sustained stress on revenue or margins.

Find out about the key risks to this Jabil narrative.

Another way to look at Jabil's value

Our SWS DCF model points to a fair value of about US$349.45 per share, which is roughly 35.8% above the current US$224.45 price. That suggests a much larger margin between price and value than the 13.4% gap implied by the narrative fair value of US$259.25. Which set of assumptions do you feel more comfortable leaning on?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Jabil Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised Jabil view in just a few minutes, starting with Do it your way.

A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one company. Use the Simply Wall St Screener to hunt for fresh opportunities other investors might miss.

- Spot potential value by checking out these 884 undervalued stocks based on cash flows that have share prices sitting below their estimated cash flow based worth.

- Target future growth themes by scanning these 26 AI penny stocks that are tied to artificial intelligence across different parts of the market.

- Boost your income focus by reviewing these 12 dividend stocks with yields > 3% that could add consistent cash returns alongside any share price moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal